Download Case Study to Unlock Valuable Insights

Fill out the form to gain access to exclusive content and data-driven strategies

Asset Prioritization

- Home

- case study

- asset prioritization

Objective: Identifying and Prioritizing High-Potential Atrial Fibrillation Therapeutic Assets

Asset Prioritization Analysis to provide strategic direction to the client planning to enter into the Atrial Fibrillation space in identifying and prioritizing the most promising therapeutic assets for potential in-licensing. The client sought strategic insights to address their growth goals and bolster their pipeline with high-value assets aligned with their long-term development goals.

Problem Statement: Expanding Pharmaceutical Assets Through Evidence-Based Licensing Strategies

A mid-sized pharmaceutical client aimed to expand their asset portfolio by identifying the best possible therapeutic candidate for Atrial Fibrillation to support future development and licensing opportunities. The client sought evidence-based insights to prioritize assets and products suitable for Phase II development, with a focus on potential licensing collaborations. Additionally, the client wanted to strategically align their research efforts by identifying an optimal asset to enhance and complement their existing research portfolio, ensuring a targeted and impactful approach to advancing their pipeline.

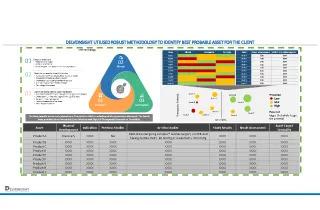

DelveInsight’s Comprehensive Asset Prioritization Methodology

Technology Assessment: Evaluating Innovation and Feasibility in Atrial Fibrillation Therapies

The Technology Assessment focussed on evaluating the innovative capabilities of potential assets within the Atrial Fibrillation space. This includes analyzing the underlying scientific principles, mechanisms of action, and differentiating features of the assets. Key considerations include:

- Innovation potential: Is the technology addressing unmet needs?

- Feasibility: How viable is the technology for Phase II development?

- Competitiveness: How does it stand against existing and pipeline therapies?

This analysis provided insights into the technical robustness and novelty of the assets, forming the foundation for prioritization.

Technology Assessment: Evaluating Innovation and Feasibility in Atrial Fibrillation Therapies

This component evaluated the organizations behind the assets. The analysis includes:

- Reputation and track record: A company’s history in drug development and successful commercialization.

- Strategic alignment: How well the company’s vision aligns with the client’s goals.

- Financial health: Stability to support potential licensing collaborations.

- Partnership potential: Willingness and ability to collaborate effectively with the client.

By assessing these factors, the client gained confidence in the reliability and compatibility of potential partners.

Commercial Assessment: Market Forecast, Competitor Landscape, and Reimbursement Outlook

A comprehensive evaluation of the market potential of the assets, considering:

- Market size and growth: The current and projected market for Atrial Fibrillation treatments. DelveInsight helped client to understand the Atrial Fibrillation Market forecast up to 2032 and helped to understand the market share uptake of various assets in the emerging phase.

- Competitor landscape: Positioning of competing products and gaps the asset could fill.

- Pricing and reimbursement: Viability of pricing strategies and likelihood of payer support.

- Regulatory environment: Market access challenges and opportunities in key regions. As client's geographies of interest were 7MM, so DelveInsight's team assessed the regulatory scenarios wrt these geographies.

This ensured that the selected asset is not only clinically promising but also commercially viable.

Commercial Assessment: Market Forecast, Competitor Landscape, and Reimbursement Outlook

This assessment delved into the clinical development stage and potential of the assets, analyzing:

- Efficacy: Data from preclinical and clinical trials.

- Safety profile: Adverse events, tolerability, and risk management.

- Development feasibility: Scalability and challenges in progressing to Phase II.

- Regulatory progress: Status of interactions with regulatory authorities.

The focus is on identifying assets with strong clinical credentials and a high likelihood of successful progression.

Primary Assessment: Stakeholder Insights from KOLs, Providers, and Patients

Primary Assessment involves direct engagement with stakeholders through surveys, interviews, and focus groups. This captures real-world insights and opinions from:

- Key opinion leaders (KOLs): Experts in Atrial Fibrillation treatment.

- Healthcare providers: Insights into prescribing behaviors and unmet needs.

- Patients: Perspectives on current treatments and desired outcomes.

These insights enriched the evaluation process by ensuring that the prioritization aligns with actual market and patient demands and also to understand how the KOLs feel about the MOAs of the asset.

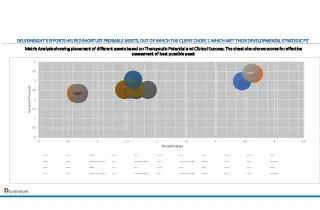

Matrix Analysis: Evidence-Based Asset Ranking and Prioritization Framework

Matrix Analysis synthesizes all data into a structured framework to rank and prioritize assets. Factors include:

- Strategic fit: Alignment with the client’s goals.

- Clinical viability: Strength of efficacy and safety data.

- Market potential: Commercial attractiveness and differentiation.

- Feasibility: Challenges in development and regulatory pathways.

By applying weighted scoring, the matrix helped visualize the comparative strengths and weaknesses of each asset, ensuring an evidence-based decision-making process.

Best Asset Identified: High-Value Therapeutic Opportunity for Licensing and Development

After synthesizing all assessments, the process concludes with the identification of the best possible asset for licensing and development. This asset was chosen based on its:

- Strong clinical data: Efficacy and safety profiles with promising trial results.

- Market potential: Clear differentiation and unmet need fulfillment.

- Alignment with client goals: Strategic fit with the client’s research and business objectives.

- Licensing viability: Feasibility of negotiation and collaboration with the originating company.

The final recommendation provides a comprehensive roadmap for the client to proceed with licensing discussions, ensuring a strategic addition to their Atrial Fibrillation pipeline.

Results

- Matrix Analysis positioned the top 7 companies researched out of the 20 companies.

- The client could assess the Top companies which would effectively fit their strategic needs and objectives (the TARGET quadrant).

- Insights into market trends for different candidates the company is developing and helping to prioritise the products.

Strategic Impact

By leveraging the Matrix Analysis, the client gained a comprehensive understanding of the competitive landscape and a clear pathway to identify the most promising candidates for collaboration. This approach not only facilitated targeted decision-making but also ensured alignment with the client’s long-term objectives for portfolio expansion in the Atrial Fibrillation space.

Furthermore, client employed DelveInsight to do negotiations for In-licensing of the asset.

Our Related Services

Sample Visuals

Get Visuals