Human Immunodeficiency Virus Type-1 Market

Key Highlights

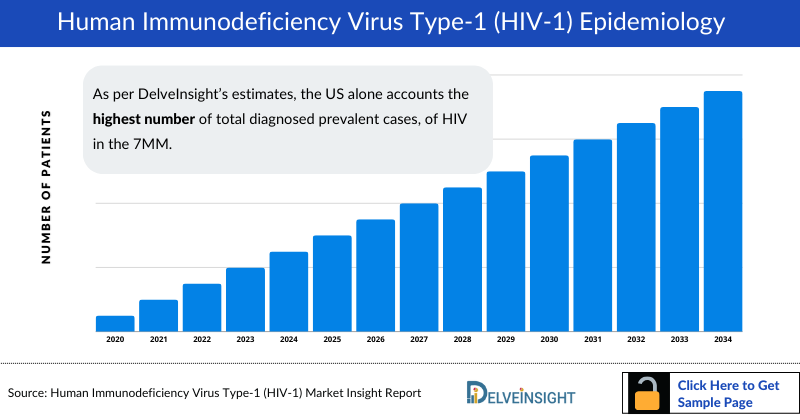

- HIV (Human Immunodeficiency Virus) targets and destroys CD4 cells essential for immune function. Without treatment, this leads to a gradual weakening of the immune system, potentially advancing to acquired immunodeficiency syndrome (AIDS). In 2023, the prevalent population of HIV in the 7MM is estimated to be around 2 million.

- In 2023, the US represented the largest share of the diagnosed HIV population within the 7MM, accounting for 62% of the total cases.

- HIV-1 is a significant health issue in the United States, and its prevalence has been increasing over the past few decades. According to DelveInsight estimates, among the 7MM, the US has most number of cases of HIV-1 as compared to HIV-2, accounting for around 1,039 thousand cases of HIV-1 alone whereas HIV-2 accounted for nearly 104 cases only in 2023.

- In 2023, the US reported diagnosed prevalence of HIV-1 by different routes of transmission where, ~416 thousand HIV-1 cases from male-to-male sexual contact, ~312 thousand from heterosexual contact, ~249 thousand from injecting drug use, and ~62 thousand from other sources. Male-to-male sexual contact remains the most common transmission route.

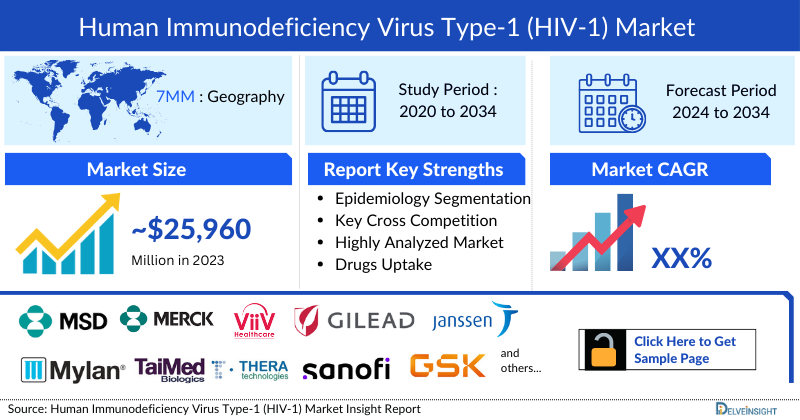

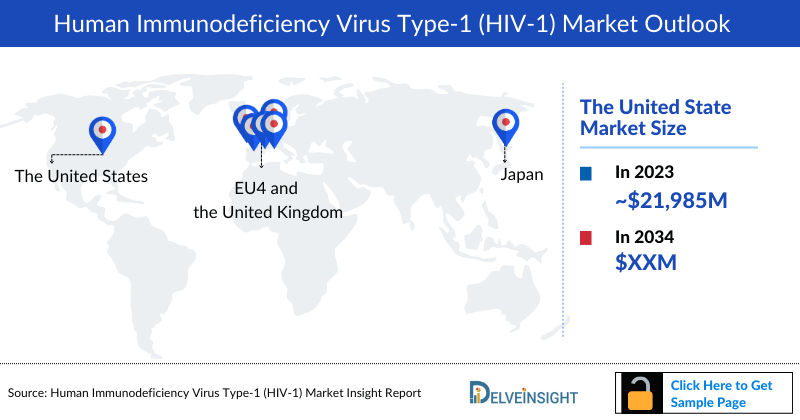

- In 2023, the market size of HIV-1 was highest in the US among the 7MM, accounting for approximately USD 21,985 million which is further expected to increase at a significant CAGR of 4.58% by 2034.

