Enteral Feeding Devices Market Summary

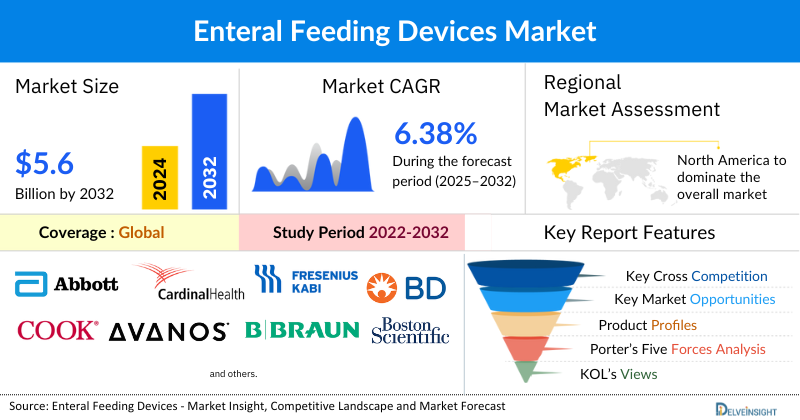

- The Global Enteral Feeding Devices Market is expected to increase from USD 3,450.26 million in 2024 to USD 5,622.79 million by 2032, reflecting strong and sustained growth.

- The Global Enteral Feeding Devices Market is growing at a CAGR of 6.38% during the forecast period from 2025 to 2032.

Enteral Feeding Devices Market Trends & Insights

Enteral Feeding Devices Market Trends & Insights

- The market of enteral feeding devices is being primarily driven by the rising prevalence of chronic disease such as cancer, diabetes, and neurological disorders, increase in hospital admission, and increase in product developmental activities by the key market players across the globe.

- The leading companies operating in the enteral feeding devices market include Abbott Laboratories, Cardinal Health, Fresenius Kabi AG, Becton, Dickinson and Company (BD), Cook Medical, Avanos Medical, Inc., B. Braun SE, Boston Scientific Corporation, Baxter, Vygon SA, Applied Medical Technology, Inc., Amsino International, Inc., Vesco Medical, LLC, Rockfield Medical Devices, Nutricia, danumed Medizintechnik GmbH, ICU Medical, Inc., Medcaptain Medical Technology Co., Ltd., Fidmi Medical, GBUK Enteral, and others.

- The North American enteral feeding devices market is expanding due to the rising prevalence of chronic diseases such as cancer, neurological disorders, and gastrointestinal conditions, coupled with an aging population prone to malnutrition and dysphagia. Advancements in feeding tubes, pumps, and accessories, along with the growing preference for home healthcare and strong reimbursement policies, are further driving adoption. Together, these factors are fueling steady market growth and increasing demand for safe, effective, and convenient enteral nutrition solutions.

- In the product type segment of the enteral feeding devices market, the enteral feeding pumps category is estimated to account for the largest market share in 2024.

Request for unlocking the report of the @ Enteral Feeding Devices Market

Enteral Feeding Devices Market Size and Forecasts

|

Report Metrics |

Details |

|

2024 Market Size |

USD 3,450.26 million |

|

2032 Projected Market Size |

USD 5,622.79 million |

|

Growth Rate (2025-2032) |

6.38% CAGR |

|

Largest Market |

North America |

|

Fastest Growing Market |

Asia-Pacific |

|

Market Structure |

Moderately to Highly Consolidated |

Factors Contributing to the Growth of the Enteral Feeding Devices Market

-

Growing Prevalence of Chronic Diseases Leading to a Surge in Enteral Feeding Devices

The increasing global burden of chronic conditions, such as cancer, diabetes, neurological disorders (e.g., stroke, Alzheimer's, and Parkinson's disease), and gastrointestinal disorders, is a primary driver. These diseases often impair a person's ability to swallow or digest food, making enteral nutrition a critical necessity for survival and improved quality of life. This demographic shift, particularly with an aging population more susceptible to these illnesses, creates a sustained demand for enteral feeding solutions.

