An Insight Into the Weight Loss and Obesity Market

Mar 24, 2025

Table of Contents

Obesity is one of the significant global health challenges, having a severe socio-economic impact. It is basically an imbalance in calories consumed versus calories expended. Over the past two to three decades, it has grown to be a global epidemic and impacting people across age and geographic regions, which has a direct influence on morbidity and mortality. Several factors such as genetics, a sedentary lifestyle, high consumption of fat and sugars (energy-dense foods), daily routine, taking certain medications, endocrine problems, and physical inactivity contributed immensely to obesity. Similarly, environmental or societal changes, behaviour, and culture also have a direct impact.

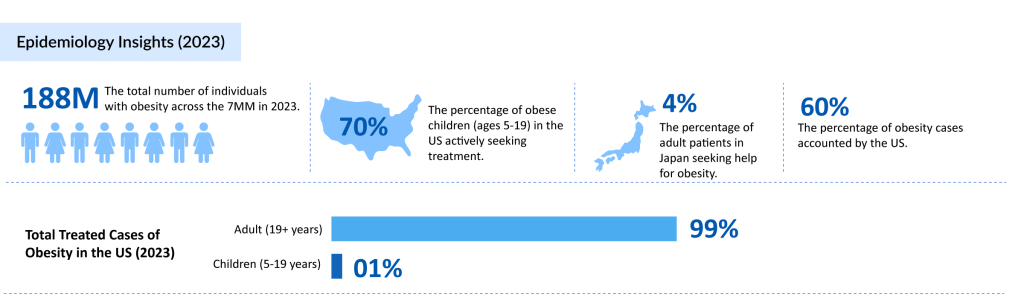

The global obesity crisis is worsening, with 1 in 8 people worldwide affected in 2022, according to WHO. Since 1990, adult obesity has doubled, and adolescent obesity has quadrupled. That year, 2.5 billion adults were overweight, including 890 million with obesity, while 43% of adults were overweight and 16% had obesity. Childhood obesity is also rising, with 37 million children under five affected and 160 million adolescents living with obesity. The economic toll is staggering, with global costs projected to hit $3 trillion annually by 2030 and $18 trillion by 2060. These figures highlight the increasing prevalence of obesity across all age groups, making early intervention and prevention crucial.

Downloads

Article in PDF

Recent Articles

- Redefining Liver Disease in the Metabolic Era: From NASH to MASH and the Rise of Obesity‐targeted...

- The Obesity Pandemic: What Can we do About it?

- Body Contouring Devices: Understanding the Key Factors Determining the Market Growth and Evolving...

- Commercial

- FDA Approves LUMAKRAS with VECTIBIX for KRAS G12C-Mutated Colorectal Cancer; PYC Receives FDA Rar...

In 2020, nearly 39 million children under the age of 5 were overweight or obese globally. The impact is not severe during childhood, but it can lead to premature death and disability in adulthood. Heart disease, stroke, diabetes, high blood pressure, sleep disorders, and breathing problems are closely associated with obesity. Apart from these, overweight and obesity can lead to musculoskeletal disorders and can also be a critical factor in developing certain types of cancers.

Despite being a preventable disease, nearly one-third of the world’s adult population is overweight or obese. Leading companies have developed various pharmacotherapies and medical devices to tackle the rising prevalence and meet unmet needs. The treatment options are available based on the severity of the condition, economic status, and personal preferences of the user. Behaviour modifications, prescription medicines, surgical options and medical devices are available to tackle obesity efficiently.

Impact of Dietary Changes and Physical Exercise on Overweight

Dietary changes aim to reduce the intake of processed, refined, and ready-made food high in sugar and fat and increase the consumption of whole grains, low-calorie sweeteners, organic food, protein supplements, and other high-fiber supplements/foods such as vegetables and fresh fruits.

As per the product types, the dietary supplement market for weight management is segmented into meals, beverages, and supplements. Some of the most common products include green tea (or herbal tea), low-calorie sweeteners, stevia, Conjugated Linoleic Acid (CLA), aspartame, sucralose, diet soft drinks, slimming water, saccharin, and others.