- The key market drivers for the HIV market include increasing awareness, improved access to diagnostics and treatments, and advances in antiretroviral therapies, which enhance disease management and patient outcomes. Conversely, several market barriers are present that comprises of high treatment costs, disparities in healthcare access, and stigma associated with HIV, which can deter testing and adherence.

- In June 2024, the PURPOSE 1 trial reported a groundbreaking result; a Phase III HIV PrEP drug candidate, Gilead Sciences’ lenacapavir, showed zero infections. This trial, evaluated lenacapavir administered subcutaneously every six months to cisgender women and adolescent girls. Already FDA-approved under the brand SUNLENCA for challenging HIV cases, lenacapavir’s impressive PrEP results highlight its potential as a highly effective preventive measure.

- Notably, Merck Sharp & Dohme Corp has an advancing robust HIV pipeline, including the Phase III combination of islatravir and doravirine (MK-8591A). In Phase II, the company is working on islatravir with MK-8507 (MK-8591B) and islatravir with lenacapavir (MK-8591D). Additionally, MK-8527 is in Phase II for HIV-1 prevention. These efforts reflect Merck Sharp & Dohme's dedication to advancing both treatment and prevention options for HIV.

- The total market size of HIV-1 is anticipated to upsurge during the forecast period due to the expected entry of emerging therapies that includes Lenacapavir, islatravir + doravirine (MK-8591A), islatravir + MK-8507 (MK-8591B), and others.

DelveInsight’s “HIV-1– Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of the HIV-1, historical and forecasted epidemiology as well as the HIV-1 market trends in the United States, EU4 and the UK (Germany, France, Italy, Spain) and the United Kingdom, and Japan.

The HIV-1 market report provides current treatment practices, emerging drugs, and market share of the individual therapies, current and forecasted 7MM HIV-1 market size from 2020 to 2034. The Report also covers current HIV-1 treatment practice, market drivers, market barriers, SWOT analysis, reimbursement and market access, and unmet medical needs to curate the best of the opportunities and assess the underlying potential of the market.

Geography Covered

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2020–2034

Human Immunodeficiency Virus Type-1 (HIV-1) Overview and Treatment Algorithm

HIV is a retrovirus that targets immune cells, specifically T lymphocytes with CD4 receptors, impairing the body’s ability to combat infections and diseases. Unlike most viruses that use DNA, HIV relies on RNA. It is transmitted through exposure to specific bodily fluids from an infected individual, typically via unprotected sexual activity or shared injection equipment. Untreated HIV can progress to AIDS (acquired immunodeficiency syndrome).

There are two main types of HIV: HIV-1 and HIV-2, with HIV-1 being the more prevalent, accounting for over 90% of cases. HIV-1 is categorized into groups M, N, O, and P, with group M being the most widespread and subdivided into nine subtypes. HIV-1 is globally distributed and more readily transmitted than HIV-2.

Human Immunodeficiency Virus Type-1 (HIV-1) Diagnosis

HIV-1 diagnosis can be performed through various methods, including antibody tests, antigen/antibody tests, and Nucleic Acid Tests (NATs). During treatment, additional tests such as viral load measurement, CD4 count, and drug resistance testing are used. Typically, HIV infection is first identified with screening tests that detect antibodies in blood or oral fluid, followed by confirmatory tests. Enzyme immunoassays (EIAs) are the most frequently employed methods for antibody testing.

Unmet needs in HIV-1 diagnosis include the need for more sensitive and early detection methods to identify infections before the body produces detectable antibodies or antigens. Improved accessibility to testing in underserved or remote areas is crucial for early intervention. Cost-effective diagnostic solutions are needed to broaden access and reduce healthcare expenses. Enhanced accuracy in tests is necessary to reduce false negatives and positives, ensuring reliable results. Additionally, integrating diagnostic testing into routine healthcare practices can help increase testing rates and improve overall management of the disease.

