Endometriosis Market

- Endometriosis is a condition where patches of the endometrium appear in parts of the body other than the womb, such as the fallopian tubes, ovaries, or lungs. During a menstrual cycle, the endometrium thickens and increases its blood supply in preparation for the release of an egg. The body then sheds the endometrium if the egg is not fertilized. Endometrial tissues undergo this process no matter where it is in the body, which can lead to pain, swelling bleeding in those areas.

- Based on the endometrium implants on the tissues outside the uterus, the condition is ranked in one of four stages: Stage 1 or minimal implants, Stage 2 or mild implants, Stage 3 or moderate implants, and Stage 4 or severe implants. Stage 4 is the most widespread, with many deep implants and thick adhesions.

- Several factors augment disease propensity at greater risk of developing endometriosis, such as never giving birth, early menarche, late menopause, short menstrual cycles, genetic (mother, aunt or sister) with endometriosis, disorders of the reproductive tract etc.

- An average diagnostic delay of ~6–10 years is seen among patients with endometriosis, mainly due to delays in referral from primary care to a specialist.

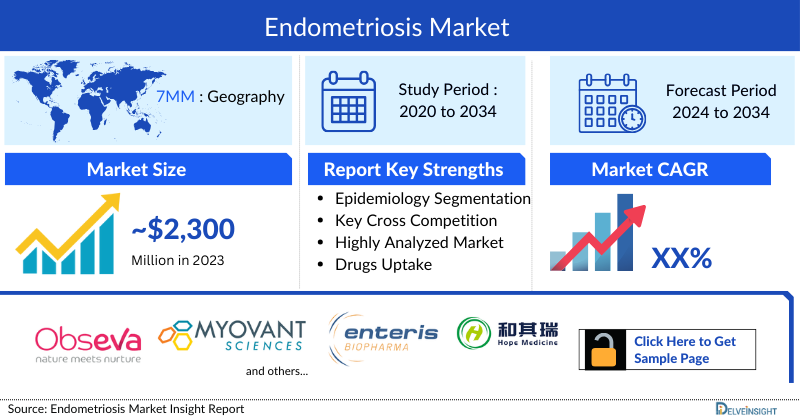

- In 2023, the diagnosed prevalent cases of endometriosis in the 7MM were ~10,770,000 cases.

- Based on severity, moderate cases accounted for the highest share, i.e. ~40% in the 7MM, followed by severe and mild cases, respectively in 2023.

- The total market size of endometriosis in the 7MM was USD 2,300 million in 2023 and is expected to grow significantly over the forecast period owing to launch of new therapies.

- Despite developing novel treatments, the present pharmacological landscape has several drawbacks. Hormone therapy can affect the ability to get pregnant, so it may not be right for everyone. NSAIDs are mostly used as off-label for pain management of endometriosis, but chronic uses may cause kidney damage. Moreover, opioids have high addiction potential.

- Various new therapies are in development with a focus on mentioned limitations of the currently approved drugs. Some of the most prominent ones include OG-6219 (Organon), linzagolix (ObsEva SA), HMI-115 (Hope Medicine), VML-0501 (Viramal), and others.

- Among emerging therapies, OG-6219 is expected to garner the largest market share by 2034.

- Growth of the endometriosis market is expected to be mainly driven by the entry of novel therapies with better clinical profiles, an upsurge in research and development, and an enriched understanding of the disease.

- The rise in market size during the study period (2020─2034) is mainly driven by current treatment options like NSAIDs/opioids and the introduction of pipeline candidates OG-6219, and elagolix + estradiol + norethindrone during the forecast period.

Endometriosis Market Report Summary

- The report offers extensive knowledge regarding the epidemiology segments and predictions, presenting a deep understanding of the potential future growth in diagnosis rates, disease progression, and treatment guidelines. It provides comprehensive insights into these aspects, enabling a thorough assessment of the subject matter.

- Additionally, an all-inclusive account of the current management techniques and emerging therapies and the elaborative profiles of late-stage (Phase III and Phase II) and prominent therapies that would impact the current treatment landscape and result in an overall market shift has been provided in the report.

- The report also encompasses a comprehensive analysis of the Endometriosis market, providing an in-depth examination of its historical and projected market size (2020 – 2034). It also includes the market share of therapies, detailed assumptions, and the underlying rationale for our methodology. The report also includes drug outreach coverage in the 7MM region.

- The report includes qualitative insights that provide an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, including experts from various hospitals and prominent universities, patient journey, and treatment preferences that help shape and drive the 7MM Endometriosis market.

The table given below further depicts the key segments provided in the report:

Endometriosis Market

Various key players are leading the treatment landscape of Endometriosis, such as Abbvie, Myovant, Pfizer, ASKA Pharmaceutical, Enteris BioPharma, and others. The details of the country-wise and therapy-wise market size have been provided below.

