ER+/ HER2- Breast Cancer Market

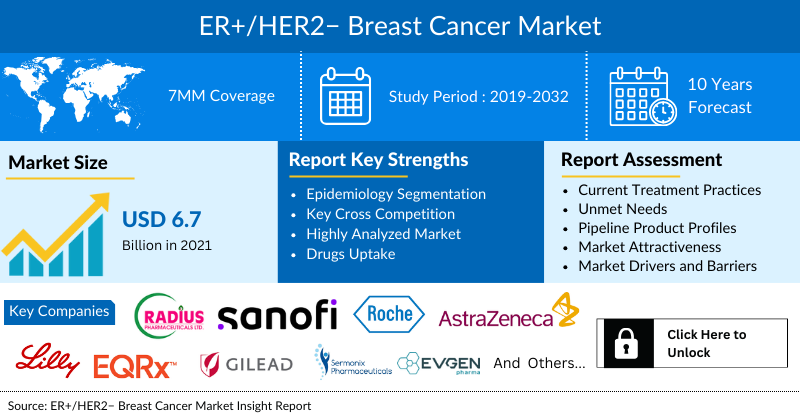

DelveInsight's “ER+/HER2− Breast Cancer - Market Insights, Epidemiology and Market Forecast– 2032” report delivers an in-depth understanding of the ER+/HER2− Breast Cancer, historical and forecasted epidemiology as well as the ER+/HER2− Breast Cancer market trends in the United States, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan.

ER+/HER2− Breast Cancer market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM ER+/HER2− Breast Cancer market size from 2019 to 2032. The report also covers current ER+/HER2− Breast Cancer treatment practice/algorithm and unmet medical needs to curate the best of the opportunities and assesses the underlying potential of the market.

ER+/HER2− Breast Cancer Disease Understanding and Treatment Algorithm

ER+/HER2− Breast Cancer Overview

Breast Cancer initiates when abnormal cancerous cells in the breast grow and multiply without stopping, creating a tumor. It usually starts in the ducts or lobules of the breast. Cancer cells get many signals that drive their growth. These signals may take the form of hormones.

Hormone receptors are proteins that receive hormone signals and tell the cancer cells to grow. If Breast Cancer cells get signals from the hormone estrogen that could promote tumor growth, it is known as estrogen receptor-positive (ER+) Breast Cancer. If cancerous cells get signals from the hormone progesterone that could promote growth, it is known as progesterone receptor-positive (PR+) Breast Cancer. Breast Cancer that is ER+ or PR+ falls under the category of hormone receptor-positive (HR+) Breast Cancer.

Additionally, there is another category of Breast Cancer, which is known as hormone receptor-negative (HR−). This type of Breast Cancer has cells without hormone receptors. HR- Breast Cancer cells do not depend on estrogen or progesterone to grow.

Addition to this, there is another factor, which is also responsible for Breast Cancer, which is known as human epidermal growth factor receptor 2 (HER2). Human epidermal growth factor receptor-2 is a gene that helps control how cells grow, divide, and repair themselves. These proteins are receptors on breast cells. Human epidermal growth factor receptor-2 positive (HER2+) is Breast Cancer that tests positive for the HER2 protein. HER2- Breast Cancer tends to grow faster and is more likely to spread and come back compared to human epidermal growth factor receptor-2 negative (HER2−) Breast Cancer. Patients HER2 status is determined by whether Breast Cancer tests are positive or negative for the HER2 protein.

In HER2−negative, cancer cells do not have high amount of a protein called HER2 on their surface. Cancer cells that are HER2 negative may grow more slowly and are less likely to recur (come back) or spread to other parts of the body than cancer cells that have a large amount of HER2 on their surface. Checking for HER2 on some types of cancer cells may help plan treatment.

ER+/HER2− Breast Cancer Diagnosis

The diagnosis of Breast Cancer depends on the presentation of the lesion by mammographic screening, other radiological imaging (such as ultrasound) or by a physical presence. In all cases, it is important to combine the radiologic assessment of the entire affected breast and the contralateral breast with the general health of the woman, examination of the breast and nodal areas, and pathological diagnosis. The treatment of Breast Cancer will depend on combining the results of these investigations.