-

Rising hospital admissions and critical care are escalating the demand for enteral feeding devices

The growing number of patients admitted to hospitals, especially those in critical care or post-surgery, further fuels market expansion. In these settings, patients often require nutritional support that cannot be delivered orally. Enteral feeding devices are essential for providing timely and adequate nutrition, which helps reduce complications, shorten hospital stays, and improve recovery outcomes. This trend is also extending to long-term and home-care settings as patients with chronic conditions are increasingly managed outside of the hospital.

-

Increasing technological advancements in enteral feeding devices

The market is also propelled by continuous innovation from key players. Recent developments have focused on improving device safety, user-friendliness, and patient comfort. Examples include:

-

- Smart Pumps: Next-generation enteral feeding pumps are becoming more intelligent, with features like wireless connectivity, real-time monitoring, and automated flow adjustments.

- Advanced Materials: The use of new biocompatible materials for tubes and connectors, such as those that are more flexible and less prone to kinking or occlusion, is enhancing patient safety and comfort.

- Standardized Connectors: The introduction of ENFit connectors, designed to prevent misconnections between enteral and other medical devices, has significantly improved patient safety and reduced the risk of serious medical errors.

Enteral Feeding Devices Market Report Segmentation

This enteral feeding devices market report offers a comprehensive overview of the global enteral feeding devices market, highlighting key trends, growth drivers, challenges, and opportunities. It covers detailed market segmentation by Product Type (Enteral Feeding Pumps, Enteral Feeding Tubes [Enterostomy Feeding Tubes, Oroenteric Feeding Tubes, Nasoenteric Feeding Tubes {Nasogastric Feeding Tubes, Nasojejunal Feeding Tubes, and Nasoduodenal Feeding Tubes}, and Others], Enteral Syringes, Gravity Sets, and Others), Age Group (Adults and Pediatrics), Application (Gastroenterology, Critical Care, Neurology, Oncology, and Others), End-Userss (Hospitals, Ambulatory Surgical Centers (ASC), Emergency Centers, and Others), and geography. The report provides valuable insights into the competitive landscape, regulatory environment, and market dynamics across major markets, including North America, Europe, and Asia-Pacific. Featuring in-depth profiles of leading industry players and recent product innovations, this report equips businesses with essential data to identify market potential, develop strategic plans, and capitalize on emerging opportunities in the rapidly growing enteral feeding devices market.

Enteral feeding devices, also known as feeding tubes or enteral access devices, are medical instruments used to deliver nutrition, fluids, and medications directly into the gastrointestinal (GI) tract. They are used for people who are unable to consume or absorb adequate nutrition by mouth, but who have a functional digestive system.

The overall market for enteral feeding devices is significantly boosted by several interrelated factors. The rising prevalence of chronic diseases such as cancer, diabetes, and neurological disorders creates a substantial need for enteral nutrition due to the impaired ability of affected individuals to consume or digest food normally. Additionally, the growing number of hospital admissions of patients requiring extended nutritional care further propels the need for these devices, as hospitals seek effective solutions for managing patient nutrition. Concurrently, the surge in product development activities by key market players enhances the market by introducing innovative and improved enteral feeding solutions. Thus, these factors are expected to boost the market of enteral feeding devices during the forecast period from 2025 to 2032.

What are the latest Enteral Feeding Devices Market Dynamics and Trends?

The global enteral feeding devices market is witnessing robust growth, primarily driven by the rising prevalence of chronic, debilitating diseases that impair patients’ ability to meet nutritional needs orally. Conditions such as cancer, neurological disorders, and diabetes frequently result in dysphagia, malabsorption, or hypermetabolic states where oral intake is insufficient. In such cases, enteral nutrition becomes a medical necessity to prevent malnutrition, support treatment outcomes, and improve quality of life.

Cancer care remains the largest application segment, as many patients, particularly those with head and neck cancers, suffer from swallowing difficulties due to the disease or side effects of chemotherapy and radiation. According to the International Agency for Research on Cancer (IARC), nearly 20 million new cancer cases were diagnosed worldwide in 2022, with the WHO projecting this number to rise to 35 million by 2050, a 77% increase. This dramatic surge will significantly escalate the demand for enteral feeding devices.

