Pancreatic Cancer Treatment: Top 8 Emerging Therapies to Watch Out

Jul 01, 2024

Pancreatic cancer is enlisted as one of the most common cancers and the seventh-highest cause of cancer mortality worldwide. The incidence of pancreatic cancer is increasing in the Western world. The incidence of pancreatic adenocarcinoma is rising in the developed world, and modifiable lifestyle factors such as alcohol and obesity may play an essential role.

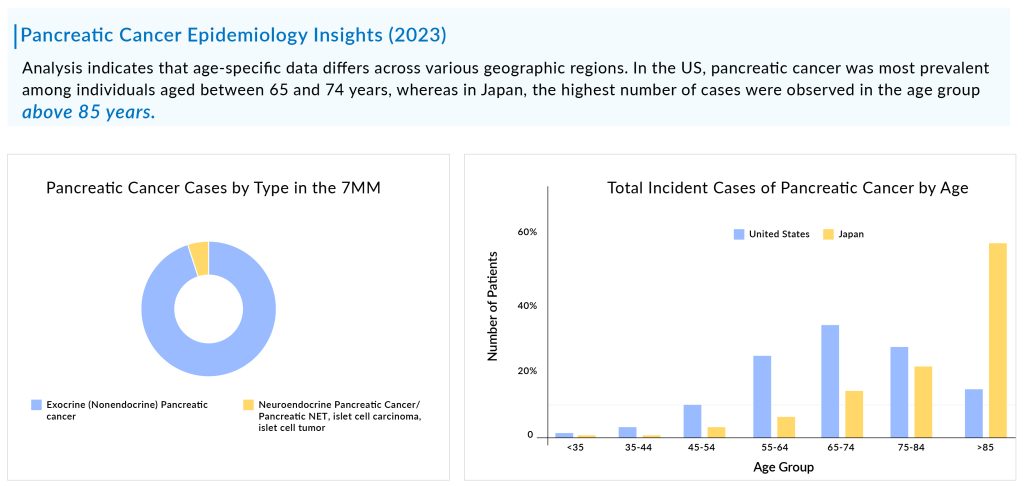

Pancreatic cancer, known for its aggressiveness, is typically diagnosed at advanced stages, with the majority of patients falling within the age range of 65 to 74 years. The total incident cases of pancreatic cancer in the 7MM were ~184K in 2023, which is expected to increase by 2034. As per DelveInsight estimates, exocrine pancreatic cancer is more common than neuroendocrine pancreatic cancer accounting for more than 90% of total cases.

Pancreatic cancer can be segmented into localized, regional, and distant on the basis of staging of the cancer. Based on molecular alterations, pancreatic cancer can be classified into six different categories. The mutation types involved in pancreatic cancer include KRAS2, TP53, SMAD4/DPC4, BRCA1/2, MSI-H/dMMR, and NTRK.

Downloads

Article in PDF

Recent Articles

- 5 Novel CDK7 Inhibitors Pushing the Boundaries in Oncology

- Venclexta full approval; PBP1510 Orphan Status; Roche/ Genesis collab; Immunomodulators for COVID-19

- Zejula’s priority review; Erytech Pharma’s new facility; good news for Krystal

- Notizia

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prim...

Among the molecular alterations, KRAS2 mutation is the most common type of mutation observed in pancreatic cancer, followed by TP53, and p16/CDKN2A. As per the estimates, in the US, approximately half of the patients in the cases were found to be distant at the time of diagnosis. In 2023, most of the treated pancreatic patients experienced disease progression from the first-line to the second-line treatment.

Pancreatic cancer treatment options are chosen based on the extent of the cancer. Pancreatic cancer treatment options may include surgery, chemotherapy, radiation therapy, targeted therapy, or a combination of these.

Surgical intervention is the best treatment for localized or regional cases of pancreatic cancer, while chemotherapy is the preferred drug treatment for all stages. Additionally, targeted pancreatic cancer therapies like LYNPARZA for BRCA mutations, VITRAKVI and ROZLYTREK for NTRK gene expressions in solid tumors, and KEYTRUDA for solid tumors with high microsatellite instability are also used alongside traditional pancreatic cancer treatments.

Chemotherapy, along with surgery, is the main pharmaceutical option for pancreatic cancer treatment. For initial therapy, gemcitabine-based regimens are preferred due to their lower adverse event rates compared to 5-FU-based options. For second-line treatment after FOLFIRINOX, gemcitabine combined with nab-paclitaxel is considered for eligible patients. Alternatively, gemcitabine or 5-FU monotherapy is an option for patients with poorer performance status, medical comorbidities, or those who are elderly.

