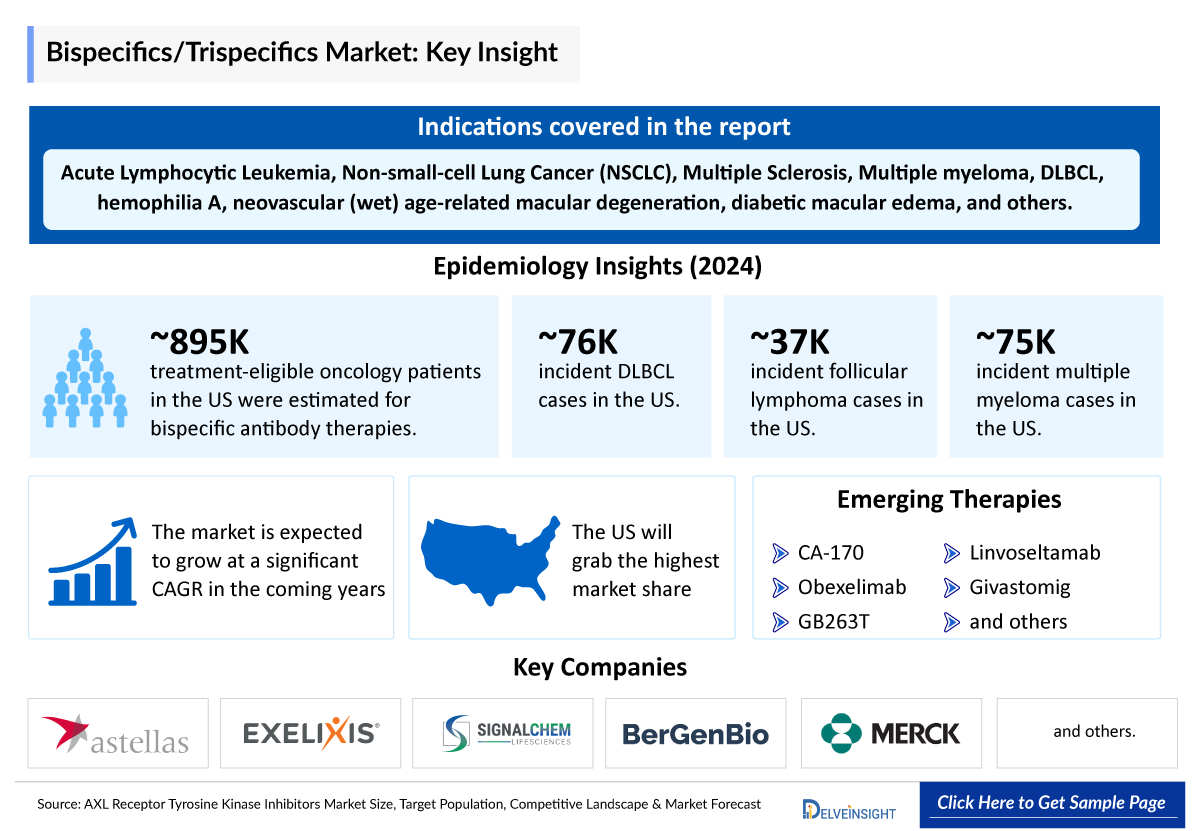

Bispecifics/Trispecifics Market Outlook

- Bispecific antibodies aim to treat multifaceted, complex diseases by engaging two disease targets with one molecule. The majority approved for oncology indications (mainly multiple myeloma and DLBCL). Only two bispecific antibodies, HEMLIBRA and VABYSMO, are authorized for non-oncology indications such as hemophilia A, neovascular (wet) age-related macular degeneration, and diabetic macular edema, and a bispecific molecule named KIMMTRAK approved for uveal melanoma.

- Based on pipeline activities most of the bispecific antibodies developed in multiple myeloma followed by NSCLC.

- Bispecific antibodies are gaining attention in both cancer and autoimmune disease research.

- The world’s first approved bispecific, REMOVAB, aimed to tackle malignant ascites in solid tumors and gained the nod from the EMA; however, it was later withdrawn in 2017 for commercial reasons.

