GnRH Receptor Antagonist Market Summary

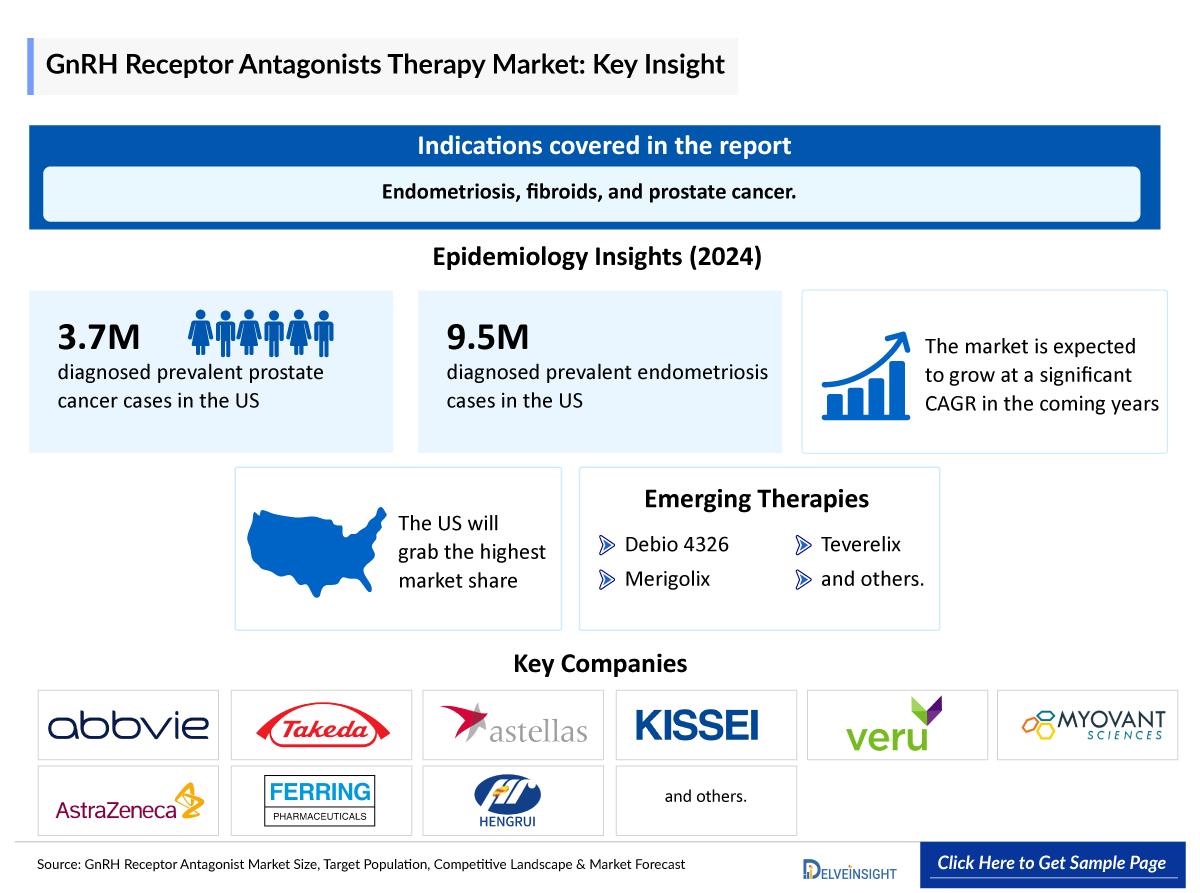

- The GnRH receptor antagonists market in the 7MM is projected to grow at a significant CAGR by 2034 in leading countries (US, EU4, UK and Japan).

GnRH Receptor Antagonists Market and Epidemiology Analysis

- Gonadotropin-releasing hormone (GnRH) receptor antagonist is a class of drug that produces a direct and immediate blockade of GnRH pituitary receptors and rapid testosterone suppression without an initial surge or subsequent microsurges.

- The recent advent of oral GnRH antagonists with an inherent rapid onset of action continues to transform the treatment options available for several common gynecologic conditions, including endometriosis, fibroids, and prostate cancer.

- GnRH receptor antagonists, including FIRMAGON (degarelix) and ORGOVYX (relugolix) have received approval from the FDA for the treatment of advanced prostate cancer and ORILISSA (elagolix) for management of moderate to severe pain associated with endometriosis.