Neurological conditions represent another major growth driver. A 2024 Lancet Neurology analysis reported that 3.4 billion people (over 40% of the global population) were living with neurological disorders in 2021. Diseases like stroke, Alzheimer’s, and Parkinson’s often cause severe dysphagia and increase the risk of aspiration pneumonia, making enteral nutrition a cornerstone of long-term care, particularly in aging populations of developed nations.

The diabetes epidemic further expands market demand. The International Diabetes Federation (IDF) estimates the global diabetic population will rise to 853 million by 2050. Enteral nutrition is frequently recommended for critically ill or post-surgical diabetic patients to stabilize blood glucose and ensure sufficient caloric intake, while diabetic neuropathy-related gastrointestinal complications can necessitate feeding tube support.

A significant shift toward home and long-term care settings is also reshaping the market. Driven by cost-containment pressures and patient preference, home enteral nutrition (HEN) is increasingly adopted as a cost-effective alternative to parenteral nutrition in patients with a functional GI tract. Technological advancements, such as portable, lightweight pumps and comprehensive patient/caregiver training provided by manufacturers, are enhancing confidence, safety, and adoption in home environments.

Additionally, technological innovation and safety initiatives are fueling device upgrades. The global adoption of the ISO 80369-3 standard (ENFit connectors) is minimizing the risk of fatal tubing misconnections, prompting a large-scale product replacement cycle across hospitals and care facilities.

However, the market faces restraints. Clinical complications such as tube dislodgement, occlusion, and gastrointestinal intolerance (e.g., diarrhea, nausea) remain concerns, impacting compliance. Despite ENFit, the global transition is still incomplete, and risks of misconnections persist in some regions. Financial barriers, including high device and consumable costs paired with inconsistent reimbursement policies, pose challenges for patients and providers. Furthermore, a shortage of trained healthcare professionals and limited caregiver education in home settings increases risks of user error and complications, slowing broader adoption.

Enteral Feeding Devices Market Segment Analysis

Enteral Feeding Devices Market by Product Type (Enteral Feeding Pumps, Enteral Feeding Tubes [Enterostomy Feeding Tubes, Oroenteric Feeding Tubes, Nasoenteric Feeding Tubes {Nasogastric Feeding Tubes, Nasojejunal Feeding Tubes, and Nasoduodenal Feeding Tubes}, and Others], Enteral Syringes, Gravity Sets, and Others), Age Group (Adults and Pediatrics), Application (Gastroenterology, Critical Care, Neurology, Oncology, and Others), End-Userss (Hospitals, Ambulatory Surgical Centers (ASC), Emergency Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

Enteral Feeding Devices Market By Product Type

By Product Type: Enteral Feeding Pumps Category Dominates the Market

Within the product type segment of the enteral feeding devices market, enteral feeding pumps are anticipated to dominate, accounting for around 51% of the market share in 2024. Enteral feeding pumps have emerged as a pivotal growth engine for the broader enteral feeding devices market. By offering advanced solutions that significantly enhance the safety, precision, and efficiency of nutritional delivery, they are transforming patient care from the hospital to the home. The market for these pumps is being propelled by several key factors.

First, technological sophistication is at the core of their market expansion. Modern pumps offer precise control over the flow rate and volume of enteral nutrition, mitigating risks such as overfeeding or aspiration. Features like programmable settings, automated alarms for potential issues (e.g., blockages or air-in-line), and anti-free-flow mechanisms provide a level of safety and reliability that manual or gravity-based methods cannot match. The increasing integration of these "smart pumps" with hospital information systems and remote monitoring platforms is a game-changer. For instance, data can be automatically logged in a patient's electronic health record (EHR), allowing clinicians to remotely track a patient's nutritional intake and make real-time adjustments to their care plan, which is critical for managing chronic conditions.

Second, the shift towards home healthcare is driving the demand for portable and user-friendly pumps. As patients with long-term nutritional needs are discharged from hospitals, there is a strong need for devices that are lightweight, battery-operated, and simple enough for caregivers or patients themselves to operate. This has led to the development of compact pumps with intuitive interfaces, extended battery life, and durability for a mobile lifestyle. This trend expands the market's reach beyond traditional clinical settings and into the growing segment of home enteral nutrition.