- Three main bispecific antibody fragment include Bispecific T-cell engager (BiTE), Dual-affinity re-targeting proteins (DARTs), and Tandem diabodies (TandAbs).

- A notable trispecific antibody targeting CD19, CD3, and CD28 has shown significant antitumor activity in preclinical models of B-cell malignancies. It enhances T-cell activation and memory differentiation, indicating its potential to improve treatment outcomes for patients with these cancers.

- Johnson & Johnson Innovative Medicine is the leading player, with three approved bispecific antibodies: RYBERVANT, TECVAYLI, and TALVEY, followed by other established Companies such as AbbVie/Genmab, Roche/Biogen, Pfizer, Amgen and, Akeso Biopharma.

- Key Late-stage (Registered, Phase III, and II/III) emerging bispecific companies include AstraZeneca, Zenas BioPharma, Merus, Regeneron Pharmaceuticals, Sichuan Baili Pharmaceutical, Alphamab, SystImmune, BioNTech (Biotheus), and others.

- Odronextamab monotherapy delivered strong efficacy with a manageable safety profile, positioning it as a promising off-the-shelf option for patients who progress after CAR-T therapy.

- By targeting three distinct antigens, trispecific antibodies offer enhanced therapeutic potential compared to monoclonal and bispecific antibodies. They can address multiple disease pathways simultaneously, increasing efficacy and potentially reducing resistance.

- There are no approved trispecific antibody drugs yet, but the rising demand for targeted oncology therapies is set to fuel strong growth.

- Trispecific antibodies are a relatively uncharted territory with the majority of players such as Innovent Biologics, Merck, Genor Biopharma, Chimagen Biosciences, Sanofi, Beijing Mabworks Biotech, Roche, Simcere Pharma, Johnson & Johnson Innovative Medicine, Novartis, Chugai, Numab Therapeutics, and others, in an early stage of development.

- While specific figures for the trispecific market alone are limited due to its early stage, combined bispecific and trispecific antibody markets are projected to grow robustly.

DelveInsight’s “Bispecifics/Trispecifics Market Size, Target Population, Competitive Landscape, and Market Forecast – 2035” report delivers an in-depth understanding of the Bispecifics/Trispecifics, historical and Competitive Landscape as well as the Bispecifics/Trispecifics market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The Bispecifics/Trispecifics market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM Bispecifics/Trispecifics market size from 2020 to 2035. The report also covers current Bispecifics/Trispecifics treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

|

Study Period |

2020–2035 |

|

Forecast Period |

2025–2035 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

Bispecifics/Trispecifics Epidemiology |

Segmented by:

|

|

Bispecifics/Trispecifics Key Companies |

|

|

Bispecifics/Trispecifics Key Therapies |

|

|

Bispecifics/Trispecifics Market |

Segmented by:

|

|

Analysis |

|

Bispecifics/Trispecifics Market: Understanding

Bispecifics/Trispecifics Overview

Bispecific and trispecific antibodies are recombinant molecules that bind specifically to more than one target. Bioengineered to contain two or three distinct antigen binding domains, these antibodies are critical for a successful immunotherapy strategy, bridging the gap between cancer and cytotoxic T cells, and promoting cancer cell lysis.

Bispecifics are designed to bring cytotoxic immune effector cells into proximity with tumor cells, and there are several drug candidates in clinical trials at the moment. Trispecific antibodies may represent an advance over bispecifics by providing a T-cell costimulatory signal such as CD28, or alternatively, by increasing the specificity of natural killer or T-cell targeting. This is an area of active preclinical research at this time.

Further details related to country-based variations are provided in the report.

Bispecifics/Trispecifics Epidemiology

The Bispecifics/Trispecifics epidemiology chapter in the Bispecifics/Trispecifics market report provides historical as well as forecasted epidemiology segmented as total cases in selected indications for bispecifics/trispecifics, total eligible patient pool in selected indications for bispecifics/trispecifics, and total treated cases in selected indications for bispecifics/trispecifics in the 7MM covering the US, EU4 (Germany, France, Italy, and Spain), and the UK, and Japan from 2020 to 2035.

- The treatment-eligible population targeted by bispecific antibodies in oncology in the United States was estimated to be approximately 895,600.