- In 2023, the total market size of endometriosis in the 7MM was ~USD 2,300 million. Among all the available therapies, prescription analgesics (NSAIDs/Opioids) garner the highest market share currently, and is expected to maintain its dominance over the forecast period.

- In the total market size of endometriosis in the 7MM, the United States accounted for the highest market size, i.e., ~USD 1,400 million in 2023.

- In 2023, UK accounted for the highest market share i.e. ~20% in EU4 and the UK region, and Spain accounted for the least market share.

- The growth in market size is mainly driven by the introduction of pipeline candidates OG-6219, and elagolix + estradiol + norethindrone during the forecast period (2024-2034).

Endometriosis Recent Developments

- In February 2025, Serac Healthcare announced receiving positive feedback from the FDA following its End of Phase II Meeting for 99mTc-maraciclatide. This molecular imaging agent is being developed for use with SPECT-CT to visualize and diagnose superficial peritoneal endometriosis (SPE) in women aged 16 and older.

Endometriosis Drug Chapters

The section dedicated to drugs in the Endometriosis report provides an in-depth evaluation of late-stage pipeline drugs (Phase III and Phase II) related to Endometriosis.

The drug chapters section provides valuable information on various aspects related to clinical trials of Endometriosis, such as the pharmacological mechanisms of the drugs involved, designations, approval status, patent information, and a comprehensive analysis of the pros and cons associated with each drug. Furthermore, it presents the most recent news updates and press releases on drugs targeting Endometriosis.

Marketed Therapies

ORILISSA (elagolix): AbbVie

ORILISSA (elagolix) is a gonadotropin-releasing hormone (GnRH) receptor antagonist and is available in two oral dosages 150 mg once daily and 200 mg twice daily. ORILISSA inhibits endogenous GnRH signaling by binding competitively to GnRH receptors in the pituitary gland. Administration of ORILISSA results in dose-dependent suppression of luteinizing hormone (LH) and follicle-stimulating hormone (FSH), leading to decreased blood concentrations of the ovarian sex hormones estradiol and progesterone. ORILISSA was the first FDA-approved oral treatment for managing moderate-to-severe pain associated with endometriosis.

MYFEMBREE (relugolix, estradiol, and norethindrone acetate): Myovant/Pfizer

MYFEMBREE (relugolix, estradiol, and norethindrone acetate) is an oral once-daily tablet. MYFEMBREE contains relugolix, which reduces the amount of estrogen (and other hormones) produced by ovaries; estradiol (an estrogen) which may reduce the risk of bone loss; and norethindrone acetate (a progestin), which is necessary when women with a uterus (womb) take estrogen. MYFEMBREE was approved as a one-pill, once-a-day therapy for managing moderate-to-severe pain associated with endometriosis in premenopausal women, with the treatment of up to 24 months.

Emerging Therapies

ORIAHNN (elagolix/estradiol/norethindrone acetate): AbbVie/Neurocrine Biosciences

ORIAHNN (elagolix/estradiol/norethindrone acetate) is an orally-administered, nonpeptide small molecule gonadotropin-releasing hormone (GnRH) receptor antagonist in combination with concomitant hormonal add-back therapy. Elagolix inhibits endogenous GnRH signaling by binding competitively to GnRH receptors in the pituitary gland and reduces estrogen releases, which leads to hypo-estrogenic side effects like bone loss, etc. While add-back hormone replacement therapy (HRT) can alleviate the undesirable hypo-estrogenic side effects, elagolix thus decreases treatment discontinuation. In May 2020, the FDA-approved ORIAHNN for managing heavy menstrual bleeding associated with uterine fibroids in premenopausal women.

ORIAHNN is being evaluated in Phase III clinical trials to assess the safety and efficacy of elagolix in managing moderate-to-severe endometriosis-associated pain in adult premenopausal female participants, including the safety and efficacy of elagolix in combination with concomitant hormonal add-back therapy. The trials are expected to be completed by January 2023.

Linzagolix (OBE2109): ObsEva/Kissei Pharmaceuticals

Linzagolix is a novel, orally administered GnRH receptor antagonist that potentially effectively manages endometriosis-associated pain while mitigating bone mineral density loss and other adverse effects typically associated with currently approved treatments. Unlike marketed GnRH agonists, it has the potential to be administered orally once a day, with symptoms relieved within days, while potentially mitigating the initial worsening of symptoms often associated with GnRH agonist treatments. Linzagolix has the potential to dose-dependently lower estradiol levels hence maintaining such levels within an optimal range to mitigate patient bone mineral density loss.

