The Race to Redefine Obesity Treatment

Mar 12, 2025

Table of Contents

Obesity ranks as the second leading cause of preventable death, linked to the risk of inflammatory conditions that are directly and indirectly related to cardiovascular disease, diabetes, respiratory issues, psychological problems, hypertension, obstructive sleep apnea, cancer, and hyperlipidemia. This poses a major public health crisis that has steadily worsened over the last fifty years. Rising obesity rates have been noted among children and adults of both genders and are prevalent in both developed and developing nations.

According to DelveInsight’s analysis, as of 2023, ~188 million people were living with obesity across the 7MM. These cases are further expected to increase by 2034. Obesity rates in the United States have been steadily rising, particularly among the adult population. The highest prevalence of obesity in 2023 was observed in both adults (ages 19 and older) and children (ages 5-19). These numbers are expected to grow at a moderate CAGR for both groups.

Downloads

Article in PDF

Recent Articles

- Cytokinetics Announces Results From SEQUOIA-HCM Clinical Trial of Aficamten; FDA Approves Chiesi’...

- Amgen to Acquire Horizon Therapeutics; Sanofi and Teva Announce Collaboration; Boehringer Obesity...

- Body Contouring Devices: Understanding the Key Factors Determining the Market Growth and Evolving...

- Chemists may help solve the air-pollution health crisis

- 7 Promising Obesity Drugs Set to Launch by 2027

In 2023, approximately 70% of obese children (ages 5-19) in the US were actively seeking treatment. Additionally, based on DelveInsight’s assessment, about 4% of adult patients in Japan were seeking help for obesity in 2023. DelveInsight estimates that the total number of prevalent obesity cases among adults in the United States accounted for approximately 60% of the cases across the 7MM in 2023.

Obesity Treatment: Then & Now

Current obesity management aims to reduce body weight and fat percentage, mitigating associated health risks. Strategies include dietary modifications, exercise (aerobic, high-intensity interval, cardiovascular, resistance training), behavioral therapy, lifestyle adjustments, pharmacotherapy, and surgical interventions like intragastric balloons, bariatric surgery, and laparoscopic gastric banding.

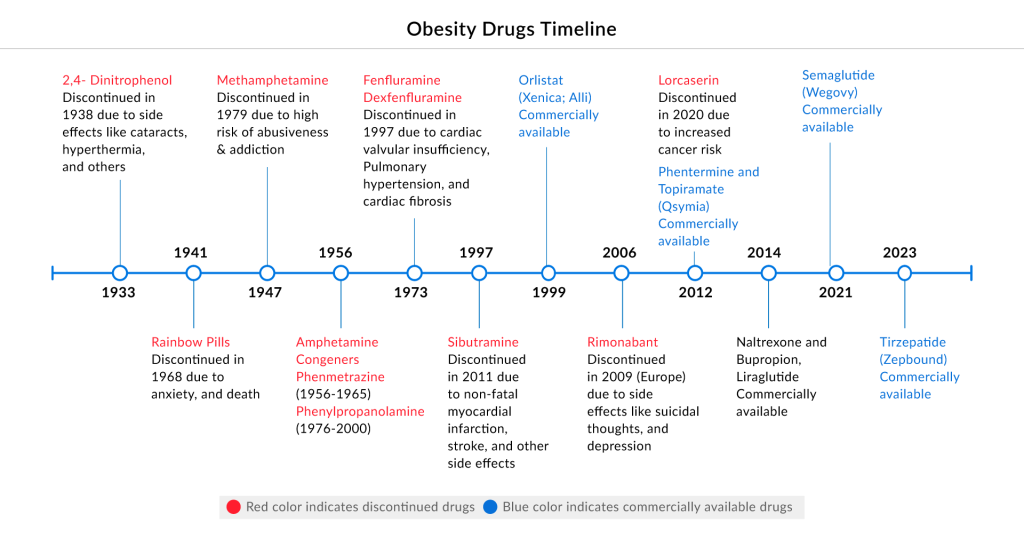

In the last century, obesity pharmacotherapy has seen diverse approaches, including amphetamines, thyroid hormones, and withdrawn drug combinations. Current obesity treatment options, like phentermine, cathine, and diethylpropion, offer short-term benefits. Investigations into mitochondrial uncouplers, serotonergic agonists, and others show limited efficacy, with most failing to achieve over 10% placebo-adjusted mean weight loss at tolerable doses.