- As per the analysis, the total diagnosed prevalent cases of multiple sclerosis in the United States comprised approximately 121,250 cases in 2024 and are projected to increase during the forecast period.

- Among EU4 and the UK, the incident cases of multiple myeloma were the maximum in Germany and France with approximately 24% of the total cases in 2024. While the lowest number of cases was in Spain.

- Among EU4 and the UK, the diagnosed prevalent cases of multiple sclerosis were maximum in Germany with approximately 35,250 cases in 2024. While the lowest number of cases was in France.

- As per the analysis, in Japan, females accounted for the highest number of multiple sclerosis cases in 2024, with approximately 700 reported among females compared to around 350 among males.

|

Epidemiology of Top Indications | |

|

Indication |

Estimated Cases in 2024 in the US |

|

Acute Lymphocytic Leukemia (ALL) |

~12,900 (Incident) |

|

Diffuse Large B-cell Lymphoma (DLBCL) |

~76,500 (Incident) |

|

Follicular Lymphoma |

~37,700 (Incident) |

|

Multiple Myeloma |

~74,900 (Incident) |

|

Non-small-cell Lung Cancer (NSCLC) |

~204,814 (Incident) |

|

Small-cell Lung Cancer (SCLC) |

~94,700 (Incident) |

|

Biliary Tract Cancer (BTC) |

~46,800 (Incident) |

|

Psoriasis |

~8,000,500 (Prevalent) |

|

Rheumatoid Arthritis |

~1,453,200 (Prevalent) |

|

Multiple Sclerosis |

~121,250 (Prevalent) |

|

Systemic Lupus Erythematosus (SLE) |

~529,400 (Prevalent) |

|

Wet Age-related Macular Degeneration (AMD) |

~1,383,000 (Prevalent) |

NOTE: The list of indications is not exhaustive, and will be provided in the final report. Also, numbers are indicative and are subject to change as per report updation.

Bispecifics/Trispecifics Drug Chapters

The drug chapter segment of the Bispecifics/Trispecifics market reports encloses a detailed analysis of approved as well as emerging drugs in late and early-stage (Phase III, Phase II, and Phase I) pipeline drugs. It also helps understand the Bispecifics/Trispecifics’ clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Bispecifics/Trispecifics Drugs

ZIIHERA (zanidatamab): Zymeworks, Jazz Pharmaceuticals, and BeiGene

ZIIHERA is a bispecific HER2-directed antibody that binds to two extracellular sites on HER2. In November 2024, the US FDA granted accelerated approval of ZIIHERA 50 mg/mL for injection for IV use for the treatment of adults with previously treated, unresectable, or metastatic HER2-positive (IHC 3+) BTC.

Zanidatamab is also being investigated in multiple other clinical trials as a targeted treatment option for patients with solid tumors (Phase III for GEA and mBC and Phase II for colorectal cancer and breast cancer). Zanidatamab is being developed by Jazz and BeiGene under license agreements from Zymeworks, which first developed the molecule. Jazz has rights to commercialize zanidatamab in the US, Europe, Japan, and all other territories except for those Asia/Pacific territories that Zymeworks previously licensed to BeiGene, [which are Asia (excluding Japan), Australia, and New Zealand].

In April 2025, Zymeworks partner Jazz announced their participation at the ASCO annual meeting with three zanidatamab abstracts accepted for presentation. Additionally, Jazz Pharmaceuticals announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) adopted a positive opinion recommending the conditional marketing authorization of zanidatamab, an investigational dual HER2-targeted bispecific antibody, as monotherapy for the treatment of adults with unresectable locally advanced or metastatic HER2-positive (IHC 3+) BTC previously treated with at least one prior line of systemic therapy.

COLUMVI (glofitamab-gxbm): Genentech

COLUMVI is a CD20 x CD3 T-cell engaging bispecific antibody designed with a novel 2:1 structural format. COLUMVI targets both T cells and B cells, which are cancerous in DLBCL. In June 2023, the US FDA granted accelerated approval to COLUMVI for relapsed or refractory DLBCL, not otherwise specified (DLBCL, NOS) or Large B-cell Lymphoma (LBCL) arising from follicular lymphoma, after two or more lines of systemic therapy.