Because of the rapid progression and low survival rates of pancreatic cancer, many patients do not receive second-line treatment if the initial therapy is unsuccessful, with almost 70% moving from first-line to second-line treatment. For those who do undergo second-line pancreatic cancer treatment, the choice depends on the prior regimen. Presently, there are no universally accepted standard options for second-line therapy in pancreatic cancer. Generally, chemotherapy is the preferred approach in this scenario. Despite the current emphasis on chemotherapy, there is hope for advancements in the treatment of metastatic pancreatic cancer. Ongoing research, especially in targeted therapies and immunotherapies, brings optimism for future innovations and the potential for improved outcomes and more treatment options for patients in the near future.

As per DelveInsight analysis, the pancreatic cancer market size is supposed to grow from USD 1.7 billion in 2023 at a significant CAGR during the forecast period owing to the expected launch of novel emerging therapies, which shall fuel the growth of the pancreatic cancer treatment market during the forecast period, i.e., 2024–2034. As per the estimates, the United States accounted for the highest market size of pancreatic cancer in 7MM in 2023, in comparison to the other major markets i.e., EU4 countries (Germany, Italy, France, and Spain), the United Kingdom, and Japan.

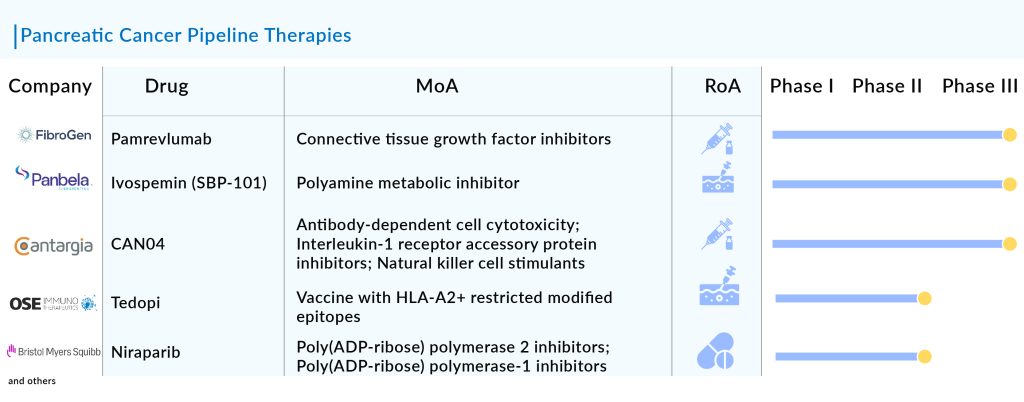

The current pancreatic cancer pipeline consists of a great deal of drugs. OSE2101 (OSE Immunotherapeutics), LOAd703 (Lokon Pharma), CAN04 (Cantargia AB), Niraparib (Bristol-Myers Squibb), Sotorasib (Amgen), Zenocutuzumab (Merus), and some others are the most highlighted drugs of this indication. Ongoing research and current trials have the potential to change the pancreatic cancer treatment market.

The potential for effective pancreatic cancer treatment in the future is expected to grow with the addition of numerous drugs to the pancreatic cancer pipeline of new therapeutics. Currently, a variety of candidate drugs for the treatment of pancreatic cancer are being tested in various clinical trials, with some showing positive results. Any drug approved with increased safety and efficacy is expected to cause significant changes in the overall pancreatic cancer market.

Now, let’s examine the top 8 pipeline therapies under investigation for pancreatic cancer

Zenocutuzumab: Merus

Preregistration

Zenocutuzumab is an enhanced Biclonics antibody that leverages antibody-dependent cell-mediated cytotoxicity (ADCC) to target the HER3 pathway. Using the Merus Dock & Block mechanism, it inhibits the neuregulin/HER3 signaling pathway in solid tumors with NRG1 gene fusions (NRG1+ cancer). Zenocutuzumab attaches to HER2, which is abundantly expressed on tumor cells, and then binds to HER3, blocking the growth of tumor cells stimulated by heregulin. This drug aims to overcome both inherent and acquired resistance to HER2-targeted therapies by blocking tumor growth and survival pathways while recruiting immune effector cells to help eliminate tumors.

Pamrevlumab: FibroGen

Phase III

Pamrevlumab is an innovative antibody developed by FibroGen to block the action of connective tissue growth factor (CTGF), which plays a key role in fibrotic and proliferative disorders marked by ongoing and excessive scarring that can result in organ dysfunction and failure. The company is currently conducting a Phase III LAPIS trial of the drug, with topline results anticipated in the third quarter of 2024.

CAN04: Cantargia AB

Phase III

CAN04 is a fully humanized IgG1 antibody that targets Interleukin-1 Receptor Accessory Protein (IL1RAP), inhibiting IL-1α and IL-1β signaling and inducing antibody-dependent cellular cytotoxicity (ADCC). By binding effectively to IL1RAP, CAN04 not only blocks IL-1α and IL-1β signaling but also triggers ADCC. This dual action allows CAN04 to combat the role of the IL-1 system in promoting an immune-suppressive tumor microenvironment and in the development of resistance to chemotherapy.