FDA-approved therapies for obesity treatment include CONTRAVE (bupropion-naltrexone), a combination of medications reducing appetite and cravings; SAXENDA (liraglutide), an injectable GLP-1R agonist suppressing appetite and affecting gastric emptying; Alli, XENICAL (orlistat), an inhibitor of pancreatic lipase aiding obesity management; QSYMIA (phentermine-topiramate), a prescription suppressing appetite and promoting weight loss; IMCIVREE (setmelanotide), approved for genetic-based obesity; and WEGOVY (semaglutide), an injectable medication aiding weight loss in adults with obesity or overweight, coupled with a reduced-calorie meal plan and increased physical activity.

Novo Nordisk Leading the Way in the Anti-Obesity Treatment Market

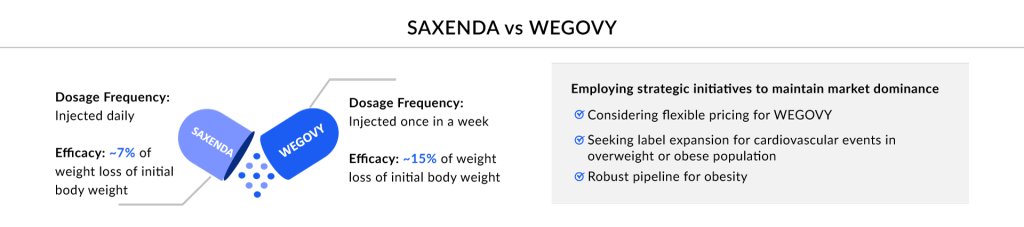

Novo Nordisk solidifies its dominance in the obesity market with SAXENDA, its pioneering GLP-1-based drug, and the recent addition of WEGOVY.

SAXENDA, a product of Novo Nordisk was initially approved in December 2014 in the US for the treatment of chronic weight management in adults with a BMI of 30 kg/m2 or higher or a BMI of 27 kg/m2 or higher who have at least one weight-related condition.

WEGOVY (semaglutide), another Novo Nordisk lead asset, is a GLP-1 receptor agonist indicated as an adjunct to a reduced-calorie diet and increased physical activity. In June 2021, the FDA approved WEGOVY injection for chronic weight management in adults. The prescription volume for WEGOVY was ~92,000 in the US in January 2024. After its launch in the US, WEGOVY is now accessible in over 15 markets globally. In 2024, WEGOVY generated sales of USD 6.4 billion in the US. In January 2025, Novo Nordisk reported that a high dose of its obesity drug Wegovy led to greater weight loss than the approved regimen in a Phase III trial.

Novo Nordisk experienced a staggering 147% surge in sales of its obesity care products due to the rapid adoption of WEGOVY among healthcare professionals. The drug also achieved over 70% commercial formulary access within six months of launch. Additionally, in January 2024, Novo Nordisk ramped up the supply of lower-dose WEGOVY to meet the surging demand. In Feb 2025, Novo Nordisk reported that for the final three months of 2024, Novo reported sales of approximately $12 billion, a 30% increase from the same period in 2023. This performance helped Novo’s total sales for 2024 grow by 26% at constant currencies, reaching nearly $41 billion. The company also achieved operating profits of $18 billion for the year, as stated in a press release on.