- In May 2021, the FDA approved the combination product of relugolix, estradiol, and norethindrone under the brand name MYFEMBREE, the first once-daily treatment for the management of heavy menstrual bleeding associated with uterine fibroids in premenopausal women, with a treatment duration of up to 24 months.

- In February 2025, Kissei submitted New Drug Application (NDA) for "linzagolix" indicated for Uterine Fibroids in Japan. In the EU, linzagolix received marketing authorization for uterine fibroids in June 2022.

- According to DelveInsight's analysis, the growth of the GnRH receptor antagonist market is expected to be mainly driven by the expected launch of various emerging therapies, including TU2670, Teverelix, Debio 4326, and others covering various indications.

- Medicus Pharma and Antev Pharma announced that they have entered into a binding letter of intent dated April 26, 2025, according to which Medicus has agreed to acquire all of the issued and outstanding shares of Antev.

- Key players in the GnRH receptor antagonist market includes Tiumbio, Antev, Debiopharm, and others.

DelveInsight’s “GnRH receptor antagonists – Target Population, Competitive Landscape, and Market Forecast – 2034” report delivers an in-depth understanding of the GnRH receptor antagonist, historical and competitive landscape as well as the GnRH receptor antagonist market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The GnRH receptor antagonist market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM GnRH receptor antagonist market size from 2020 to 2034. The report also covers current GnRH receptor antagonist treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

|

Study Period |

2020–2034 |

|

Forecast Period |

2025–2034 |

|

Geographies Covered |

US, EU4 (Germany, France, Italy, and Spain) the UK, and Japan |

|

GnRH Receptor Antagonist Patient Pool |

Segmented by:

|

|

GnRH Receptor Antagonist Key Companies |

|

|

GnRH Receptor Antagonist Key Therapies |

|

|

GnRH Receptor Antagonist Market |

Segmented by:

|

|

GnRH Receptor Antagonist Market Analysis |

|

GnRH Receptor Antagonist Understanding

GnRH Receptor Antagonist Overview

GnRH antagonists represent a significant advancement in androgen deprivation therapy (ADT) for hormone-sensitive prostate cancer. These agents work by directly blocking GnRH receptors in the pituitary gland, leading to an immediate suppression of luteinizing hormone (LH), follicle-stimulating hormone (FSH), and subsequently testosterone levels. This mechanism enables rapid induction of chemical castration without the initial testosterone surge, or “flare,” associated with other ADT approaches.

One of the key clinical advantages of GnRH antagonists is the rapid onset of action. Testosterone levels typically fall to castration levels within days of administration, which can be crucial in patients with symptomatic or metastatic disease where prompt hormonal control is needed.

Additionally, GnRH antagonists have demonstrated a superior cardiovascular safety profile. Clinical trials, such as the HERO study, showed that patients receiving relugolix a once-daily oral GnRH antagonist had a significantly lower risk of major cardiovascular events compared to standard therapies. This makes antagonists especially suitable for patients with pre-existing cardiovascular conditions.

Currently available GnRH antagonists include: FIRMAGON, ORGOVYX, and others

Beyond their use in prostate cancer, GnRH antagonists are also being investigated in other hormone-driven conditions such as endometriosis, uterine fibroids, and assisted reproductive technologies.

Further details related to country-based variations are provided in the report…

GnRH Receptor Antagonist Patient Pool

The GnRH receptor antagonist epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented as total cases of selected indication for GnRH receptor antagonist, total eligible patient pool for GnRH receptor antagonist in selected indication, and total treated cases in selected indication for GnRH receptor antagonist in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain), and the United Kingdom, and Japan from 2020 to 2034.

- In 2024, the US accounted for the highest prevalent cases of prostate cancer among the 7MM, i.e., ~3,752,000.

- Among EU4 and the UK, Germany accounted for the highest number of prostate cancer cases, while Spain accounted for the fewest prevalent cases.

- Prostate cancer is common in men of 50-64 years and over age 65; however, it can occur in men younger than 50 years of age.

- Endometriosis cases affect roughly 10% of reproductive-age women and girls globally.