ER+/HER2− Breast Cancer Treatment

Estrogen receptor (ER) expression is the main indicator of potential responses to hormonal therapy, and most of the human Breast Cancers are hormone-dependent and ER-Positive. A number of classes of anti-estrogenic agents available for patients with early, advanced, or metastatic Breast Cancer, which includes selective estrogen receptor modulators (SERMs), aromatase inhibitors (AIs), and a selective estrogen receptor degrader. However, the clinical development of combinations of antiestrogenic therapy with targeted agents that inhibit the phosphatidylinositol 3 kinase (PI3K)/akt murine thymoma viral oncogene (AKT)/mammalian target of rapamycin inhibitor (mTOR) signaling pathway or the cyclin-dependent kinase 4/6 (CDK4/6) pathway at the G1/S checkpoint of the cell cycle is currently a key focus of clinical research in patients with Hormone-Receptor Positive Breast Cancer who have demonstrated disease recurrence or progression.

ER+/HER2− Breast Cancer Epidemiology

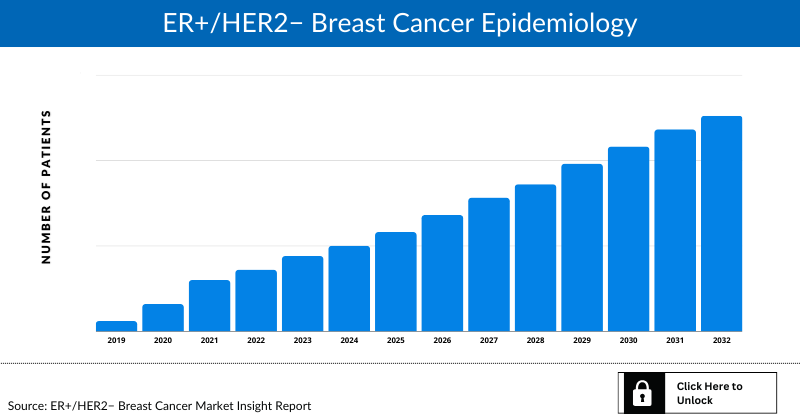

The disease epidemiology covered in the report provides historical as well as forecasted epidemiology segmented by total incident population of Breast Cancer, incidence of Breast Cancer cases by menopausal status, stage-specific incidence of Breast Cancer, subtype-specific incidence of Breast Cancer, and treatment eligible pool for localized and metastatic Breast Cancer in the 7MM market covering the United States, EU4 countries (Germany, France, Italy, and Spain), the United Kingdom, and Japan from 2019 to 2032.

Key Findings

This section provides glimpse of the ER+/HER2− Breast Cancer epidemiology in the 7MM

Country Wise- ER+/HER2− Breast Cancer Epidemiology

The epidemiology segment also provides the ER+/HER2− Breast Cancer epidemiology data and findings across the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- The total incident population of Breast Cancer in the United States is 256,431 in 2021.

- In the United States, more cases were observed for postmenopausal Breast Cancer, with 205,145 cases in 2021.

- In 2021, cases of localized, regional, distant and unknown stage were observed to be 164,116, 74,365, 15,386 and 2,564 respectively. This number might increase during forecast period.

- Among the various subtypes of the disease (localized and regional), ER+/HER2− occupies the maximum patient pool, with 147,977 cases of this category, followed by the number of those with 24,325 cases of Triple-negative and 20,271 cases of ER+/HER2+. On the other hand, HR−/HER2+ accommodated the least number of cases.

ER+/HER2− Breast Cancer Drug Chapters

Drug chapter segment of the ER+/HER2− Breast Cancer report encloses the detailed analysis of ER+/HER2− Breast Cancer marketed drugs and late stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the ER+/HER2− Breast Cancer clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

Marketed Drugs

KISQALI (ribociclib): Novartis

KISQALI is a kinase inhibitor indicated for the treatment of adult patients with HR+, HER2− advanced or metastatic cancer in combination with:

An aromatase inhibitor as initial endocrine-based therapy

Fulvestrant as initial endocrine-based therapy or following disease progression on endocrine therapy in postmenopausal women or in men

IBRANCE (palbociclib): Pfizer

IBRANCE is a kinase inhibitor approved in the US by the FDA, in Europe by the EMA, and in Japan by PMDA for the treatment of adult patients with HR+ HER2− advanced or metastatic Breast Cancer in combination with an aromatase inhibitor (AI) as initial endocrine-based therapy in postmenopausal women or men or fulvestrant in patients with disease progression following endocrine therapy. IBRANCE is currently approved in more than 90 countries.

AFINITOR (everolimus): Novartis

AFINITOR is a kinase inhibitor used for the treatment of postmenopausal women with advanced hormone receptor-positive, HER2− negative Breast Cancer (advanced HR+ BC) in combination with exemestane after failure of treatment with letrozole or anastrozole. The generics of AFINITOR entered the US market in 2019.