Third, sustained product development and regulatory support are constantly introducing new and improved models to the market. This competitive innovation ensures a steady supply of cutting-edge devices that meet evolving safety standards. For example, in May 2024, Rockfield Medical Devices received FDA clearance for the Mobility+ system for Over-the-Counter (OTC) use. This approval is significant as it allows the device to be sold directly to consumers without a prescription. The Mobility+ is a portable, lightweight elastomeric system that uses a food pouch and a feeding set to deliver nutrition. This clearance, combined with a new reimbursement code, is intended to give users greater and faster access to the system, positively impacting their mobility and quality of life. Further, Inoct 2023, the FDA granted 510(k) clearance for Vesco Q™ Enteral Feeding Pump System. The Vesco Q™ pump is a portable, rotary peristaltic pump featuring a touchscreen interface. It is intended for both adult and pediatric patients for intermittent and continuous delivery of enteral fluids in hospital and home care settings. The system's feed sets are ENFit-compliant, aligning with current safety standards. This continuous cycle of innovation is a crucial factor in driving the growth of the enteral feeding pump segment, which in turn boosts the overall enteral feeding devices market.

In conclusion, the enteral feeding pumps segment is poised to generate considerable revenue, thereby pushing the overall growth of the global enteral feeding devices market. The enhanced capabilities, convenience, and safety features of these pumps are making them an indispensable tool for nutritional management, cementing their role as a central driver of market expansion during the forecast period.

Enteral Feeding Devices Market By Application

By Application: Oncology Category Dominates the Market

Within the application segment of the enteral feeding devices market, oncology is anticipated to dominate, accounting for around 30% of the market share in 2024. This is due to a combination of high disease prevalence, the unique nutritional challenges posed by cancer and its treatments, and the critical role that enteral nutrition plays in improving patient outcomes.

Cancer is a leading cause of death and a major health burden globally. Critically, a high percentage of cancer patients, particularly those with advanced disease, suffer from malnutrition and dysphagia (difficulty swallowing) due to both the physical effects of the tumor and the side effects of aggressive treatments like chemotherapy and radiation. Studies indicate that the prevalence of malnutrition in hospitalized cancer patients can be as high as 70%. For example, chemotherapy often causes severe nausea and painful mucositis, while radiation to the head and neck can lead to permanent damage that impairs the ability to eat. In these cases, enteral feeding is not just supportive; it is a clinical necessity that allows patients to meet their metabolic needs, thereby helping them better tolerate their treatments and improve their clinical outcomes, including reduced hospital stays, lower infection rates, and better survival. As the global cancer burden continues to rise, the indispensable role of enteral nutrition in managing the nutritional status of this large patient population ensures the oncology category's sustained dominance in the market.

Enteral Feeding Devices Market By End-Users

By End-Users: Hospitals Dominate the Market

In the enteral feeding devices market, hospitals are expected to hold the largest end-user share of around 53% in 2024. While home care is the fastest-growing segment, hospitals remain the primary environment where these devices are first introduced and used, establishing their market leadership.

Hospitals, particularly intensive care units (ICUs) and surgical wards, are where the most critically ill patients are treated. These patients are often unable to swallow or consume nutrition orally due to conditions like major surgeries, severe burns, head injuries, or strokes, which often require immediate and sustained nutritional support that cannot be provided by mouth. Patients with severe cancer, advanced neurological disorders, or multi-organ failure require a precise and controlled method of nutrient delivery, making enteral feeding devices indispensable. A large percentage of hospitalized patients are malnourished or at high risk of becoming malnourished, making early nutritional intervention a standard of care. The sheer volume of these high-acuity patients necessitates a constant and high-volume demand for a wide range of enteral feeding devices, from temporary nasogastric tubes to surgically placed G-tubes.

Further, Hospitals are built with the necessary infrastructure and professional expertise to support the use of enteral feeding devices effectively and safely. Hospitals have multidisciplinary teams, including dietitians, nutrition nurses, and gastroenterologists, who are trained to assess patients' nutritional needs, select the appropriate feeding device, and manage potential complications. This level of specialized care is not as readily available in other settings. Hospitals operate under strict protocols and clinical guidelines for initiating, managing, and troubleshooting enteral nutrition. This standardized approach ensures patient safety and optimizes care, reinforcing the hospital as the primary end-user.