Emerging Bispecifics/Trispecifics Drugs

CA-170: Aurigene Oncology and Curis

CA-170 is a first-in-class, potent, and orally available small molecule. CA-170 selectively targets PD-L1 and VISTA, both of which function as negative checkpoint regulators of immune activation. Currently, CA-170 is in Phase III clinical trials for the treatment of NSCLC, and Bladder Cancer and Kidney Cancers.

In February 2020, Curis amended its collaboration, license, and option agreement with Aurigene Discovery Technologies. Under the terms of the amended agreement, Aurigene obtained the rights to develop and commercialize CA-170 in Asia, in addition to its existing rights in India and Russia as outlined in the original agreement. Curis retains the rights to CA-170 in the US, Europe, and the rest of the world, and is entitled to receive royalty payments on potential future sales of CA-170 in Asia. Earlier, in 2015, Curis entered into a collaboration with Aurigene.

GB263T: Genor Biopharma

GB263T is a highly differentiated EGFR/cMET/cMET tri-specific antibody targeting EGFR and two different epitopes of cMET. Currently, GB263T is undergoing Phase I/II clinical trial for the patients with advanced NSCLC and other solid tumors.

|

Comparison of Key Emerging Bispecifics/Trispecifics | |||||

|

Product |

Company |

Molecule type |

RoA |

Phase |

Indication |

|

CA-170 |

Aurigene Oncology and Curis |

Small molecule |

Oral |

III |

NSCLC, and Bladder and Kidney Cancers |

|

Obexelimab |

Zenas BioPharma |

Bifunctional monoclonal antibody |

SC |

III |

Immunoglobulin G4-related disease (IgG4-RD) |

|

II |

Relapsing Multiple Sclerosis (RMS) | ||||

|

II |

SLE | ||||

|

GB263T |

Genor Biopharma |

Trispecific antibody |

IV infusion |

I/II |

NSCLC |

|

Linvoseltamab |

Regeneron Pharmaceuticals |

Bispecific antibody |

IV infusion |

III |

Multiple myeloma |

|

I |

Severe food allergy (Dupilumab/Linvoseltamab) | ||||

|

Givastomig |

I-MAB Biopharma, ABL Bio, and Bristol Myers Squibb |

Bispecific antibody |

IV infusion |

I |

Gastric Cancer Gastroesophageal Junction Cancer (GEJ), and Esophageal Adenocarcinoma (EAC) |

|

IMB-101 |

IMBiologics, Y-Biologics, and HK Innoen |

Bispecific antibody |

IV infusion |

I |

Rheumatoid Arthritis |

|

SAR446422 |

Sanofi |

Bispecific monoclonal antibody |

SC and IV infusion |

I |

Inflammatory indication |

|

GB268 |

Genor Biopharma |

Trispecific antibody |

IV infusion |

I |

Solid Tumor Cancer |

|

BG-T187 |

BeOne Medicines (BeiGene) |

Trispecific antibody |

IV infusion |

I |

Lung Cancers |

|

PIT565 |

Novartis |

Trispecific antibody |

SC or IV infusion |

I |

SLE and B-cell malignancies |

Note: Detailed current therapies assessment will be provided in the full report of Bispecifics/Trispecifics

Bispecifics/Trispecifics Market Outlook

Bispecific and Trispecific antibodies are essentially antibodies bioengineered to contain two or three distinct antigen-binding domains, which allow these recombinant molecules to bind specifically to more than one target. Harnessing the versatility of multi-specific antibodies, an immunotherapy strategy relies on using bispecific and, more recently, trispecific antibodies to close the gap between cancer and cytotoxic T cells, promoting cancer cell lysis.

Bispecific antibodies have gained momentum over the past decade. Despite promising progress in the clinical application field of bispecific immunomodulatory antibodies in part of human tumor types, more prominent anti-tumor efficacy in most solid tumors still needs constant exploration. Furthermore, dozens of bispecific antibodies with different target combinations have exhibited potent anti-tumor effects in preclinical studies, but most of the positive preclinical outcomes could not be further validated in the clinic. With increasingly diverse bispecific antibodies entering preclinical and clinical trials, various challenges have emerged hampering the development of bispecific antibodies.