Eli Lilly and Novo Nordisk: A Battle for Supremacy in the Anti-Obesity Treatment Market

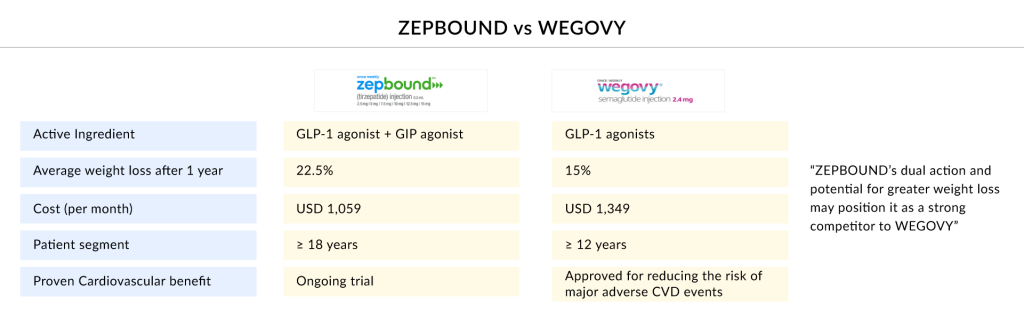

Eli Lilly and Novo Nordisk, two pharmaceutical giants, are at the forefront of the burgeoning anti-obesity treatment market, fiercely competing for supremacy. Eli Lilly, with its innovative drug ZEPBOUND, has made significant strides by demonstrating superior efficacy in weight reduction compared to existing treatments. ZEPBOUND, originally developed for type 2 diabetes, recently got approved for obesity treatment. The company’s strategic focus on leveraging its expertise in metabolic diseases positions it well to capture a substantial share of this rapidly growing obesity treatment market. In February 2025, Eli Lilly launched 7.5 mg and 10 mg Zepbound (tirzepatide) vials for $499 through the Zepbound Self Pay Journey Program, alongside price reductions for 2.5 mg and 5 mg vials. These are available exclusively via LillyDirect Self Pay Pharmacy Solutions, offering direct savings outside of insurance.

On the other hand, Novo Nordisk, a leader in diabetes care, has established itself as a formidable player in the anti-obesity treatment market with its drug semaglutide, marketed under the brand name WEGOVY. Semaglutide has received widespread acclaim for its effectiveness in weight management, significantly reducing body weight in patients. Novo Nordisk’s extensive experience in GLP-1 receptor agonists and its robust global distribution network gives it a competitive edge. As both companies continue to innovate and expand their portfolios, the battle for dominance in the anti-obesity treatment market is set to intensify, promising advancements that could transform patient outcomes and redefine the landscape of obesity management.

However, pharmaceutical companies face an uphill battle in securing public reimbursement for obesity treatments as access to weight loss medications is frequently limited by both private and public insurers. The drugs are excluded from Medicare coverage, and many private health plans resist covering them due to their high cost. In Germany, Novo Nordisk’s obesity drug WEGOVY will continue to be excluded from reimbursement for the treatment of obesity, while in Spain and France, WEGOVY and Saxenda are not reimbursed by public and private insurance. Despite the strong demand for anti-obesity drugs like WEGOVY and ZEPBOUND after approval, a supply shortage has occurred.

The Competition Among Leading Manufacturers to Revolutionize Obesity Treatment

The current obesity pipeline comprises over 100 clinical-stage assets undergoing trials, dominated by GLP-1 receptor agonists, either alone or in combination with GIP agonists. Some of the drugs in the obesity pipeline include Semaglutide oral, Tirzepatide, Tesomet, RZL-012, and others. Key players, such as Novo Nordisk, Eli Lilly and Company, Saniona, Raziel Therapeutics, Empros Pharma, and others are involved in developing novel therapies for, overweight and obesity which will eventually help in weight management.