Additionally, Hospitals have the capacity to perform the procedures required for more permanent enteral access, which further solidifies their dominance. Procedures such as Percutaneous Endoscopic Gastrostomy (PEG) tube placement, which is a common method for long-term enteral access, are performed in a hospital setting. The initial placement and subsequent patient stabilization for these devices almost always occur within a hospital. Hospitals use a full spectrum of enteral feeding devices, from short-term nasal tubes for critically ill patients to more permanent gastrostomy tubes for long-term care. This breadth of usage and expertise makes them the central hub for the initial adoption and management of these products.

While the home care segments are growing rapidly, their expansion is largely dependent on the initial care and discharge planning provided by hospitals. A patient's journey with an enteral feeding device almost always begins within a hospital, solidifying its position as the largest and most critical end-user segment.

Enteral Feeding Devices Market Regional Analysis

North America Enteral Feeding Devices Market Trends

North America is projected to dominate the global enteral feeding devices market in 2024, accounting for approximately 43% of the total share, due to the high prevalence of cancer, gastrointestinal diseases, and neurological conditions, along with well-established healthcare infrastructure, strong adoption of advanced technologies, and favorable reimbursement policies. The region also benefits from the presence of leading device manufacturers and ongoing R&D investments, which drive the availability of innovative enteral feeding solutions.

In North America, cancer incidence continues to rise, with approximately 2.04 million new cases expected in the U.S. alone in 2025, alongside an estimated 618,000 cancer-related deaths, while Canada reported over 1.23 million new cases in recent years. The most common cancers, including breast, prostate, lung, and colorectal cancers, often lead to complications such as dysphagia, gastrointestinal dysfunction, or malnutrition, driving the demand for enteral feeding devices. With cancer survivorship projected to exceed 22 million in the U.S. by 2035, the growing population of patients requiring nutritional support underscores the expansion of the enteral feeding devices market.

Additionally, trends such as earlier diagnosis, rising incidence among younger adults, and longer patient survival contribute to increased utilization of gastrostomy tubes, nasogastric tubes, and associated delivery systems. The steady decline in overall cancer mortality, coupled with rising incidence, suggests a sustained need for long-term nutritional management, positioning North America as a key growth region for enteral feeding solutions over the coming decade.

The North American market is also characterized by a strong preference for high-tech, user-friendly devices, with enteral feeding pumps leading the charge. The market is driven by the increasing adoption of smart pumps that offer advanced features like precision flow control, real-time monitoring, and connectivity to electronic health records (EHRs). This technology enhances patient safety and allows for more efficient management of nutritional delivery in both hospital and home settings.

The market is highly influenced by regulatory and safety standards, particularly the global migration to the ENFit connector standard (ISO 80369-3). The ENFit standard was developed to prevent dangerous tubing misconnections between enteral devices and other medical lines. North America has been at the forefront of this transition, leading to a massive replacement cycle for older, non-compliant devices. This has created a significant revenue stream for manufacturers and has enhanced overall patient safety across the region.

Therefore, the factors mentioned above are expected to drive the growth of the enteral feeding devices market in North America.

Europe Enteral Feeding Devices Market Trends

The European enteral feeding devices market is a major segment of the global market, distinguished by its mature healthcare systems and a strong emphasis on safety and home-based care. The market's trends are heavily influenced by the European Medical Device Regulation (MDR) and the global adoption of the ENFit connector standard, which collectively drive a significant product replacement cycle to ensure enhanced safety and quality. A primary driver of growth is the region's aging population, which is highly susceptible to chronic diseases and conditions like stroke, dementia, and cancer that lead to dysphagia and a need for nutritional support. This demographic trend, coupled with the rising prevalence of gastrointestinal disorders and the high number of preterm births, creates a continuous demand across all end-user segments. Furthermore, Europe's market is a leader in the shift toward home enteral nutrition (HEN), supported by favorable and well-established reimbursement policies in key countries like Germany, France, and the UK. The availability of portable, user-friendly feeding pumps and low-profile devices enhances patient mobility and quality of life, further accelerating the adoption of HEN and positioning the market for sustained growth.

