WINREVAIR Approval for Pulmonary Arterial Hypertension Treatment: Is It A Game-Changer for Merck?

Jun 17, 2024

Merck’s investment of $11.5 billion in acquiring Acceleron Pharma is expected to yield significant returns with the FDA’s approval of WINREVAIR (sotatercept), a pivotal component of the acquisition, for the treatment of pulmonary arterial hypertension.

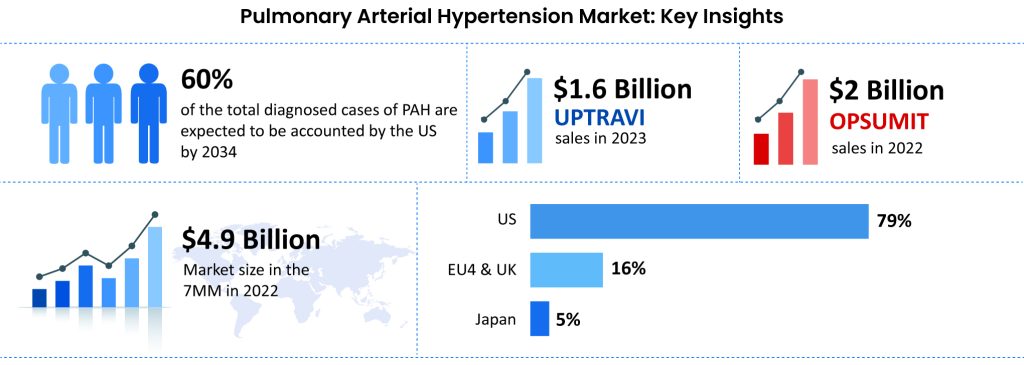

An estimated prevalence of pulmonary hypertension at the population level is approximately 1% to 3%. The total prevalent cases of PAH in the 7MM were found to be approximately 88K cases in 2022, which are expected to increase by 2034 at a CAGR of 0.4% during the study period (2020─2034). It is observed females are more affected by PAH than males. According to DelveInsight’s estimates in 2022, the gender-specific diagnosed prevalent cases of pulmonary arterial hypertension in the US were approximately 23K females and 7K males.

The pulmonary arterial hypertension medication, WINREVAIR, marks the first FDA approval for an activin signaling inhibitor treatment for PAH. This new category of therapy aims to enhance the equilibrium of pro- and anti-proliferative signals, thereby controlling the proliferation of vascular cells, a key factor in PAH. WINREVAIR is designed to complement current PAH treatments, enhancing the ability to exercise, decreasing PAH severity, and lowering the chances of disease progression.

Downloads

Click Here To Get the Article in PDF

Recent Articles

- LEQEMBI Intravenous Infusion Approval; Novartis’ Presented Updates on Lutathera; FDA Accept...

- Pulmonary Arterial Hypertension Therapies

- New Clinical Developments in the Pulmonary Arterial Hypertension Treatment Domain

- Siemens Healthineers’s COVID-19 Antigen Self-Test; Paragon’s R3ACT Stabilization System; Pulnovo ...

- World Hypertension day

Originally developed through collaboration between Acceleron and Celgene, sotatercept was initially studied as a potential remedy for conditions such as osteoporosis, anemia, and multiple myeloma. It has now emerged as a supplementary treatment alongside established standards of care, albeit in a limited yet significant capacity.

The approval was granted based on findings from the Phase III STELLAR trial, where WINREVAIR (n=163) was compared to a placebo (n=160), both used alongside standard care treatments for adults with PAH (WHO Group 1 FC II or III). The results demonstrated that the addition of WINREVAIR to the existing therapy resulted in a 41-meter increase in the six-minute walk distance from the starting point at Week 24 (95% CI: 28, 54; p<0.001; adjusted for placebo). Additionally, it notably enhanced various key secondary outcomes, such as an 84% reduction in the risk of death from any cause or PAH clinical worsening events compared to standard therapy alone (number of events: 9 vs 42, hazard ratio=0.16; 95% CI: 0.08, 0.35; p<0.001).

WINREVAIR might raise hemoglobin levels, potentially causing an increase in red blood cell count, which, if significant, could heighten the chances of blood clotting events or a condition called hyperviscosity syndrome. Additionally, WINREVAIR might lower platelet count, resulting in severe thrombocytopenia, which could raise the risk of bleeding; notably, cases of thrombocytopenia were more common in patients also undergoing prostacyclin infusion.