- Uterine fibroid cases are most common in women aged 30 to 40, but they can occur at any age.

|

Epidemiology of Selected Indications | |

|

Indication |

Estimated Cases in US (2024) |

|

Prostate Cancer (Prevalence) |

~3,752,000 |

|

Endometriosis (Prevalence) |

~9,570,000 |

Note: Indications are selected based on pipeline activity

GnRH Receptor Antagonist Drug Chapters

The drug chapter segment of the GnRH receptor antagonist reports encloses a detailed analysis of GnRH receptor antagonists in late-stage and mid-stage pipeline drugs. It also helps understand the GnRH receptor antagonist clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug and the latest news and press releases.

GnRH Receptor Antagonist Marketed Drugs

FIRMAGON (degarelix): FERRING PHARMACEUTICALS

Degarelix is used for the treatment of advanced prostate cancer. Degarelix is a synthetic peptide derivative drug that binds to GnRH receptors in the pituitary gland and blocks interaction with GnRH. This antagonism reduces luteinizing hormone (LH) and follicle-stimulating hormone (FSH) which ultimately causes testosterone suppression. Reduction in testosterone is important in treating men with advanced prostate cancer. Chemically, it is a synthetic linear decapeptide amide with seven unnatural amino acids, five of which are D-amino acids.

ORGOVYX (relugolix): Sumitomo Pharma

Relugolix is a GnRH receptor antagonist used to treat several hormone-responsive conditions. Relugolix was the first orally administered GnRH receptor antagonist approved for the treatment of prostate cancer. In addition to its relative ease of use, relugolix was shown to be superior in the depression of testosterone levels when compared to leuprolide, another androgen deprivation therapy used in prostate cancer treatment.

|

Product |

Company |

RoA |

Molecule Type |

First Approval |

|

FIRMAGON (degarelix) |

Ferring Pharmaceuticals |

Subcutaneous |

Small molecule |

2008 (US) |

|

ORGOVYX (relugolix) |

Sumitomo Pharma |

Oral |

Small molecule |

2020 (US) |

|

YSELTY (linzagolix) |

Theramex/Kissei |

Oral |

Small molecule |

2022 (EMA) |

Note: Detailed marketed therapies assessment will be provided in the final report.

GnRH Receptor Antagonist Emerging Drugs

Debio 4326: Debiopharm

Debio 4326 is a unique injectable, biodegradable 12-month extended-release formulation of triptorelin in development for the treatment of central precocious puberty (CPP). The product has been designed to further reduce the frequency of injections, particularly lightening the treatment administration burden for children affected by this rare disorder.

Based on favorable efficacy and safety data from currently marketed triptorelin 1, 3, and 6-month formulations, this new formulation aims to provide improved long-term compliance and reduced stress for children and their parents. Debio 4326 is currently in a Phase 3 study across North and South America, aiming to evaluate the efficacy and safety of the 12-month triptorelin formulation.

Teverelix: Antev

Teverelix is an injectable, long-acting GnRH antagonist. In a novel and unique microcrystal formulation which can overcome the well-documented safety issues associated with other GnRH antagonist candidates in the treatment of prostate cancer. With good injection site tolerance and a six-week dosing interval, Teverelix is likely to secure better patient compliance and therefore better clinical outcomes. Teverelix also has the potential to be developed for Benign Prostate Hyperplasia (BPH), Acute Urinary Retention (AUR) Endometriosis and Uterine Fibroids.

In January 2023, the US FDA reviewed Phase I and Phase IIa data and provided written guidance on Antev's proposed Phase III trial design for Teverelix. This pivotal trial aims to evaluate Teverelix's efficacy and safety in advanced prostate cancer patients with increased cardiovascular risk, addressing a significant unmet need in this patient population.

In December 2023, the FDA approved a Phase IIb study design for advanced prostate cancer, enrolling 40 patients, and in November 2024, approved a Phase IIb study design for acute urinary retention, enrolling 390 patients. These milestones support Antev's clinical plans to develop Teverelix as a treatment option for patients with specific therapeutic needs.

|

Product |

Company |

RoA |

Molecule Type |

Phase |

|

Debio 4326 |

Debiopharm |

Intramuscular |

Small molecule |

III |

|

Merigolix (TU2670) |

Tiumbio |

Oral |

Small molecule |

II |

|

Teverelix |

Antev |

Subcutaneous/Intramuscular |

Small molecule |

II |

Note: Detailed emerging therapies assessment will be provided in the final report.