Further details related to diagnosis are provided in the report…

Human Immunodeficiency Virus Type-1 (HIV-1) Treatment

The treatment landscape for HIV-1 presents several unmet needs that demand innovative solutions. Current antiretroviral therapies (ART) have significantly improved the management of HIV-1, yet there remains a need for more effective and tolerable treatment options. Advances in HIV-1 treatment have made significant strides, offering effective management and improved patient outcomes. Innovations such as long-acting formulations and reduced dosing frequency have further enhanced convenience and adherence

The treatment of HIV-1 faces several critical challenges. There is a need for more effective and tolerable antiretroviral therapies to improve patient adherence and minimize long-term side effects. Treatment options must also address drug resistance and complex health conditions. Additionally, reducing the high cost of current treatments is crucial for broader access, particularly in resource-limited settings. Research into a potential cure and long-term remission strategies remains essential for ultimate disease eradication.

Further details related to treatment are provided in the report…

Human Immunodeficiency Virus Type-1 (HIV-1) Epidemiology

As the market is derived using the patient-based model, the HIV-1 epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Prevalent Cases of HIV, Diagnosed Prevalent Cases of HIV, Type-specific Diagnosed Prevalent Cases of HIV, Gender-specific Diagnosed Prevalent Cases of HIV-1, Diagnosed Prevalent Cases of HIV-1 by route of transmission, and Age-specific Diagnosed Prevalent Cases of HIV-1 in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan, from 2020 to 2034.

- The total prevalent cases of HIV in the US comprised approximately 1,267 thousand in 2023 and are projected to increase during the forecast period.

- As per DelveInsight’s estimates, the US alone accounts the highest number of total diagnosed prevalent cases, of HIV in the 7MM, followed by EU4 and the UK and Japan, contributing to 36% and 2% of all HIV cases respectively.

- The diagnosed prevalent cases HIV were further divided into two broad categories, HIV-1 and HIV-2. There were total ~28,837 cases of HIV-1 and ~192 cases of HIV-2 in 2023 in Japan.

- In 2023, the EU4 and the UK reported a total of 610 thousand HIV-1 diagnosed prevalent cases where, nearly 444 thousand cases accounted for males and approximate 166 thousand cases attributed to females. This data highlights a significant distribution difference across genders within the specified regions.

- In Japan, 2023 saw a total of approximate 29 thousand HIV-1 cases distributed across age groups. The highest prevalence of cases was reported in the 30─39 year’s age group, with approximate 9,025 cases, while the smallest prevalence was seen in the under 13 age group, with nearly 149 cases.

- There are a plethora of modes of transmission of HIV1, among which the most common types of routes are male-to-male sexual contact which accounts for approximately 13,275 cases, Heterosexual contact (7,435), Injecting drug users (IDUs) (3,504), and other routes with 4,624 cases in 2023 in Japan.

- The age‐specific data in the US revealed that the highest number of HIV-1 people affected with was found in the age group of 30─39 years followed by patients of age group 40─49 years (second-highest). In comparison, they are relatively less common in 13─19 years and <13 years.

- In EU4 and the UK, France reported the highest diagnosed prevalent cases of HIV-1 with 159 thousand cases in 2023, followed by Spain (133 thousand), Italy (125 thousand), the UK (103 thousand), and Germany (89 thousand) in 2020.

Human Immunodeficiency Virus Type-1 (HIV-1) Recent Developments

- In February 2025, Gilead Sciences announced that the FDA accepted its New Drug Application (NDA) for lenacapavir, a twice-yearly injectable HIV-1 capsid inhibitor, for use as pre-exposure prophylaxis (PrEP) to prevent HIV.

- In February 2025, Theratechnologies resumed the distribution of EGRIFTA SV® after receiving FDA clearance to release two new batches. This ensures continued availability of the treatment for people with HIV in the United States, with the FDA's review of the Prior Approval Supplement expected to conclude by April 18, 2025.

- In February 2025, Lupin received tentative FDA approval under the U.S. President’s Emergency Plan for AIDS Relief for its abacavir, dolutegravir, and lamivudine tablets for oral suspension (60 mg/5 mg/30 mg), a generic version of ViiV Healthcare’s Triumeq.