LYNPARZA (olaparib): AstraZeneca

LYNPARZA is a poly (ADP-ribose) polymerase (PARP Inhibitor), including PARP1, PARP2, and PARP3. It is used in patients with deleterious or suspected deleterious gBRCAm, HR+ HER2− metastatic Breast Cancer who have been treated with chemotherapy in the neoadjuvant, adjuvant, or metastatic setting. Patients with HR+ Breast Cancer can also be treated with prior endocrine therapy or be considered inappropriate for endocrine therapy. This drug is also used as a first-line maintenance treatment of BRCA-mutated advanced ovarian cancer. LYNPARZA is now indicated for the adjuvant treatment of adult patients with deleterious or suspected deleterious gBRCAm HER2− high-risk early Breast Cancer who have been treated with neoadjuvant or adjuvant chemotherapy.

Note: Detailed current therapies assessment will be provided in the full report of ER+/HER2− Breast Cancer

Emerging Drugs

Elacestrant: Radius Pharmaceuticals

Elacestrant is a selective estrogen receptor degrader (SERD), out-licensed to Menarini Group, which is being evaluated for potential use as a once-daily oral treatment for HR+ Breast Cancer. Studies completed to date indicate that the compound has the potential for use as a single agent or in combination with other therapies to treat Breast Cancer. In October 2017, Radius Health announced that the US FDA granted Fast Track Designation to elacestrant for the treatment of women with ER+ and HER2− advanced or metastatic Breast Cancer.

Giredestrant (RG6171, GDC-9545): Roche

Giredestrant is an investigational SERD designed to block ER signalling entirely with robust receptor occupancy. Estrogen encourages HR+ Breast Cancer cells to grow by attaching to the ER. Giredestrant works by blocking this receptor to prevent the action of estrogen and, in the process, causes the receptor to be degraded. This investigational medicine has also shown efficacy regardless of ESR1 mutation status (mutations in the ESR1 gene are important mechanisms of resistance to hormone therapy). In December 2020, giredestrant received the Fast Track Designation from the US FDA for ER+, HER2−, second and third-line metastatic Breast Cancer.

Camizestrant (AZD9833): AstraZeneca

Camizestrant (AZD9833) is an oral SERD that has shown antitumor efficacy in a range of preclinical models of Breast Cancer. This compound was demonstrated to be a highly potent SERD that showed a pharmacological profile comparable to fulvestrant in its ability to degrade ERα in both MCF-7 and CAMA-1 cell lines. Stringent control of lipophilicity ensured that it had favorable physicochemical and preclinical pharmacokinetic properties for oral administration. This is combined with the demonstration of potent in vivo activity in mouse xenograft models. In June 2021, AstraZeneca initiated a Phase III clinical trial, SERENA-6, to evaluate the safety and efficacy of AZD9833 in combination with a CDK4/6 inhibitor (palbociclib or abemaciclib) for the treatment of patients with HR+, HER2− metastatic Breast Cancer with a detectable ESR1 mutation.

LY3484356 (imlunestrant): Eli Lilly

LY3484356 (imlunestrant) is a chemical entity that functions as an oral selective estrogen receptor degrader (SERD). It is being studied to treat the second line ER+, HER2− metastatic Breast Cancer (mBC). The drug is currently in Phase III trial (NCT04975308; EMBER-3). The study’s primary purpose is to measure how well imlunestrant works compared to standard hormone therapy and how well imlunestrant with abemaciclib works compared to imlunestrant in participants with Breast Cancer that is ER+ and HER2−.

Lerociclib (EQ132): EQRx

Lerociclib (EQ132) is a novel, oral, potent, and selective small-molecule cyclin-dependent kinase (CDK) 4/6 inhibitor. In July 2020, EQRx in-licensed the exclusive development and commercialization rights of lerociclib for the US, Europe, Japan, and all other global markets, excluding the Asia-Pacific region (except Japan), from G1 Therapeutics. Genor Biopharma (Genor) holds the development and commercialization rights to lerociclib within the Asia-Pacific region (except Japan).

Note: Detailed emerging therapies assessment will be provided in the final report.

ER+/HER2− Breast Cancer Market Outlook

Breast Cancer is the second most common cancer in women and men worldwide, and among all types of Breast Cancer, estrogen receptor-positive (ER+) Breast Cancer is the most common type of cancer diagnosed in patients with Breast Cancer. ER+ Breast Cancer cells have a receptor that attaches to estrogen, which helps them to grow. According to the statement of the American Cancer Society, about two out of every three cases of Breast Cancer are HR+, and in those cases, most of the cases are ER+.