GnRH Receptor Antagonist Market Outlook

The GnRH inhibitor market has evolved considerably over the past decade, transitioning from injectable options to more patient-friendly oral therapies. Initially dominated by FIRMAGON, an injectable small molecule GnRH antagonist approved in the US in 2008 for advanced prostate cancer, the market saw a significant shift with the approval of ORGOVYX by Sumitomo Pharma in 2020. As the first oral GnRH antagonist for prostate cancer, ORGOVYX offered a major clinical and convenience advantage, avoiding the testosterone flare commonly associated with GnRH agonists and reducing the burden of injections. It quickly established itself as a key player in ADT and signaled a broader shift in treatment preference toward oral formulations.

Another notable entrant is YSELTY (linzagolix), approved in 2022 by the EMA for uterine fibroids and endometriosis. Developed by Theramex/Kissei, YSELTY broadened the therapeutic reach of GnRH inhibitors beyond oncology into women’s health, providing a once-daily oral option with the flexibility of partial suppression regimens aimed at reducing long-term hypoestrogenic side effects. Its approval reinforced the clinical and commercial viability of oral GnRH inhibitors in non-oncologic indications, further expanding market potential.

The emerging GnRH inhibitors pipeline reflects continued innovation and diversification. Debio 4326, currently in Phase III development by Debiopharm, is being evaluated as an intramuscular long-acting formulation, aiming to improve compliance through less frequent dosing while maintaining rapid testosterone suppression. Similarly, merigolix (TU2670), an oral small molecule from Tiumbio in Phase II, and Teverelix by Antev, with both subcutaneous and intramuscular formulations in Phase II, represent efforts to refine delivery methods and dosing flexibility across indications including prostate cancer, endometriosis, and Benign prostatic hyperplasia.

As oral GnRH inhibitors demonstrate superior safety profiles, better patient adherence, and lower cardiovascular risk, particularly relevant in prostate cancer patients, the market is poised for expansion. The ability to avoid testosterone surge, quickly reverse suppression when needed, and tailor dosing in women's health makes this class highly attractive. However, the injectable segment continues to serve patients requiring depot-like options or who face adherence challenges with daily oral therapies.

Looking ahead, ORGOVYX is expected to retain leadership in the prostate cancer space, especially in Western markets, while YSELTY continues to expand in gynecological use. The success of late-stage candidates such as Debio 4326 will determine whether long-acting injectable formulations can reclaim a share of the market dominated by oral drugs. As regulatory approvals broaden and real-world evidence accumulates, GnRH inhibitors are set to become the preferred therapeutic option over GnRH agonists in multiple endocrine-driven conditions, due to their rapid onset, reversible action, and reduced side effect burden.

In conclusion, the GnRH inhibitor market is transitioning toward convenience-driven, patient-centric therapy, led by oral agents like ORGOVYX and YSELTY. With an active pipeline and expanding indications, the class is expected to gain wider clinical adoption and shape the future of hormonal suppression therapy in both oncology and women’s health.

GnRH Receptor Antagonist Drugs Uptake

This section focuses on the uptake rate of potential emerging GnRH Receptor Antagonist expected to be launched in the market during 2025–2034.

GnRH Receptor Antagonist Pipeline Development Activities

The report provides insights into different GnRH Receptor Antagonist therapeutic candidates in Phase III, Phase II, and Phase I. It also analyzes key players involved in developing targeted therapeutics.

The presence of numerous drugs at different stages is expected to generate immense opportunities for GnRH Receptor Antagonist market growth over the forecasted period.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for GnRH Receptor Antagonist therapies.

KOL Views

To keep up with current and future market trends, we take Industry Experts’ opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts were contacted for insights on the GnRH receptor antagonist evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, drug uptake, along challenges related to accessibility.

DelveInsight’s analysts connected with 25+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the UC Davis Comprehensive Cancer Center, University of Texas, Anderson Cancer Center, etc. were contacted.