Weight loss equipment can be a great way to do physical activities, boost workouts, burn calories, and create an energy deficit in the body. The key companies in the fitness equipment market include Life Fitness, Precor, Nautilus, Cybex, Technogym, Matrix, Hammer Strength, Star Trac, True Fitness, and Hoist Fitness, and several others. Being quite expensive can be a key factor for their low demand.

Medication for the Weight Management and Obesity

Today, certain FDA-approved medicines are available in the market for weight loss with different mechanisms of action. Some medications work like stopping the body cells from absorbing fat from the foods, while some other medicine class makes a person feel less hungry. Medications provide optimum results when combined with dietary and lifestyle changes or followed by physical activity. Various studies have suggested that prescription medications and lifestyle programs have provided better results than single programs. It is a must to mention that weight-loss drugs may not be effective for everyone. Similarly, they may lead to serious side effects as well.

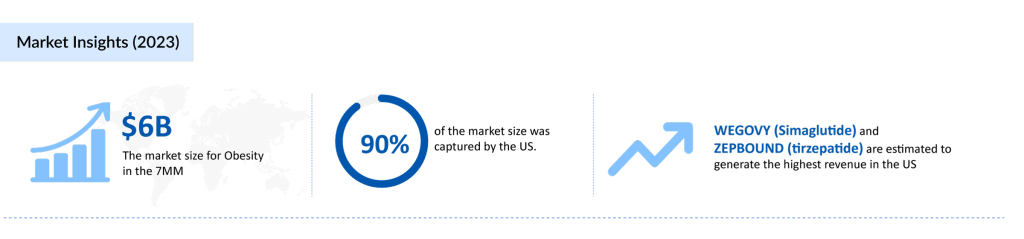

The obesity treatment market has witnessed significant advancements in recent years, with the FDA approving several medications to address the growing prevalence of obesity. Currently, six drugs—XENICAL (orlistat), QSYMIA (phentermine-topiramate), CONTRAVE (naltrexone-bupropion), SAXENDA (liraglutide), WEGOVY (semaglutide), and IMCIVREE (setmelanotide)—are approved for long-term use in managing overweight and obesity. These medications work through various mechanisms, such as reducing appetite, altering metabolism, or limiting fat absorption, providing patients with multiple options for weight management.

In November 2023, the FDA approved ZEPBOUND (tirzepatide), developed by Eli Lilly, as a breakthrough therapy for obesity. This drug activates both glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) hormone receptors, enhancing weight loss by regulating appetite and glucose metabolism. The approval of ZEPBOUND marks a significant milestone in the obesity drugs market, offering patients an innovative treatment option with promising clinical outcomes.

Among all approved obesity therapies, WEGOVY (semaglutide) and ZEPBOUND (tirzepatide) are projected to dominate the market and generate the highest revenues in the US. Their strong efficacy, coupled with increasing demand for effective weight-loss solutions, positions them as leading players in the evolving obesity treatment market. As pharmaceutical companies continue to invest in research and development, the future of obesity therapies looks promising, bringing hope to millions struggling with weight management.

In June 2021, the FDA approved a new drug treatment, WEGOVY (semaglutide), by Novo Nordisk for Chronic Weight Management, the first since 2014. Adults with obesity or overweight can use WEGOVY (semaglutide) injection with at least one weight-related condition. It can also be used in addition to a reduced-calorie diet and increased physical activity.

In March 2025, Novo Nordisk launched NovoCare® Pharmacy, a direct-to-patient delivery service offering cash-paying patients all doses of WEGOVY (semaglutide) at a reduced cost of $499 per month. This option is available to uninsured patients or those with commercial insurance lacking obesity medicine coverage, expanding Novo Nordisk’s efforts to improve access for people living with obesity.

Currently, some of the key companies in the Weight Loss/Weight Management (Obesity) Market, including DD01 (D&D Pharmatech), ZP 8396 (Zealand Pharma), ERX-1000 (ERX Pharmaceuticals), Survodutide (Zealand Pharma), Ecnoglutide (Sciwind Biosciences), CT-868 (Carmot Therapeutics), DD01 (D&D Pharmatech), and others, are actively investigating new therapies for the Weight Management. The obesity treatments are in different stages of clinical development and are expected to launch in the coming years.

Weight Loss/Weight-management Surgeries and Medical Devices

It is not likely that every person may respond well to dietary or lifestyle changes or medications. When medication is ineffective or obesity-related complications grow to a more significant extent, the person may follow surgical options or use medical devices upon recommendation from the doctor or physician.