This newly approved PAH drug WINREVAIR will be administered as a subcutaneous injection every three weeks for a year with the recommended starting dose is 0.3 mg/kg. The cost of therapy for WINREVAIR depends upon the dose prescribed by the patient’s HCP. Based on this, the annual cost of therapy is estimated to be approximately $175,000 per patient, as the per vial cost is $14,000, across both kit configurations (45mg and 60mg) and will be available for eligible patients through the Merck Access Program. The drug can be accessed via a network of specialty pharmacies and will be largely covered under the patient’s pharmacy benefit including under Medicare Part D for Medicare patients. Similar to other products covered by a patient’s pharmacy benefit, Merck will be providing certain government-mandated discounts on WINREVAIR, including responsibility for costs in the initial coverage and catastrophic phases required through the benefit redesign of the Medicare Part D program under the IRA, starting in 2025.

The current market dominators, Johnson & Johnson and Nippon Shinyaku’s UPTRAVI and OPSUMIT are vasodilators that help widen blood vessels, improve exercise capacity, alleviate symptoms, and slow disease progression but do little to ameliorate the disease, as they do not address the underlying cause. UPTRAVI, an agonist for the prostacyclin receptor (IP), generated $1.6 billion in sales last year, marking a 20% increase. OPSUMIT, an agonist for the endothelin receptor, brought in $2 billion in revenue, showing a 14% rise from 2022 figures.

Even the recently approved, Johnson & Johnson’s OPSYNVI, the first and only once-daily combination pill of macitentan and tadalafil, specifically for people with functional class II and III PAH, offers increased convenience that can improve quality of life but provides only symptomatic relief.

Merck’s WINREVAIR, a TGF-beta inhibitor, is a novel first-in-class non-vasodilator selective ligand trap, that re-balances antiproliferative and pro-proliferative signaling, the key drivers of PAH, reversing vascular and right ventricle remodeling. It moves beyond the three typical pathways where all the other drugs have been developed and targets the disease cause. It blocks activin proteins that contribute to the thickening of blood vessel walls in the lung and subsequent increase in blood pressure. In its Phase III trial, the drug had statistically significant results and led to a 34% reduction in pulmonary vascular resistance as compared with a placebo from baseline. It also reduced the risk of death from any cause or PAH clinical worsening event, a big development from the current regime.

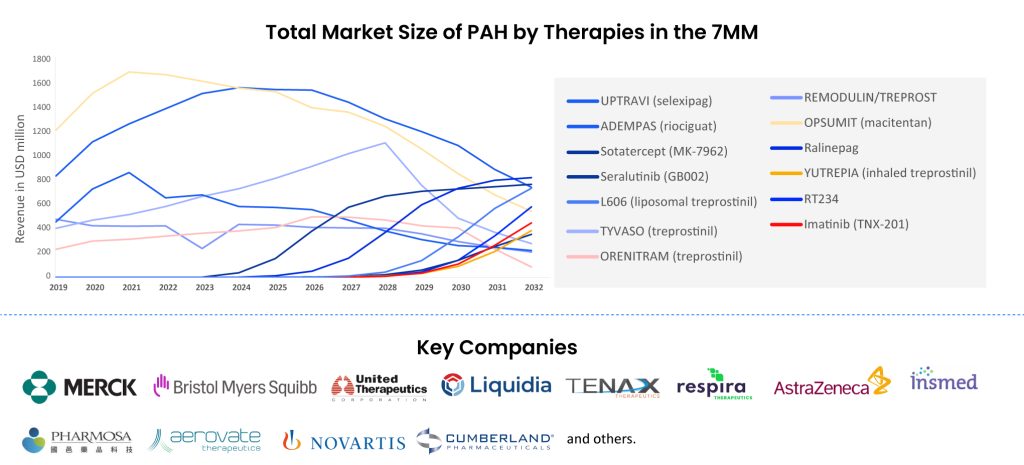

With excellent efficacy, disease-modifying properties, and a compliant dose regime, the drug has immense potential even in this cramped market space, making Merck an important market player. According to DelveInsight’s estimates, the drug is projected to change the existing PAH market dynamics, and with a medium-fast uptake is poised to generate nearly USD 1bn by 2034.

While significant progress has been made in the development of therapies for PAH, challenges persist in demonstrating meaningful clinical benefits, managing patient heterogeneity, and ensuring long-term safety. Past failures such as Bosentan and Sitaxsentan have emphasized the importance of rigorous safety monitoring and the need for innovative trial designs. Bosentan, an endothelin receptor antagonist, and sitaxsentan, another endothelin receptor antagonist, both showed promise in early studies. However, sitaxsentan was withdrawn from the market due to liver toxicity concerns, highlighting the importance of safety monitoring.