Oral semaglutide, marketed as RYBELSUS, is approved in the US, EU, and Japan as an adjunct to diet and exercise to improve glycemic control in adults with type II diabetes. It is an oral GLP-1 receptor agonist, mimicking the naturally occurring hormone GLP-1. The drug is currently being developed for obesity and is undergoing a Phase III trial (NCT05564117; OASIS 4) to assess its safety and efficacy in subjects with overweight or obesity.

| Obesity Pipeline Therapies | |||

| Drugs | Company | Phase | MoA |

| Semaglutide oral | Novo Nordisk | Phase III | Glucagon like peptide 1 receptor agonists |

| Tirzepatide | Eli Lilly and Company | Phase III | Gastric inhibitory polypeptide receptor agonists; Glucagon like peptide 1 receptor agonists |

| Tesomet | Saniona | Phase II | Beta 1 adrenergic receptor antagonists; Biogenic monoamine uptake inhibitors |

| RZL-012 | Raziel Therapeutics | Phase II | Lipolysis modulators |

| EMP16 | Empros Pharma | Phase II | Alpha-glucosidase inhibitors; Amylase inhibitors; Lipase inhibitors |

| DD01 | D&D Pharmatech | Phase I | Glucagon like peptide 1 receptor agonists; Glucagon receptor agonists |

| ZP 8396 | Zealand Pharma | Phase I | Islet amyloid polypeptide replacements |

| ERX-1000 | ERX Pharmaceuticals | Phase I | |

Pfizer has developed danuglipron (PF-06882961), an oral small-molecule GLP-1R agonist, and announced in June 2023 its decision to progress this candidate toward further clinical development for obesity treatment. In December 2023, Pfizer reported topline data from a Phase IIb clinical trial demonstrating a statistically significant change in body weight in adults with obesity without type II diabetes. Boehringer Ingelheim is developing survodutide (BI 456906), a dual GCGR/GLP-1 agonist, which leverages the effects of oxyntomodulin to decrease food intake and increase energy expenditure. In August 2023, Boehringer Ingelheim announced plans to advance survodutide into three registrational Phase III studies for people with overweight or obesity, based on promising Phase II data.

The anticipated launch of these emerging therapies for obesity are poised to transform the market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the obesity market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

DelveInsight estimates that the market for obesity treatment in the 7MM was 6 billion and is expected to grow at a significant CAGR due to rising demand and increasing research to launch new products to cater to the patient pool.

What Lies Ahead in Obesity Treatment?

The battle for dominance in the obesity treatment market is heating up between WEGOVY and ZEPBOUND, two leading weight loss medications. Novo Nordisk’s WEGOVY, a higher-dose formulation of its diabetes drug semaglutide, has gained widespread attention for its significant weight reduction results in clinical trials. Meanwhile, Eli Lilly’s ZEPBOUND, powered by tirzepatide, employs a dual mechanism targeting both GLP-1 and GIP receptors, delivering potentially superior weight loss outcomes. As both pharmaceutical giants compete for market leadership, their rivalry is marked by aggressive marketing strategies, continuous innovation, and efforts to enhance patient outcomes. In January 2025, Novo Nordisk reported that a high dose of WEGOVY achieved even greater weight loss than the current approved regimen in a Phase III trial. However, data suggest that Eli Lilly’s ZEPBOUND may still hold a competitive edge, intensifying the race for obesity treatment supremacy.

The competition is expected to become even fiercer with the arrival of upcoming obesity therapies. Several pharmaceutical companies are developing new weight loss medications that target different pathways and offer various benefits, such as improved cardiovascular outcomes or fewer side effects. These new obesity therapies might include novel combinations of existing drugs, advanced formulations, or entirely new classes of medications. The success of WEGOVY and ZEPBOUND will depend on their ability to not only maintain their current advantages but also adapt to the evolving landscape by enhancing their formulations, demonstrating long-term safety and efficacy, and possibly integrating complementary treatments. This dynamic environment promises rapid advancements in obesity treatment, ultimately benefiting patients through more effective and personalized therapies.

Downloads

Article in PDF

Recent Articles

- Body Contouring Devices: Understanding the Key Factors Determining the Market Growth and Evolving...

- Cardio Flow’s FreedomFlow Orbital Atherectomy Peripheral Platform; Medtronic’s Aurora EV- ICD Sys...

- Commercial

- The Latest Breakthroughs in Obesity Treatment: A New Era of Weight Loss Innovation

- The Obesity Pandemic: What Can we do About it?