SBP-101: Panbela Therapeutics

Phase II/III

SBP-101 is a unique polyamine analog intended to cause polyamine metabolic inhibition (PMI) by leveraging its strong affinity for pancreatic ductal adenocarcinoma and other tumors. The company is currently conducting Phase III trials of this drug for first-line treatment of metastatic pancreatic cancer, with interim results anticipated in 2024.

Tedopi (OSE2101): OSE Immunotherapeutics

Phase II

Tedopi (OSE2101) is a therapeutic vaccine based on neo-epitopes. It combines nine optimized neo-epitopes from five tumor antigens to specifically activate T-cells, along with an additional epitope that provides a universal helper T-cell response. The Phase II TEDOPAM study evaluates Tedopi in combination with FOLFIRI chemotherapy compared to FOLFIRI alone, used as maintenance treatment following FOLFIRINOX therapy. The main goal of the trial is to assess the 1-year survival rate.

Niraparib: Bristol-Myers Squibb

Phase II

Niraparib is a daily oral medication that selectively inhibits PARP-1 and PARP-2. PARP, which stands for poly (ADP-ribose) polymerase, is a protein involved in DNA repair that fixes single-strand DNA breaks. By blocking PARP, some cancer cells may be prevented from repairing DNA damage, resulting in cell death. This drug is currently undergoing evaluation in several key clinical trials.

LOAd703: Lokon Pharma

Phase I/II

LOAd703, an engineered adenovirus serotype 5/35, is equipped with two transgenes—TMZ-CD40L and 4-1BBL—that effectively trigger both local and systemic anti-tumor immune responses. Locally, TMZ-CD40L and 4-1BBL activate antigen-presenting cells and stimulate macrophages, cytotoxic lymphocytes (CTLs), and natural killer cells to target cancer cells. Systemically, these transgenes promote the migration of dendritic cells to lymph nodes, where they activate naive CTLs and enhance immune surveillance by CTLs and natural killer cells. Upon administration, LOAd703 infects cancer cells and produces the proteins encoded by the transgenes in the tumor microenvironment. These proteins initiate an immune response against cancer. Essentially, LOAd703 functions by modulating the tumor microenvironment and simultaneously activating the immune system to attack tumor cells.

Sotorasib: Amgen

Phase I/II

Amgen’s Sotorasib (LUMAKRAS/AMG 510) is a small molecule that targets KRASG12C with a unique interaction at the P2 pocket, inhibiting it irreversibly. It traps KRASG12C in its inactive GDP-bound state, similar to other KRASG12C inhibitors. Sotorasib is approved for treating adults with KRAS G12C-mutated locally advanced or metastatic non-small cell lung cancer who have undergone at least one prior systemic therapy, based on an FDA-approved test. This indication received accelerated approval based on overall response rate (ORR) and duration of response (DOR).

The launch of these emerging therapies for pancreatic cancer treatment holds significant promise in revolutionizing its treatment landscape. Traditional approaches, often limited by the aggressive nature and late-stage diagnosis of this cancer, have faced challenges in achieving substantial improvements in patient outcomes. However, new therapies, such as targeted molecular therapies and immunotherapies, are poised to address these limitations. Targeted therapies, for instance, aim to inhibit specific molecular pathways that drive cancer growth, potentially leading to more effective and less toxic treatments. Meanwhile, immunotherapies harness the body’s immune system to recognize and attack cancer cells, offering new avenues for personalized and durable treatment responses.

Furthermore, the launch of these emerging pancreatic cancer therapies is expected to bring about transformative changes in pancreatic cancer care. By enhancing treatment efficacy and expanding options beyond conventional chemotherapy, these innovations offer hope for improved survival rates and quality of life for patients. Moreover, advancements in early detection methods coupled with these therapies could potentially shift the current paradigm towards earlier intervention and better long-term outcomes. As research continues to uncover new insights into the molecular mechanisms of pancreatic cancer and as more therapies undergo clinical trials and regulatory approvals, the future holds promise for a more hopeful outlook for patients facing this challenging disease.

Downloads

Article in PDF

Recent Articles

- 5 Novel CDK7 Inhibitors Pushing the Boundaries in Oncology

- Venclexta full approval; PBP1510 Orphan Status; Roche/ Genesis collab; Immunomodulators for COVID-19

- Ipsen’s Onivyde Combo Ends a Decade-Long Dry Spell in Newly Diagnosed Pancreatic Cancer

- Incyte meets endpoint in second atopic dermatitis trial; NeoTX lands USD 45 M series C; Five Prim...

- Zejula’s priority review; Erytech Pharma’s new facility; good news for Krystal