Asia-Pacific Enteral Feeding Devices Market Trends

The Asia-Pacific region is emerging as the fastest-growing market for enteral feeding devices, a trend fueled by a unique confluence of demographic and economic factors. The region's rapidly aging population, particularly in countries like China and Japan, has led to a surge in chronic diseases such as cancer, stroke, and dementia, all of which often necessitate nutritional support. At the same time, increasing healthcare spending and the expansion of medical infrastructure in countries like India and China are providing a more robust framework for the adoption of these devices in both hospital and, increasingly, home care settings. While home enteral nutrition is not yet as widespread as in Western markets, a growing emphasis on cost-effectiveness and patient quality of life, alongside supportive government policies and an expanding middle class, is paving the way for its rapid growth. Furthermore, the region's high rates of preterm births create a significant and consistent demand for specialized feeding devices in the pediatric segment. This combination of an aging and expanding patient population, improving healthcare access, and a focus on both affordability and local manufacturing positions the Asia-Pacific market to drive a substantial portion of global market growth in the coming years.

Who are the major players in the enteral feeding devices market?

The following are the leading companies in the enteral feeding devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Cardinal Health

- Fresenius Kabi AG

- Becton, Dickinson and Company (BD)

- Cook Medical

- Avanos Medical, Inc.

- B. Braun SE

- Boston Scientific Corporation

- Baxter

- Vygon SA Corporation

- Applied Medical Technology, Inc.

- Amsino International, Inc.

- Vesco Medical, LLC

- Rockfield Medical Devices

- Nutricia

- danumed Medizintechnik GmbH

- ICU Medical, Inc.

- Medcaptain Medical Technology Co., Ltd.

- Fidmi Medical

- GBUK Enteral

How is the competitive landscape shaping the enteral feeding devices market?

The competitive landscape of the enteral feeding devices market is dynamic and moderately concentrated, with a mix of multinational healthcare giants and a growing number of smaller, innovative players. Tier-1 companies like Cardinal Health, Fresenius Kabi, and Avanos Medical dominate with comprehensive portfolios and strong global distribution networks, often leveraging their established relationships with hospitals. However, the market's concentration is being challenged by new entrants and specialized firms that are carving out niches through technological innovation, particularly in the fast-growing home care segment. The widespread adoption of the ENFit safety standard is a key competitive lever, forcing all players to re-engineer their product lines and rewarding companies that were early to comply. This has created a significant barrier to entry for firms without the resources to adapt, while also stimulating a replacement cycle that benefits compliant manufacturers. Ultimately, competition is driven by a focus on product differentiation through enhanced safety features, portability for home use, and integration with digital health platforms, pushing the market towards more technically capable and patient-centric solutions.

Recent Developmental Activities in the Enteral Feeding Devices Market

- In 2025, Fresenius Kabi released next-gen feeding tubes with surface treatments aimed at reducing clogging and enhancing patient comfort.

- In Feb 2025, Cardinal Health announced a plan to launch Kangaroo OMNI™ Enteral Feeding Pump in new international markets, including Europe, Australia, and New Zealand.

- In 2024, Cardinal Health completed a full transition to ENFit connectors across its enteral device portfolio and launched its Kangaroo OMNI™ feeding pump in the U.S., designed for greater personalization and safety.

- In June 2024, Amsino, a major manufacturer of enteral feeding and other medical devices, announced a substantial investment from Novo Tellus, a leading investment firm. This is more of an investment partnership than a commercial one, but it's a significant development. The collaboration is aimed at strengthening Amsino's global production, research and development, and supply chain, which will enable it to better serve the enteral feeding market.

- In May 2024, this system received FDA clearance for Over-the-Counter (OTC) use, a significant development for patient access.