Currently, its extension Phase III (NCT04335591) study is going on to assess the maintenance of efficacy of linzagolix administered orally once daily for up to an additional 6 months in women who have completed 6 months of linzagolix treatment at a dose of 75 mg alone or of 200 mg in combination with ABT (E2 1 mg/NETA 0.5 mg), in the management of moderate-to-severe endometriosis-associated pain (EAP) in women with surgically confirmed endometriosis.

| Emerging Therapies | Patient Segment | Phase | Company | Molecule Type |

| Linzagolix | Moderate-to-severe endometriosis-associated pain | III | ObsEva SA | Small molecule |

| ORIAHNN | Moderate-to-severe endometriosis-associated pain | III | Myovant Sciences | Small molecule |

| Leuprorelin oral | Endometriosis (18─49 years) | II | Enteris BioPharma | Small molecule |

| HMI-115 | Moderate-to-severe endometriosis-associated pain | II | Hope Medicine | Monoclonal antibody |

| TU-2670 | Moderate-to-severe endometriosis-associated pain | II | Tiumbio | Small molecule |

Note: Detailed assessment will be provided in the final report Endometriosis……

Endometriosis Market Outlook

Without a cure, endometriosis treatments aim to manage symptoms, especially pain and infertility, including drug therapies (analgesic and hormone) and surgery. While drug therapies reduce pain, surgery is currently the only treatment option shown to improve fertility rates. Current treatment guidelines for endometriosis emphasize the management of pain and infertility. Most treatment guidelines recommend using nonsteroidal anti-inflammatory drugs, combined hormonal contraceptives, progestogens (or antiprogestogens), gonadotropin-releasing hormone agonists and antagonists, surgical fulguration or excision of endometrial lesions, or hysterectomy with and without bilateral salpingo-oophorectomy.

Many new molecules with novel mechanisms, like LHRH receptor antagonists, Gonadotropin-releasing hormone stimulants, Prolactin receptor antagonists, among others, are being developed for the treatment of Endometriosis by key players like ObsEva SA, Myovant Sciences, Hope Medicine, and Organon among others.

In conclusion, despite the lack of appropriate treatment in the current treatment landscape, many potential therapies with novel mechanisms are expected to enter the market, resolving a dire unmet need and leading to significant improvement in the treatment outcome of Endometriosis patients. Hence, with the upcoming availability of new treatment options and increasing healthcare spending across the 7MM, the treatment scenario is expected to experience significant growth during the forecast period (2024–2034).

Further details are provided in the report…

Endometriosis Understanding and Treatment

Endometriosis is a disease distinguished by endometrial tissue outside the uterine cavity with recurrent intralesional bleeding because of the hormonal responsiveness of ectopic endometrial tissue, resulting in fibrosis. It is a disease of adolescents and reproductive-aged women commonly associated with chronic pelvic pain and infertility. The most common locations for endometriosis are the ovaries, pelvic peritoneum, uterosacral ligaments, and torus uterinus. Atypical pelvic endometriosis localizations can occur in the cervix, vagina, round ligaments, ureter, and nerves. Moreover, rare extrapelvic endometriosis implants can be localized in the upper abdomen, subphrenic fold, or abdominal wall.

Further details are provided in the report…

Diagnosis

Clinically diagnosing endometriosis can be challenging because the signs and symptoms are nonspecific. A thorough history and a comprehensive assessment of a patient’s pain experience are recommended. A stepwise pelvic exam may reveal anatomic features of endometriotic implants, and imaging, predominantly transvaginal ultrasound, can be a useful adjunct.

Laparoscopy- At laparoscopy, endometriosis may be visualized as peritoneal implants, peritoneal windows, endometriomas, and deep infiltrating nodules of endometriosis which may each be associated with adhesions.

Imaging- Imaging has limited utility in diagnosing endometriosis, as it lacks adequate resolution to identify adhesions or superficial peritoneal implants. Ultrasound is cheap and easy to perform but user-dependent; MRI is more accurate but considerably more expensive. As CT of the pelvis does not visualize pelvic organs well, it is not useful in diagnosing endometriosis.

Serum markers- Serum markers for endometriosis have been eagerly sought for their use in diagnosing, measuring disease activity, and monitoring improvement. Serum cytokines, matrix metalloproteinases, adhesion molecules, and markers of angiogenesis or inflammation have been investigated.

Endometrial nerve fibers- Endometrial biopsy is being explored for the diagnosis of endometriosis. Recent studies have shown an increased number of nerve fibers in the endometrium of women with endometriosis compared to women without endometriosis.