- In December 2024, Theratechnologies Inc. a biopharmaceutical company specializing in innovative therapies, announced the submission of a Prior Approval Supplement (PAS) to the U.S. FDA. The submission outlines changes to the manufacturing environment of the facility producing EGRIFTA SV®.

- In October 2024, ViiV Healthcare has revealed new real-world evidence and implementation data demonstrating the effectiveness, adherence, and quality-of-life benefits of Apretude (long-acting cabotegravir (CAB LA)) for HIV pre-exposure prophylaxis (PrEP). This data will be presented at IDWeek 2024, which takes place in Los Angeles, California, from October 16 to 19.

Human Immunodeficiency Virus Type-1 (HIV-1) Drug Chapters

The drug chapter segment of the HIV-1 report encloses a detailed analysis of HIV-1 off-label drugs and late-stage (Phase-III and Phase-II) pipeline drugs. It also helps to understand the HIV-1 clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Drugs

CABENUVA: ViiV Healthcare

CABENUVA is a once-monthly injectable regimen for treating HIV-1 in adults who are virologically suppressed with no history of treatment failure or resistance to cabotegravir or rilpivirine. Administered as two intramuscular injections, CABENUVA combines cabotegravir, an integrase strand transfer inhibitor, with rilpivirine, a non-nucleoside reverse transcriptase inhibitor. This regimen offers an alternative to daily oral medications. Cabotegravir and rilpivirine are produced by ViiV Healthcare and Janssen, respectively, and are available in various formulations. Prior to starting CABENUVA, patients should complete a one-month oral lead-in with cabotegravir and rilpivirine to assess tolerability.

In January 2021, the US FDA approved CABENUVA, a two-drug combination for HIV-1 treatment in adults. The European Medicines Agency (EMA) authorized CABENUVA in December 2020, with ViiV Healthcare's cabotegravir and Janssen's rilpivirine marketed under the names Vocabria and Rekambys, respectively. The patents for CABENUVA are anticipated to be expired by April 2025.

GENVOYA: Gilead Sciences

GENVOYA is a four-drug combination for HIV-1 treatment, including elvitegravir (an integrase strand transfer inhibitor), cobicistat (a CYP3A inhibitor), emtricitabine, and tenofovir alafenamide (TAF), both nucleoside reverse transcriptase inhibitors (NRTIs). It is prescribed for adults and pediatric patients over 25 kg who are either treatment-naive or virologically suppressed on a stable regimen.

GENVOYA is taken as one oral tablet daily with food. Elvitegravir blocks HIV-1 integrase, preventing viral DNA integration. Cobicistat enhances elvitegravir's efficacy by inhibiting CYP3A metabolism, while emtricitabine and TAF inhibit HIV-1 reverse transcriptase and block viral DNA replication.

In November 2015, GENVOYA received marketing authorization from the European Commission for use across the EU, and the US FDA approved it as a complete HIV-1 treatment regimen for adults and children aged 12 and older. In 2017, the FDA updated GENVOYA’s labeling to include new safety and efficacy data from a study involving virologically-suppressed children aged 6 to <12 years. Japan Tobacco secured approval in May 2019 for an additional dosage and administration of Genvoya for pediatric HIV-1 treatment. The patents for GENVOYA are expected to be expire from 2026 to 2032, making it clinically available as strong market player for longer period of time.

Emerging Drugs

MK-8591A (Islatravir/doravirine; DOR/ISL): Merck & Co., Inc

Merck Sharp & Dohme Corp. is assessing MK-8591A, a combination of the investigational islatravir and doravirine, for HIV-1 treatment. In October 2020, Week 96 data from a Phase IIb trial showed that MK-8591A maintained virologic suppression comparable to Delstrigo, with consistent results from Week 48. The study reported low rates of protocol-defined virologic failure and no resistance cases in either treatment group. MK-8591A is now under evaluation in a Phase III trial for both treatment and prevention of HIV.

As of December 2021, MK-8591A is under a partial clinical hold by the FDA due to concerns about higher doses not yet tested in current trials. Despite this, islatravir, developed in collaboration with Yamasa Corporation, remains a key focus in the pipeline, demonstrating ongoing commitment to its development.