The stage (extent) of breast cancer is an essential factor in making treatment decisions. Most women with breast cancer in Stages I, II, or III are treated with surgery, often followed by radiation therapy. Most women with breast cancer in Stages I–III will get some drug therapy as part of their treatment. This may include chemotherapy, hormone therapy (tamoxifen, an aromatase inhibitor, or one followed by the other), HER2 targeted drugs, such as trastuzumab (Herceptin) and pertuzumab (Perjeta), and some combination of these. The drugs that might work best depend on the tumor’s hormone receptor status, HER2 status, and other factors.

Among Stage I breast cancers, for women who have an HR+ (ER+ or PR+) breast cancer, most doctors recommend hormone therapy (tamoxifen or an aromatase inhibitor, or one followed by the other) as an adjuvant (additional) treatment, no matter how small the tumor is. Women with tumors larger than 0.5 cm across may be more likely to benefit from it. Hormone therapy is typically given for at least 5 years. If the tumor is larger than 1 cm across, adjuvant chemotherapy is sometimes recommended. A woman’s age at the time of diagnosis may help in deciding if chemotherapy should be offered or not. Some doctors may suggest chemotherapy for smaller tumors as well, especially if they have any unfavourable features (cancer that is growing fast; HR−, HER2+; or having a high score on a gene panel). For HER2+ cancers, 6 months to a year of adjuvant trastuzumab (Herceptin) is usually recommended as well.

Furthermore, systemic therapy is recommended for women with Stage II breast cancer. Some systemic therapies are given before surgery (neoadjuvant therapy), and others are given after surgery (adjuvant therapy). Neoadjuvant treatments are often a good option for women with large tumors because they can shrink the tumor before surgery, possibly enough to make breast-conserving surgery an option. But this does not improve survival more than getting these treatments after surgery. In some cases, systemic therapy may be started before surgery and then continued after surgery.

Most often, Stage III cancers are treated with neoadjuvant chemotherapy (before surgery). For HER2+ tumors, the targeted drug trastuzumab (Herceptin) is given as well, sometimes along with pertuzumab. This may shrink the tumor enough to allow a woman to have breast-conserving surgery (BCS). If the tumor does not shrink enough, a mastectomy is done. Nearby lymph nodes will also need to be checked. A sentinel lymph node biopsy (SLNB) is often not an option for Stage III cancers, so an axillary lymph node dissection (ALND) is usually done.

Currently available drugs include (a) tamoxifen, a prodrug that blocks estrogen uptake by the ER; (b) aromatase inhibitors (letrozole, anastrozole, and exemestane), which suppress the conversion of androgens to estrogens, thus resulting in estrogen depletion; (c) luteinizing hormone-releasing hormone analogs (goserelin and leuprolide), which suppress the production of hormone from the ovary; and (d) fulvestrant (a selective ER degrader), which is suitable for breast cancer patients refractory to previous hormonal therapy. Sequential administration of endocrine treatments is recommended until there is a need for rapid response or evidence of clinical resistance when chemotherapy is indicated.

The ER+/HER2− Breast Cancer pipeline possessed multiple potential drugs in late- and mid-stage developments to be launched shortly. Key players involved in robust research and development include Radius Pharmaceuticals (Elacestrant), AstraZeneca (Camizestrant (AZD9833)), Roche (Giredestrant), Sermonix Pharmaceuticals (Lasofoxifene), AstraZeneca and Daiichi Sankyo (Datopotamab deruxtecan), Eli Lilly (Imlunestrant), Veru (Enobosarm), Roche/Genentech (Inavolisib), Tyme (SM-88), Gilead Sciences (TRODELVY) are some of the major players that are going to alter the market dynamics in the coming years.

Key Findings

This section includes a glimpse of the ER+/HER2− Breast Cancer in 7MM market.

The total market size of ER+/HER2− Breast Cancer in the United States is USD 6,759 million in 2021 and is projected to grow during the forecast period (2022-2032)

The total market size of ER+/HER2− Breast Cancer in first-line setting in the United States is USD 3,471 million in 2021

The United States Market Outlook

The total market size of ER+/HER2− Breast Cancer in the United States is expected to increase during the study period (2019–2032).

EU4, the UK Market Outlook

The total market size of ER+/HER2− Breast Cancer in EU4, and the UK is expected to increase during the study period (2019–2032).