Further details related to country-based variations are provided in the report…

Treatment

Current strategies for treating endometriosis include surgical removal of endometriotic lesions by laparoscopy, which reduces pain and improves pregnancy rates, and/or therapeutics that suppress pain, ovarian function, and estrogen action. The recurrence rate of endometriosis is high; estimates show that 21.5% of patients experience recurrence within 2 years after surgery, and 40–50% of patients experience recurrence within 5 years of surgery. Patients with endometriosis thus often undergo several surgeries and/or are treated pharmacologically for decades during their reproductive years.

The available therapies include oral contraceptives (off-label), progestins as the first-line pharmacological treatment, and GnRH agonists/antagonists as the second-line treatment. The latter option leads to hypoestrogenism and is associated with serious side effects, including drug-induced menopause and osteoporosis. Importantly, all these therapies preclude fertility. Persistent pain, a typical and debilitating symptom of endometriosis, is most commonly alleviated with NSAIDs which show variable efficacy and have serious side effects when used for a prolonged time. There is an unmet clinical need for new non-hormonal treatments for endometriosis.

Further details related to treatment and management are provided in the report…

Endometriosis Epidemiology

The Endometriosis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Prevalent cases, Diagnosed prevalent cases, Age-specific diagnosed prevalent cases, Diagnosed prevalent cases by pain severity, Total treated cases of endometriosis in the United States, EU4 countries (Germany, France, Italy, Spain) and the United Kingdom, and Japan from 2020 to 2034.

- In 2023, the diagnosed prevalent cases of endometriosis in the 7MM were ~10,800,000. In the 7MM, the highest number of diagnosed prevalent cases of endometriosis was observed in the US.

- In the 7MM, Moderate cases garner the highest share in diagnosed prevalent cases by pain severity in 2023.

- Endometriosis is most common among 18-29 years female population which represented ~ 40% of all prevalent cases in the 7MM.

- Total treated cases of endometriosis amounted to ~2,900,000 in the US, followed by the UK and France, respectively in 2023.

Further details related to epidemiology will be provided in the report…

KOL Views

To stay abreast of the latest trends in the market, we conduct primary research by seeking the opinions of Key Opinion Leaders (KOLs) and Subject Matter Experts (SMEs) who work in the relevant field. This helps us fill any gaps in data and validate our secondary research.

We have reached out to industry experts to gather insights on various aspects of Endometriosis, including the evolving treatment landscape, patients’ reliance on conventional therapies, their acceptance of therapy switching, drug uptake, and challenges related to accessibility. The experts we contacted included gynaecologists, medical/scientific writers, professors, and researchers from prestigious universities in the US, Europe, the UK, and Japan.

Our team of analysts at Delveinsight connected with more than 15 KOLs across the 7MM. We contacted institutions such as the Michigan State University College of Human Medicine, Women’s Healthcare of Princeton etc., among others. By obtaining the opinions of these experts, we gained a better understanding of the current and emerging treatment patterns in the Endometriosis market, which will assist our clients in analyzing the overall epidemiology and market scenario.

Qualitative Analysis

We perform Qualitative and Market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, designation, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

In efficacy, the trial’s primary and secondary outcome measures are evaluated; for instance, in trials for Endometriosis, important primary endpoints are verbal rating scale (VRS), numeric rating scale (NRS), endometriosis health profile‐30 (EHP‐30), endometriosis-associated pelvic pain (EAPP), endometriosis impact questionnaire (EIQ), etc. Based on these parameters, the overall efficacy is evaluated.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, a final weightage score is decided, based on which the emerging therapies are ranked.

Market Access and Reimbursement

Because newly authorized drugs are often expensive, some patients escape receiving proper treatment or use off-label, less expensive prescriptions. Reimbursement plays a critical role in how innovative treatments can enter the market. The cost of the medicine, compared to the benefit it provides to patients who are being treated, sometimes determines whether or not it will be reimbursed. Regulatory status, target population size, the setting of treatment, unmet needs, the number of incremental benefit claims, and prices can all affect market access and reimbursement possibilities.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Endometriosis Report Insights

- Patient Population

- Therapeutic Approaches

- Endometriosis Market Size and Trends

- Existing Market Opportunity

Endometriosis Report Key Strengths

- Eleven-year Forecast

- The 7MM Coverage

- Endometriosis Epidemiology Segmentation

- Key Cross Competition

- Endometriosis Report Assessment

- Current Treatment Practices

- Reimbursements

- Market Attractiveness

- Qualitative Analysis (SWOT, Conjoint Analysis, Unmet needs)

Key Questions

- Would there be any changes observed in the current treatment approach?

- Will there be any improvements in Endometriosis management recommendations?

- Would research and development advances pave the way for future tests and therapies for Endometriosis?

- Would the diagnostic testing space experience a significant impact and lead to a positive shift in the treatment landscape of Endometriosis?

- What kind of uptake will the new therapies witness in coming years in Endometriosis patients?

.jpg)

.jpg)

.jpg)