Their opinion helps understand and validate current and emerging therapy treatment patterns or GnRH receptor antagonist market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

|

KOL Views |

|

“The decision to use a GnRH agonist vs antagonist depends on several factors. Given the shorter time to testosterone suppression and lack of testosterone surge, GnRH antagonists may be more clinically beneficial for patients with more advanced disease and at higher risk of developing prostate cancer–related symptoms. Additionally, the absence of tumor flare with GnRH antagonists may seem especially appealing in patients with impending cord compression or urethral obstruction; however, GnRH agonists in conjunction with antiandrogen agents for flare prophylaxis have been shown to achieve similar effects.” -Professor, University of Texas, the US |

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement may be referred to as the negotiation of a price between a manufacturer and payer that allows the manufacturer access to the market. It is provided to reduce the high costs and make the essential drugs affordable. Health technology assessment (HTA) plays an important role in reimbursement decision-making and recommending the use of a drug. These recommendations vary widely throughout the seven major markets, even for the same drug.

In the US healthcare system, both Public and Private health insurance coverage are included. Also, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs including Medicare, Medicaid, the Children's Health Insurance Program (CHIP), and the state and federal health insurance marketplaces are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services, and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Key Updates on GnRH Receptor Antagonist

- In March 2025, Kissei initiated the Phase III Clinical Trial for the GnRH Antagonist "Linzagolix" indicated for Endometriosis in Japan.

- In May 2024, Tiumbio announced positive topline results from its Phase IIa clinical trial of Merigolix (TU2670), an oral GnRH receptor antagonist, in patients with moderate to severe endometriosis-associated pain. The trial achieved its primary endpoint of reducing dysmenorrhea scores compared to placebo across all three dose groups, demonstrating a statistically significant difference.

- In May 2025, TiumBio and Daewon Pharmaceutical completed Phase II clinical trial of 'Merigolix (TU2670/DW4902)' for Uterine Fibroids with positive results.

- In July 2023, the European Medicines Agency’s (EMA’s) committee for medicinal products for human use (CHMP) adopted a positive opinion, recommending the granting of a marketing authorization for the medicinal product Degarelix Accord (generic of FIRMAGON), intended for the treatment of hormone-dependent prostate cancer.

The abstract list is not exhaustive, will be provided in the final report

Scope of the Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of GnRH receptor antagonists, explaining their causes, diagnosis, and therapies (current and emerging).

- Comprehensive insight into the GnRH Receptor Antagonist competitive landscape, and forecasts, the future growth potential of treatment rate, drug uptake, and drug information have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current landscape.

- A detailed review of the GnRH receptor antagonist market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis expert insights/KOL views, and treatment preferences that help shape and drive the 7MM GnRH receptor antagonist market.

GnRH Receptor Antagonist Report Insights

- GnRH receptor antagonist Targeted Patient Pool

- Therapeutic Approaches

- GnRH Receptor Antagonist Pipeline Analysis

- GnRH Receptor Antagonist Market Size and Trends

- Existing and future Market Opportunity

GnRH Receptor Antagonist Report Key Strengths

- 10 years Forecast

- The 7MM Coverage

- Key Cross Competition

- GnRH Receptor Antagonist Drugs Uptake and Key Market Forecast Assumptions

GnRH Receptor Antagonist Report Assessment

- Current Treatment Practices

- GnRH Receptor Antagonist Market Unmet Needs

- GnRH Receptor Antagonist Pipeline Product Profiles

- GnRH Receptor Antagonist Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

- What was the GnRH receptor antagonist total market size, the market size by therapies, market share (%) distribution, and what would it look like in 2034? What are the contributing factors for this growth?

- Which drug is going to be the largest contributor in 2034?

- Which is the most lucrative market for GnRH receptor antagonists?

- Which drug type segment accounts for the maximum GnRH receptor antagonist sales?

- What are the pricing variations among different geographies for approved therapies?

- How has the reimbursement landscape for GnRH receptor antagonists evolved since the first one was approved? Do patients have any access issues that are driven by reimbursement decisions?

- What are the risks, burdens, and unmet needs of treatment for tumors harboring GnRH receptor antagonists? What will be the growth opportunities across the 7MM for the patient population of GnRH receptor antagonists?

- What are the key factors hampering the growth of the GnRH receptor antagonist market?

- What key designations have been granted to the therapies for GnRH receptor antagonist therapies?

- What is the cost burden of approved therapies on the patient?

- Patient acceptability in terms of preferred therapy options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to buy

- The report will help develop business strategies by understanding the latest trends and changing dynamics driving the GnRH receptor antagonist market.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of indication-wise current and emerging therapies under the conjoint analysis section to provide visibility around leading indications.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.