Japan Market Outlook

The total market size of ER+/HER2− Breast Cancer in Japan is expected to increase during the study period (2019–2032).

Analyst Commentary

- The emergence of several novel CDK4/6 inhibitors in ER+/HER2- Breast Cancer space has demonstrated a widespread potential for this patient population in combination and as monotherapy

- Approval of VERZENIO, the only CDK4/6 inhibitor in the adjuvant setting, is expected to reap benefits of first mover advantage in this setting

- Pfizer’s IBRANCE is expected to dominate the first (1L) and second line (2L) market even after the entry of Next generation SERDs during the forecast years

- Upcoming pipeline of ER+, HER2− Breast cancer comprises many next-generation SERD drug candidates. They will face a strong competition from the existing CDK4/6 inhibitors that have a strong hold over majority of the market share. This could lead to their slow growth

- The only SERM in the second-line and the third-line setting is Lasofoxifene which is given in combination with abemaciclib

ER+/HER2− Breast Cancer Drugs Uptake

This section focuses on the rate of uptake of the potential ER+/HER2- Breast Cancer drugs expected to get launched in the market during the study period 2019-2032. The analysis covers ER+/HER2− Breast Cancer market uptake by drugs; patient uptake by therapies; and sales of each drug. For example- Enobosarm, is an oral, first in class, new chemical entity that is a member of a new class of endocrine drugs called selective androgen receptor targeting agonists – it is both an agonist and an antagonist depending on the tissue type. In January 2022, Veru announced that the US FDA had granted Fast Track Designation (FTD) to enobosarm for the treatment of AR+ ER+ HER2- Metastatic Breast Cancer. As per our analysis, enobosarm drug uptake in the US for 3L+ is expected to be medium-fast with a probability adjusted peak share of 15.8%, years to peak would be 6 years.

ER+/HER2− Breast Cancer Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers the detailed information of collaborations, acquisition and merger, licensing and patent details for ER+/HER2− Breast Cancer emerging therapies.

KOL- Views

To keep up with current market trends, we take KOLs and SME's opinion working in the domain through primary research to fill the data gaps and validate our secondary research. Some of the leaders from UT Southwestern Medical Center in Dallas, Cancer Research UK Barts Centre in London, MD Anderson Cancer Center. Their opinion helps to understand and validate current and emerging therapies treatment patterns or ER+/HER2− Breast Cancer market trend. This will support the clients in potential upcoming novel treatment by identifying the overall scenario of the market and the unmet needs.

Competitive Intelligence Analysis

We perform competitive and market Intelligence analysis of the ER+/HER2− Breast Cancer market by using various competitive intelligence tools that include–SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies, etc. The inclusion of the analysis entirely depends upon the data availability.

Scope of the Report

- The report covers the descriptive overview of ER+/HER2− Breast Cancer, explaining its causes, signs and symptoms, pathogenesis and currently available therapies

- Comprehensive insight has been provided into the ER+/HER2− Breast Cancer epidemiology and treatment

- Additionally, an all-inclusive account of both the current and emerging therapies for ER+/HER2− Breast Cancer are provided, along with the assessment of new therapies, which will have an impact on the current treatment landscape

- A detailed review of ER+/HER2− Breast Cancer market; historical and forecasted is included in the report, covering the 7MM drug outreach

- The report provides an edge while developing business strategies, by understanding trends shaping and driving the 7MM ER+/HER2− Breast Cancer market

Report Highlights

- In the coming years, ER+/HER2− Breast Cancer market is set to change due emerging therapies in the pipeline, and incremental healthcare spending across the world; which would expand the size of the market to enable the drug manufacturers to penetrate more into the market

- The companies and academics are working to assess challenges and seek opportunities that could influence ER+/HER2− Breast Cancer R&D. The therapies under development are focused on novel approaches to treat/improve the disease condition

- As per DelveInsight’s analysis, the major types of Breast Cancer include invasive, non-invasive, ductal carcinoma, lobular carcinoma, and others

- The report also encompasses other major segments, i.e., total incident population of Breast Cancer, incidence of Breast Cancer cases by menopausal status, stage-specific incidence of Breast Cancer, subtype-specific incidence of Breast Cancer, and treatment eligible pool for localized and metastatic Breast Cancer

- Expected launch of potential therapies such as Elacestrant (Radius Pharmaceuticals), Giredestrant (Roche), Lasofoxifene (Sermonix Pharmaceuticals), and others might change the landscape in treatment of ER+/HER2− Breast Cancer