While T cell-engaging bispecific antibodies effectively treat hematological malignancies, similar strategies have not been as successful with solid tumors. Several factors are thought to contribute to T cell engagers' lower efficacy in solid tumors, including the reduced availability of ideal tumor-specific targets, immunosuppressive nature of the tumor microenvironment, and tumor physical barriers reducing antibody access.

Despite the clinical success of monoclonal and bispecific antibodies, there are still limitations in the therapeutic effect of malignant tumors, such as low response rate, treatment resistance, and so on, inspiring the exploration of trispecific antibodies. Trispecific antibodies further improve safety and efficacy and have great clinical potential through three targets combination and format optimization. Although there are still great challenges in the clinical application of trispecific antibodies, it is undeniable that trispecific antibodies may be a breakthrough in the development of antibody drugs.

Several Bispecifics/Trispecifics companies, including Aurigene Oncology, Curis, I-MAB Biopharma, ABL Bio, Bristol Myers Squibb, IMBiologics, Y-Biologics, HK Innoen, Regeneron Pharmaceuticals, Sanofi, Zenas BioPharma, and others, are involved in developing drugs for Bispecifics/Trispecifics for various indications such as NSCLC, Bladder and Kidney Cancers, IgG4-Related Diseases, relapsing multiple sclerosis, Systemic Lupus Erythematosus, multiple sclerosis, and others.

Bispecifics/Trispecifics Drugs Uptake

This section focuses on the uptake rate of emerging Bispecifics/Trispecifics expected to be launched in the Bispecifics/Trispecifics market during 2025–2035.

Bispecifics/Trispecifics Pipeline Development Activities

The Bispecifics/Trispecifics market report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key Bispecifics/Trispecifics companies involved in developing targeted therapeutics.

The presence of numerous drugs under different stages is expected to generate immense opportunity for Bispecifics/Trispecifics market growth over the forecasted period.

Bispecifics/Trispecifics Clinical Trials activities

The Bispecifics/Trispecifics market report covers information on collaborations, acquisitions and mergers, licensing, and patent details for Bispecifics/Trispecifics emerging therapies.

The increasing strategic collaborations among major market players to enhance the growth of their pipeline products are anticipated to drive market expansion. For example: In June 2024, I-MAB Biopharma announced that it had entered into a clinical trial collaboration and supply agreement with BMS. The collaboration will evaluate the combination of givastomig, with BMS immune checkpoint inhibitor, nivolumab, and chemotherapy (FOLFOX or CAPOX), as a potential first-line treatment for patients with advanced CLDN18.2-positive gastric and esophageal cancers.

KOL Views on Bispecifics/Trispecifics

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on Bispecifics/Trispecifics' evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as Hackensack University Medical Center, University of Washington, Harvard Cancer Center, etc. were contacted.

Their opinion helps understand and validate current and emerging therapy treatment patterns or Bispecifics/Trispecifics market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“I think a lot of institutions are also struggling with that financial piece as to how you incorporate [bispecific therapy] and who’s going to assume the cost of it.… I can tell you that there are different strategies, depending on which bispecific that you’re looking at or utilizing. Some of [the companies behind the drugs] do provide a new technology payment given on the back end where they will be reimbursed better than [with] traditional medications. Another one is providing free product for the inpatient administration, and then once the patient gets to the outpatient setting…you would have to purchase the supply.” |

|

"Bispecific antibodies, clinically, are probably more similar than they are different. The overall response rates [ORRs] for them are relatively similar in the 60% to 75% range. One of the interesting things about bispecific antibodies is that the time to first respond is typically between 1 to 2 months for everybody. In my experience, you can rapidly differentiate patients who are having a response because they have good T cells and the antigens being expressed and are blocking it.” |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of gaps in disease diagnosis, patient awareness, physician acceptability, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in event-free survival, one of the most important primary outcome measures is event-free survival and overall survival.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Bispecifics/Trispecifics Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug. In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The Bispecifics/Trispecifics market report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates Bispecifics/Trispecifics

- According to Zenas BioPharma’s Q1 2025 report published in May 2025, the company anticipates reporting topline Phase III results for Obexelimab in IgG4-related disease by the end of 2025, 12-week primary endpoint data in RMS in the third quarter of 2025, and 24-week primary endpoint data in SLE in the first half of 2026.