Weight loss surgery, commonly called bariatric surgery, aims to either make the stomach smaller or bypass part of the digestive system. The surgical equipment market for weight loss is divided into minimally invasive/bariatric equipment and noninvasive surgical equipment market. Gastric bypass surgery, Gastrectomy, and Gastric banding are the most common surgeries for weight loss. The surgery helps the person to lose weight and, at the same time reduce the risk of certain obesity-related life-threatening diseases.

Over the past few years, health agencies, including the FDA, the EU, and several countries globally, have approved Medical Devices for weight loss and weight management. The FDA-approved medical devices for weight loss include Gastric Bands, Electrical Stimulation Systems, Gastric Balloon Systems, and Gastric Emptying Systems. The long-term data regarding the safety and effectiveness of these devices still require in-depth study. Similarly, the FDA-regulated devices for the Weight-Management include Oral Removable Palatal Space Occupying Device and Ingested, Transient, Space Occupying Device. Apart from these, several anti-obesity medical devices are available as over-the-counter products.

Rising Growth of Fitness Apps for Weight Loss

Mobile health apps, including fitness and weight loss apps, are gaining widespread popularity as people strive to lose weight, enhance physical fitness, and maintain a healthy lifestyle. These apps provide comprehensive tracking of daily activities such as calorie intake, calories burned, weight fluctuations, and physical activity, delivering valuable data and insights to users. With intuitive features, they simplify progress monitoring, making analyzing and interpreting results easier. Beyond basic tracking, mobile health apps offer a range of additional benefits, including educational resources, expert coaching, podcasts, online courses, webinars, and personalized feedback from nutritionists and fitness professionals. By promoting behavioral changes and offering continuous motivation, these apps empower users to stay committed to their fitness goals and achieve long-term health improvements.

Globally, Strava, Apple Fitness, Fitbit, PUSH, Runna, Strong, Hevy, Runkeeper, Gymverse, Lose It!, and MyFitnessPal are the leading fitness and weight loss apps. Along with the advancement in technology and the growth in the internet and smartphones, the fitness apps or virtual weight loss market is growing significantly faster. Strava for those who like a little competition, Apple Fitness for Apple users, Fitbit for an entry-level app, PUSH for science-backed gains, Runna for race training, Strong for strength training, Hevy for busy people, Runkeeper for running beginners, Gymverse for strength training beginners.

To stay competitive and gain market share, the fitness apps industry is expected to evolve immensely with many advanced features, usage, and lucrative offers to the user. In the coming years, digital technologies, such as AI, cloud, and wearable technology advancements, will also stimulate the fitness app industry to grow immensely.

What lies ahead

The global prevalence of obesity has observed massive growth over the years and is expected to grow in the coming years. It disrupts the health status of society and leads to even more complex and severe life-threatening diseases such as diabetes, hyperlipidemia, heart disease, and cancer. In recent times, the COVID-19 pandemic has also had an impact on rising prevalence. The lockdown measures have changed the lifestyle pattern leading to less physical activity and several other behaviour changes in daily life. The governments and health agencies need to work on new strategies to tackle rising prevalence and spread awareness about the long term consequences.

Sedentary lifestyles, growth in disposable income, and a rise in physical inactivity will be the critical factors for the increase in the obese population in the coming years. However, with the increasing awareness about nutrition and a healthy lifestyle, a growth in popularity of healthy organic food and increased expenditure on health and fitness products, the situation can be tackled efficiently. Similarly, global pharmaceutical and MedTech companies are also working diligently to provide an effective treatment paradigm. However, the stringent regulatory guidelines, high cost of the weight-loss devices, long-term efficacy, the side effects associated with the pharmacotherapies will be the key factors to be addressed.

Downloads

Article in PDF

Recent Articles

- How Bariatric Surgery Devices Are Revolutionizing Weight Loss Outcomes?

- The Race to Redefine Obesity Treatment

- The Latest Breakthroughs in Obesity Treatment: A New Era of Weight Loss Innovation

- Eli Lilly’s Obesity Treatment Drug Candidates – A Show for the Competitors

- Redefining Liver Disease in the Metabolic Era: From NASH to MASH and the Rise of Obesity‐targeted...