Lenacapavir (GS-6207): Gilead Sciences

Lenacapavir is a novel, long-acting HIV-1 capsid inhibitor in development, aimed at treating and preventing HIV-1. Unlike current antivirals that target a single stage of viral replication, lenacapavir disrupts multiple stages by targeting the HIV capsid—a protein that protects the virus's genetic material. This multi-stage action, coupled with a lack of cross-resistance to other drug classes, offers a new approach in HIV therapy. By interfering with capsid stability and host factor binding, lenacapavir potentially prevents the virus from becoming infectious and accessing uninfected cells. Lenacapavir is currently in Phase III clinical investigation and holds promise to become a key market player upon their approval.

In May 2019, the FDA awarded Breakthrough Therapy Designation to lenacapavir for treating HIV-1 in heavily treatment-experienced patients with multi-drug resistance, to be used alongside other antiretroviral drugs.

In March 2024, Gilead Sciences and Merck revealed Phase II data demonstrating that their investigational oral combination regimen of islatravir and lenacapavir achieved sustained viral suppression at Week 24. This promising regimen, presented at the 31st Conference on Retroviruses and Opportunistic Infections (CROI), could potentially become the first oral weekly HIV treatment. The results underscore the regimen’s potential to address significant unmet needs in long-acting HIV therapy.

| Drug | MoA | RoA | Company | Phase |

| islatravir + doravirine (MK-8591A) | NRTI and NNRTI: block reverse transcriptase | Oral | Merck Sharp & Dohme Corp | III |

| Lenacapavir | long-acting HIV-1 capsid inhibitor | Oral/SC | Gilead Sciences | III |

| XXX | XXX | XXX | XXX | II |

Note: Detailed emerging therapies assessment will be provided in the final report of HIV-1

Human Immunodeficiency Virus Type-1 (HIV-1) Market Outlook

The treatment landscape for HIV-1 has expanded significantly, incorporating a range of pharmacological therapies to manage the virus effectively. The primary approach involves antiretroviral therapy (ART), encompassing several drug classes. Nucleoside Reverse Transcriptase Inhibitors (NRTIs), such as tenofovir disoproxil fumarate (TDF) and emtricitabine (FTC), disrupt viral replication by inhibiting reverse transcriptase. Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs) like doravirine and rilpivirine interfere directly with reverse transcriptase activity. Integrase Strand Transfer Inhibitors (INSTIs), including dolutegravir and cabotegravir, block the integration of viral DNA into host cells. However protease Inhibitors (PIs), such as darunavir, prevent the maturation of new viral particles. Entry Inhibitors, such as maraviroc, block the virus's entry into cells. Beyond these, Pre-exposure prophylaxis (PrEP) drugs like Truvada and Descovy are used to prevent HIV infection in high-risk individuals, while Post-exposure prophylaxis (PEP) provides short-term treatment after potential exposure. Off-label and experimental therapies, including novel combinations like lenacapavir and islatravir, continue to be explored, aiming to enhance efficacy and address drug resistance. The treatment paradigm is increasingly personalized, focusing on achieving viral suppression and improving patient outcomes.

- The launch of emerging therapies, such as islatravir + doravirine (MK-8591A), Lenacapavir, and others are expected to impact the market positively. The approval of these therapies could significantly impact market dynamics, although their success rates remain uncertain.

- The market size of HIV-1 in the 7MM was nearly USD 25,960 million in 2023, which is further anticipated to increase during the forecast period with a significant compound annual growth rate (CAGR) of 4.6%.

- The EU4 and the UK accounted for the approximately 14% of the 7MM market size, amounting the value of USD ~3,727 million market size of HIV-1 approximately in 2023.

- Among the EU countries, France had the highest market size with nearly USD 964 million in 2023, while the UK had the lowest market size for HIV-1 with about USD 680 million in 2023.

Human Immunodeficiency Virus Type-1 (HIV-1) Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to launch in the market during 2020–2034. For example, MK-8591A in the US is expected to be launched by 2025 with a peak share of 6.0%. Lenacapavir is anticipated to take 6 years to peak with a medium-fast uptake.

Further detailed analysis of emerging therapies drug uptake in the report…

Human Immunodeficiency Virus Type-1 (HIV-1) Pipeline Development Activities

The report provides insights into different therapeutic candidates in Phase III, Phase II, and Phase I stage. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for HIV-1 emerging therapies.