- In February 2025, Regeneron Pharmaceuticals announced that the US FDA the resubmission of the Biologics License Application (BLA) for linvoseltamab accepted for review for the treatment of adult patients with Relapsed/Refractory multiple myeloma who have received at least four prior lines of therapy or those who received three prior lines of therapy and are refractory to the last line of therapy. The target action date for the FDA decision is July 10, 2025.

- According to I-MAB Biopharma’s Q1 2025 report published in May 2025, the company anticipates presenting data from the givastomig dose expansion cohorts (n = 40) in the first half of 2026, with further development initiatives and data readouts from the Phase Ib study expected through 2027. Additionally, new data from the givastomig dose escalation combination study in US patients will be presented at the European Society of Medical Oncology Gastrointestinal (ESMO GI) Cancers Congress 2025, scheduled for July 2–5 in Barcelona, Spain.

- In May 2025, Genentech announced two-year follow-up data from the Phase III STARGLO study. The updated data continue to demonstrate the statistically significant and clinically meaningful survival benefit of this off-the-shelf, fixed-duration COLUMVI combination for people with R/ DLBCL who have received at least one prior line of therapy and are not candidates for autologous stem cell transplant (ASCT).

- In June 2025, BioNTech and Bristol Myers Squibb announced a global strategic partnership to co-develop and co-commercialize next-generation bispecific antibody candidate BNT327 broadly for multiple solid tumor types.

Top Bispecific Antibodies’ Highlighted at ASCO 2025

|

Company |

Drug |

Target |

Trial ID/ Acronym |

Phase |

Patient Segment |

Abstract ID |

Results |

|

Amgen |

IMDELLTRA (tarlatamab) |

DLL3 x CD3 |

NCT05740566 (DeLLphi-304) |

III |

SCLC |

LBA8008 (Oral abstract) |

n = 254 Median follow-up = 11.2 months Median OS = 13.6 months compared 6- and 12-month OS = 76% and 53%, respectively |

|

Regeneron Pharmaceuticals |

LIBTAYO (cemiplimab) |

PD-1 receptor (blocking interaction with PD-L1 and PD-L2) |

NCT03969004 (C-POST) |

III |

High-Risk Cutaneous Squamous Cell Carcinoma (CSCC) |

6001 (Oral abstract) |

Reduction in the risk of disease recurrence or death: 68% At two years, DFS = 80% Reduction in the risk of locoregional Recurrence = 80% Reduction in the risk of distant recurrence = 65% AEs (any grade) = 91% Grade ≥3 AEs = 24% The most common AEs occurring in at least 10% of patients in the Libtayo arm were fatigue, pruritus, rash, diarrhea, arthralgia, hypothyroidism, and maculo-paplar rash. |

|

Johnson & Johnson Innovation Medicine |

RYBREVANT (amivantamab) + chemotherapy |

EGFR x MET |

NCT04988295 (MARIPOSA-2) |

III |

EGFR-mutant advanced NSCLC |

8639 (Poster) |

EGFR/MET independent PFS = 5.6 months ORR = 64% EGFR/MET dependent Median PFS = 5.5 ORR = 70% MET amplification Median PFS = 4.4 months ORR = 67% Secondary EGFR mutations Median PFS = 5.7 months ORR = 73% |

|

Sunshine Guojian Pharmaceutical |

SSGJ-707 |

PD-1 x VEGF |

NCT06361927 |

II |

Advanced NSCLC |

8543 (Poster) |

ORR = 41% ORRs (11 20mg/kg) (30mg/kg) = 36% and 25% respectively. Response rates = 65% 1-49% PD-L1 expressers, and 77% among ≥50% expressers |