Scope of the Enteral Feeding Devices Market | |

|

Report Metrics |

Details |

|

Study Period |

2022 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2032 |

|

Enteral Feeding Devices Market CAGR |

6.38% |

|

Enteral Feeding Devices Companies |

Abbott Laboratories, Cardinal Health, Fresenius Kabi AG, Becton, Dickinson and Company (BD), Cook Medical, Avanos Medical, Inc., B. Braun SE, Boston Scientific Corporation, Baxter, Vygon SA, Applied Medical Technology, Inc., Amsino International, Inc., Vesco Medical, LLC, Rockfield Medical Devices, Nutricia, danumed Medizintechnik GmbH, ICU Medical, Inc., Medcaptain Medical Technology Co., Ltd., Fidmi Medical, GBUK Enteral, and others. |

|

Enteral Feeding Devices Market Segments |

by Product Type, by Age Group, by Application, by End-user, and by Geography |

|

Enteral Feeding Devices Regional Scope |

North America, Europe, Asia Pacific, Middle East, Africa, and South America |

|

Enteral Feeding Devices Country Scope |

U.S., Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, China, Japan, India, Australia, South Korea, and key Countries |

Enteral Feeding Devices Market Segmentation

- Enteral Feeding Devices by Product Type Exposure

- Enteral Feeding Pumps

- Enteral Feeding Tubes

- Enterostomy Feeding Tubes

- Oroenteric Feeding Tubes

- Nasoenteric Feeding Tubes

- Nasogastric Feeding Tubes

- Nasojejunal Feeding Tubes

- Nasoduodenal Feeding Tubes

- Others

- Enteral Syringes

- Gravity Sets

- Others

- Enteral Feeding Devices Age Group Exposure

- Adults

- Pediatrics

- Enteral Feeding Devices Application Exposure

- Gastroenterology

- Critical Care

- Neurology

- Oncology

- Others

- Enteral Feeding Devices End-Users Exposure

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Emergency Centers

- Others

- Enteral Feeding Devices Geography Exposure

- United States Enteral Feeding Devices Market

- Canada Enteral Feeding Devices Market

- Mexico Enteral Feeding Devices Market

- United Kingdom Enteral Feeding Devices Market

- Germany Enteral Feeding Devices Market

- France Enteral Feeding Devices Market

- Italy Enteral Feeding Devices Market

- Spain Enteral Feeding Devices Market

- Rest of Europe Enteral Feeding Devices Market

- China Enteral Feeding Devices Market

- Japan Enteral Feeding Devices Market

- India Enteral Feeding Devices Market

- Australia Enteral Feeding Devices Market

- South Korea Enteral Feeding Devices Market

- Rest of Asia-Pacific Enteral Feeding Devices Market

- South America Enteral Feeding Devices Market

- Middle East Enteral Feeding Devices Market

- Africa Enteral Feeding Devices Market

- North America Enteral Feeding Devices Market

- Europe Enteral Feeding Devices Market

- Asia-Pacific Enteral Feeding Devices Market

- Rest of the World Enteral Feeding Devices Market

Enteral Feeding Devices Market Recent Industry Trends and Milestones (2022-2025) | |

|

Category |

Key Developments |

|

Enteral Feeding Devices Regulatory Product Launches & Approvals |

Mobility+ Enteral Feeding System (Rockfield Medical Devices) Kangaroo OMNI™ Enteral Feeding Pump Vesco Q™ Enteral Feeding Pump System |

|

Partnerships in the Enteral Feeding Devices Market |

Amsino Medical Group, Novo Tellus, Vygon, Meditaverse, Fresenius Kabi, and Premier Inc. |

|

Emerging Technology |

|

Impact Analysis

What is the impact of AI on the Enteral Feeding Devices Market?

AI-Powered Innovations and Applications:

The integration of AI into the enteral feeding devices market is set to revolutionize nutritional care, enhancing safety, precision, and patient-centric management. AI-powered innovations will move beyond basic device functions to offer personalized nutrition, with algorithms analyzing vast patient data to tailor feeding plans and ensure optimal nutrient delivery, thereby improving clinical outcomes and reducing the risk of over- or under-feeding. Furthermore, predictive analytics will enable a shift from reactive to proactive care by forecasting potential complications such as feeding intolerance or tube occlusion, allowing clinicians to intervene before problems arise.