Nevertheless, the approval of novel drugs like epoprostenol, sildenafil, riociguat, macitentan, and selexipag has provided hope for PAH patients, but ongoing research and development efforts are crucial to address the unmet needs in this challenging disease.

Research has led to a better understanding of PAH and the development of new treatment options. The PAH pipeline is robust and various drugs are in the late stages of development like Seralutinib (GB002) by Gossamer Bio, Imatinib (TNX-201) by Tenax Therapeutics, Ralinepag by United Therapeutics, etc.

RT234 (vardenafil), a product of Respira Therapeutics’ development efforts, is an innovative inhaled treatment designed for on-demand (PRN) usage. Its primary goal is to enhance exercise endurance and offer immediate relief from the most frequently reported symptoms among PAH patients (Group 1 in WHO’s classification of PH indications), namely breathlessness and fatigue. RT234 combines vardenafil with a unique axial oscillating sphere (AOS) dry powder inhaler, a drug-device pairing that delivers the powdered medication directly to the lungs. Respira has plans to explore additional applications for RT234 across other WHO PH patient categories and is presently engaged in Phase IIb trials (VIPAH-PRN 2B) for PAH treatment.

Seralutinib (GB002), currently under development by Gossamer Bio, is an inhaled, small-molecule inhibitor that selectively targets the platelet-derived growth factor (PDGF) receptor kinase. This drug is being studied for its potential in treating pulmonary arterial hypertension (PAH). Seralutinib focuses on PDGFRα/β, CSF1R, and c-KIT, leading to an increase in BMPR2 protein expression, all of which are significant pathways in PAH. It has shown notable reductions in both right ventricular systolic pressure and mean pulmonary artery pressure. Recently, Gossamer Bio released top-line results from the Phase II TORREY study, indicating favorable outcomes for seralutinib, especially in patients with more severe baseline conditions. The medication is currently in Phase III clinical trials, with an expected completion date of September 2025.

Ralinepag, an innovative oral medication, is a potent and selective agonist of the prostacyclin receptor. Developed by United Therapeutics, it is intended for the treatment of PAH. Laboratory studies suggest that ralinepag strongly binds to and selectively targets the human prostacyclin (IP) receptor. United Therapeutics is currently engaged in several Phase III trials, such as ADVANCE OUTCOMES and ADVANCE CAPACITY, which are global, multicenter investigations involving patients using approved oral therapies for PAH, and these trials are placebo-controlled.

Like WINREVAIR, some of these drugs modulate new pathways involved in long-term structural changes in the blood vessels. E.g., seralutinib and imatinib inhibit certain enzymes that manage cell growth, but they work on different pathways from each other, as well as from WINREVAIR and existing treatments. They will compete with each other to grab a part of the pie once they enter the PAH treatment market, but there is time for this, which provides Merck with an excellent opportunity to establish a strong foothold.

Some other drugs are improvements in the existing class and will contest majorly within the class, like Ralinepag, a selective, and potent prostacyclin receptor agonist, with higher binding affinity and receptor selectivity, is more potent and efficacious than selexipag at increasing cellular cyclic adenosine monophosphate levels, which might affect the market of UPTRAVI, a similar class product.

A cautious hawk-eye approach is the best way forward, for the dynamic vibrant PAH market, which is projected to witness fluctuations in the coming years.

Though it’s mostly all bright and shiny for this novel molecule, the drug will face some generic erosion and competition from the already established players and might lead to some overcast in Merck’s revenue. This might be further clouded by the fact that the labeling for WINREVAIR includes several serious risks that require monitoring, including an increased risk of bleeding. The FDA has asked physicians to monitor patient hemoglobin levels before each dose, for at least the first five doses, as the most notable side effect was increased levels of hemoglobin, with individuals experiencing spider veins, bleeding gums, and noses. However, those risks are included in the Warnings section and not in a black box warning.

Further research on diagnostic and prognostic blood biomarkers in asymptomatic or specific at-risk populations to improve diagnosis and develop novel treatment options, alongside the increasing prevalence of PAH and government support for the development of orphan drugs, provides companies with an excellent opportunity to invest in the PAH market.

Downloads

Article in PDF

Recent Articles

- Merck’s WINREVAIR™ EU Approval; BALVERSA for Urothelial Carcinoma; Novartis and Versant’s Boreali...

- Navigating the Loss of Exclusivity: Big Pharma’s New Playbook

- ACC.25 Highlights: Groundbreaking Advances in Cardiovascular Medicine and Emerging Therapeutics

- Gilead’s Livdelzi FDA Approval for Primary Biliary Cholangitis; Incyte and Syndax’s Niktimv...

- Pulmonary Arterial Hypertension Therapies