|

Biotheus |

BNT327/ PM8002 + chemotherapy |

PD-L1 and VEGF-A |

NCT05918107 |

II |

Unresectable malignant mesothelioma |

8511 (Clinical Science Symposium) |

Total population Median follow-up = 22.3 months cORR = 51.6% CR = 1 PRs = 15 SD = 12 PD = 2 DCR = 90.3% Pleural mesothelioma Median follow-up = 24 months cORR = 43.5% CR = 1 PRs = 9 SD instances = 10 PD instances = 2 DCR = 87% Pleural mesothelioma epithelioid cORR = 30.8% DCR = 84.6% Peritoneal mesothelioma median follow-up = 20.3 months cORR = 75% PRs = 6 SD instances = 12 DCR = 100% |

|

Merus N.V. |

Petosemtamab (MCLA-158) + KEYTRUDA (pembrolizumab) |

EGFR x LGR5 |

NCT03526835 |

I/II |

PD-L1+ recurrent/ metastatic HNSCC |

6024 (Poster) |

n = 43 ORR = 63% PFS = 9 months and 12-months OS rate = 79% TEAEs = Grade ≥3 TEAEs occurred in 60% of patients, including 44% of patients who experienced treatment-related TEAEs |

|

Bicara Therapeutics |

Ficerafusp alfa + KEYTRUDA (Pembrolizumab) |

EGFR x TGFβ |

NCT04429542 |

I |

Recurrent or metastatic HPV-HNSCC |

6017 (Rapid oral) |

Median time to response = 1.4 months DOR = 21.7 months Median PFS = 9.9 months Median follow-up = 25.2 months Median OS = 21.3 months |

Scope of the Bispecifics/Trispecifics Market Report

- The Bispecifics/Trispecifics market report covers a segment of key events, an executive summary, and a descriptive overview of Bispecifics/Trispecifics, explaining its mechanism, and emerging pipeline.

- Comprehensive insight into the Competitive Landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the Bispecifics/Trispecifics market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The Bispecifics/Trispecifics market report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM Bispecifics/Trispecifics market.

Bispecifics/Trispecifics Market Report Insights

- Bispecifics/Trispecifics Targeted Patient Pool

- Therapeutic Approaches

- Bispecifics/Trispecifics Pipeline Analysis

- Bispecifics/Trispecifics Market Size

- Bispecifics/Trispecifics Market Trends

- Existing and future Bispecifics/Trispecifics Market Opportunity

Bispecifics/Trispecifics Market Report Key Strengths

- Eleven Years Forecast

- The 7MM Coverage

- Key Cross Competition

- Bispecifics/Trispecifics Drugs Uptake

- Key Bispecifics/Trispecifics Market Forecast Assumptions

Bispecifics/Trispecifics Market Report Assessment

- Current Treatment Practices

- Bispecifics/Trispecifics Unmet Needs

- Bispecifics/Trispecifics Pipeline Product Profiles

- Bispecifics/Trispecifics Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

- What was the Bispecifics/Trispecifics market size, the market size by therapies, market share (%) distribution, and what would it look like in 2035? What are the contributing factors for this growth?

- Which Bispecifics/Trispecifics is going to be the largest contributor in 2035?

- What is the most lucrative market for Bispecifics/Trispecifics?

- Which drug type segment accounts for maximum Bispecifics/Trispecifics sales?

- What are the pricing variations among different geographies?

- What are the risks, burdens, and unmet needs of treatment with Bispecifics/Trispecifics? What will be the growth opportunities across the 7MM for the patient population of Bispecifics/Trispecifics?

- What are the key factors hampering the growth of the Bispecifics/Trispecifics market?

- What are the indications for which recent novel therapies and technologies have been developed to overcome the limitations of existing treatments?

- What key designations have been granted to the therapies for Bispecifics/Trispecifics?

- What is the cost burden of approved Bispecifics/Trispecifics therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

Reasons to buy

- The Bispecifics/Trispecifics market report will help develop business strategies by understanding the latest trends and changing dynamics driving the Bispecifics/Trispecifics Market.

- Understand the existing Bispecifics/Trispecifics market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current Bispecifics/Trispecifics patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming Bispecifics/Trispecifics companies in the Bispecifics/Trispecifics market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing Bispecifics/Trispecifics market so that the upcoming Bispecifics/Trispecifics companies can strengthen their development and launch strategy.