KOL Views

To keep up with current market trends, we take KOLs and SMEs’ opinions working in the domain through primary research to fill the data gaps and validate the secondary research. Industry Experts were contacted for insights on HIV-1 evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including KOL from Morehouse School of Medicine, USA; British Association for Sexual Health and HIV, UK; University Hospital, Santiago de Compostela, Spain; Japan Foundation for AIDS Prevention, Japan; Joint United Nations Programme on HIV/AIDS, and others.

Delveinsight’s analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Their opinion helps understand and validate current and emerging therapies, treatment patterns, or HIV-1 market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple approved and emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy.

Further, the therapies’ safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed, and it sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

The high cost of therapies for the treatment is a major factor restraining the growth of the global drug market. Because of the high cost, the economic burden is increasing, leading the patient to escape from proper treatment.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of approved therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report

- The report covers a segment of key events, an executive summary, descriptive overview of HIV-1, explaining its causes, signs and symptoms, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the HIV-1 market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind the approach is included in the report covering the 7MM drug outreach.

- The report provides an edge while developing business strategies, by understanding trends, through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM HIV-1 market.

Human Immunodeficiency Virus Type-1 (HIV-1) Report Insights

- Patient Population

- Therapeutic Approaches

- HIV-1 Pipeline Analysis

- HIV-1 Market Size and Trends

- Existing and Future Market Opportunity

Human Immunodeficiency Virus Type-1 (HIV-1) Report Key Strengths

- 11 years Forecast

- The 7MM Coverage

- HIV-1 Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Human Immunodeficiency Virus Type-1 (HIV-1) Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Market Insights

- What was the HIV-1 market share (%) distribution in 2020 and how it would look like in 2034?

- What would be the HIV-1 total market size as well as market size by therapies across the 7MM during the forecast period (2024–2034)?

- What are the key findings pertaining to the market across the 7MM and which country will have the largest HIV-1 market size during the forecast period (2024–2034)?

- At what CAGR, the HIV-1 market is expected to grow at the 7MM level during the forecast period (2024–2034)?

- What would be the HIV-1 market outlook across the 7MM during the forecast period (2024–2034)?

- What would be the HIV-1 market growth till 2034 and what will be the resultant market size in the year 2034?

- How would the market drivers, barriers, and future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What is the disease risk, burden, and unmet needs of HIV-1?

- What is the historical HIV-1 patient population in the United States, EU5 (Germany, France, Italy, Spain, and the UK), and Japan?

- What would be the forecasted patient population of HIV-1 at the 7MM level?

- What will be the growth opportunities across the 7MM with respect to the patient population pertaining to HIV-1?

- Out of the above-mentioned countries, which country would have the highest prevalent population of HIV-1 during the forecast period (2024–2034)?

- At what CAGR the population is expected to grow across the 7MM during the forecast period (2024–2034)?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options for the treatment of HIV-1 along with the approved therapy?

- What are the current treatment guidelines for the treatment of HIV-1 in the US, Europe, And Japan?

- What are the HIV-1 marketed drugs and their MOA, regulatory milestones, product development activities, advantages, disadvantages, safety, and efficacy, etc.?

- How many companies are developing therapies for the treatment of HIV-1?

- How many emerging therapies are in the mid-stage and late stages of development for the treatment of HIV-1?

- What are the key collaborations (Industry–Industry, Industry-Academia), Mergers and acquisitions, licensing activities related to the HIV-1 therapies?

- What are the recent therapies, targets, mechanisms of action and technologies developed to overcome the limitation of existing therapies?

- What are the clinical studies going on for HIV-1 and their status?

- What are the key designations that have been granted for the emerging therapies for HIV-1?

- What are the 7MM historical and forecasted market of HIV-1?

Reasons to Buy

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the HIV-1 Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- To understand the existing market opportunity in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan.

- Identification of strong upcoming players in the market will help in devising strategies that will help in getting ahead of competitors.

- Detailed analysis and potential of current and emerging therapies under the conjoint analysis section to provide visibility around leading emerging drugs.

- Highlights of Access and Reimbursement policies of approved therapies, barriers to accessibility of off-label expensive therapies, and patient assistance programs.

- To understand the perspective of Key Opinion Leaders around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in future.

- Detailed insights on the unmet need of the existing market so that the upcoming players can strengthen their development and launch strategy.