The next generation of smart pumps will embed AI directly into their systems, enabling real-time, wireless monitoring of patient data and even automated adjustments to the feeding regimen, while reducing "alarm fatigue." For the rapidly expanding home care segment, AI-powered mobile apps and platforms will empower patients and caregivers with remote monitoring capabilities and troubleshooting guidance, ultimately enhancing patient independence and quality of life while reducing hospital visits. Despite challenges related to regulatory hurdles and data privacy, the application of AI is poised to transform the market, making nutritional therapy more intelligent, efficient, and seamlessly integrated into the broader digital health ecosystem.

U.S. Tariff Impact Analysis on Enteral Feeding Devices Market:

The imposition of U.S. tariffs on medical devices and their components is having a multi-faceted and significant impact on the global enteral feeding devices market, primarily by increasing costs and disrupting well-established supply chains. Since a large portion of devices and their raw materials are sourced from countries like China, tariffs are raising production costs for manufacturers, forcing them to either absorb reduced margins or pass the costs on to healthcare providers and patients. This adds financial strain to already burdened hospital budgets and can potentially increase out-of-pocket costs for individuals. In response, companies are strategically diversifying their supply chains by seeking suppliers in other regions or exploring costly reshoring and nearshoring options. This shift is a major trend reshaping the global manufacturing landscape. Furthermore, the financial pressure from these tariffs could compel companies to cut back on research and development, potentially slowing the pace of innovation for next-generation devices. Finally, as a global industry, the market is also affected by retaliatory tariffs from other countries, which reduce the competitiveness of U.S.-made products in key international markets.

How This Analysis Helps Clients

- Cost Management: By understanding the tariff landscape, clients can anticipate cost increases and adjust pricing strategies accordingly, ensuring profitability.

- Supply Chain Optimization: Clients can identify alternative sourcing options and diversify their supply chains to reduce dependency on high-tariff regions, enhancing resilience.

- Regulatory Navigation: Expert guidance on navigating the evolving regulatory environment helps clients maintain compliance and avoid potential legal challenges

- Strategic Planning: Insights into tariff impacts enable clients to make informed decisions about manufacturing locations, partnerships, and market entry strategies.

Startup Funding & Investment Trends in the Enteral Feeding Devices Market | ||||

|

Company Name |

Total Funding |

Main Products |

Stage of Development |

Core Technology |

|

Luminoah Inc. |

Portable, data-driven enteral feeding system (wearable/portable pump + digital platform) |

Pre-commercial / late development (in accelerator programs; preparing for commercialization). |

Wearable/portable pump + connected digital health platform for remote monitoring and dosing analytics. | |

|

CoapTech, Inc. |

~$16.5M (multiple rounds; Series B activity). |

PUMA-G, ultrasound-guided bedside gastrostomy/feeding tube placement system |

Regulatory cleared / commercializing (FDA clearances for bedside ultrasound placement; actively fundraising to scale). |

Point-of-care ultrasound-based placement system enabling bedside gastrostomy/feeding tube procedures (reduces need for OR/X-ray). |

|

ENvizion / ENvue (ENvizion Medical) |

$24.2 million |

ENvue electromagnetic navigation system + compatible feeding tubes (real-time navigation for tube placement) |

Commercial / acquired, ENvue tech and ENvizion assets were acquired (NanoVibronix acquired ENvue Medical holdings in 2025). |

Electromagnetic navigation sensors and mapping (“Waze for the digestive tract”) for safe tube navigation and placement. |

|

Rockfield Medical Devices Ltd. |

Not publicly disclosed (SME funding/early commercial) |

Mobility+ Enteral Feeding System (portable, non-electronic enteral delivery system) |

FDA 510(k) cleared / commercial (market launches reported). |

Low-profile, mechanical/flow design for ambulatory enteral delivery (focus on mobility and single-patient sets). |

|

Fidmi Medical |

$4.85 million |

A new low-profile enteral feeding device |

Seed/Early Clinical |

A replaceable inner tube to prevent clogging and a soft, stable internal structure to prevent dislodgement |

Key takeaways from the Enteral Feeding Devices market report study

- Market size analysis for the current enteral feeding devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the enteral feeding devices market.

- Various opportunities available for the other competitors in the enteral feeding devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current enteral feeding devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the enteral feeding devices market growth in the future?