- The US FDA-approved drugs, which are currently available, include KISQALI, PIQRAY, VERZENIO, LYNPARZA, IBRANCE, and others

ER+/HER2− Breast Cancer Report Insights

- ER+/HER2− Breast Cancer Report Insights

- Patient Population

- Therapeutic Approaches

- ER+/HER2− Breast Cancer Pipeline Analysis

- ER+/HER2− Breast Cancer Market Size and Trends

- Market Opportunities

- Impact of upcoming Therapies

ER+/HER2− Breast Cancer Report Key Strengths

- 10 Years Forecast

- 7MM Coverage

- ER+/HER2− Breast Cancer Epidemiology Segmentation

- Key Cross Competition

- Highly Analyzed Market

- Drugs Uptake

ER+/HER2− Breast Cancer Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- SWOT

- Attribute Analysis

Key Questions

Market Insights:

- What was the ER+/HER2− Breast Cancer market share (%) distribution in 2019 and how it would look like in 2032?

- What would be the ER+/HER2− Breast Cancer total market size as well as market size by therapies across the 7MM during the study period (2019–2032)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest ER+/HER2− Breast Cancer market size during the study period (2019–2032)?

- At what CAGR, the ER+/HER2− Breast Cancer market is expected to grow at the 7MM level during the study period (2019–2032)?

- What would be the ER+/HER2− Breast Cancer market outlook across the 7MM during the study period (2019–2032)?

- What would be the ER+/HER2− Breast Cancer market growth till 2032 and what will be the resultant market size in the year 2032?

- How would the market drivers, barriers and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights:

- What is the disease risk, burden and unmet needs of ER+/HER2− Breast Cancer?

- What is the historical ER+/HER2− Breast Cancer patient pool in the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan?

- What would be the forecasted patient pool of ER+/HER2− Breast Cancer at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to ER+/HER2− Breast Cancer?

- Out of the above-mentioned countries, which country would have the highest incident population of ER+/HER2− Breast Cancer during the study period (2019–2032)?

- At what CAGR the population is expected to grow across the 7MM during the study period (2019–2032)?

Current Treatment Scenario, Marketed Drugs and Emerging Therapies:

- What are the current options for the treatment of ER+/HER2− Breast Cancer? What are the current treatment guidelines for the treatment of ER+/HER2− Breast Cancer in the US and Europe?

- What are the ER+/HER2− Breast Cancer marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety and efficacy, etc.?

- How many companies are developing therapies for the treatment of ER+/HER2− Breast Cancer?

- How many emerging therapies are in the mid-stage and late stage of development for the treatment of ER+/HER2− Breast Cancer?

- What are the key collaborations (Industry–Industry, Industry–Academia), Mergers and acquisitions, licensing activities related to the ER+/HER2− Breast Cancer therapies?

- What are the recent novel therapies, targets, mechanisms of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for ER+/HER2− Breast Cancer and their status?

- What are the key designations that have been granted for the emerging therapies for ER+/HER2− Breast Cancer?

- What are the 7MM historical and forecasted market of ER+/HER2− Breast Cancer?

Reasons to buy

- The report will help in developing business strategies by understanding trends shaping and driving the ER+/HER2− Breast Cancer

- To understand the future market competition in the ER+/HER2− Breast Cancer market and Insightful review of the SWOT analysis of ER+/HER2− Breast Cancer

- Organize sales and marketing efforts by identifying the best opportunities for ER+/HER2− Breast Cancer in the US, EU4 (Germany, Spain, Italy, and France), the United Kingdom, and Japan

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors

- Organize sales and marketing efforts by identifying the best opportunities for ER+/HER2− Breast Cancer market

- To understand the future market competition in the ER+/HER2− Breast Cancer market

Stay Updated with us for Recent Articles:-

- Metastatic HER2-Positive Breast Cancer

- Estrogen Receptor Positive Breast Cancer: Market Outlook

- Global HR+/ HER2- Breast Cancer Market Scenario

- How HR+/ HER2- Breast Cancer Emerging Drugs Will Transform the Market?

- HR-positive/ HER2-negative Breast Cancer Market Insights: Upcoming Therapies and Market Analysis

- Breast Cancer: Understand Your Breasts, Recognize the Symptoms

- Key Facts To Know About Triple-Negative Breast Cancer In The Breast Cancer Awareness Month

- 7 Most Common Myths About Breast Cancer Demystified

- Roche’s HER2-Positive Breast Cancer Treatment Franchise

- Latest DelveInsight Blogs