Marginal Zone Lymphoma Market

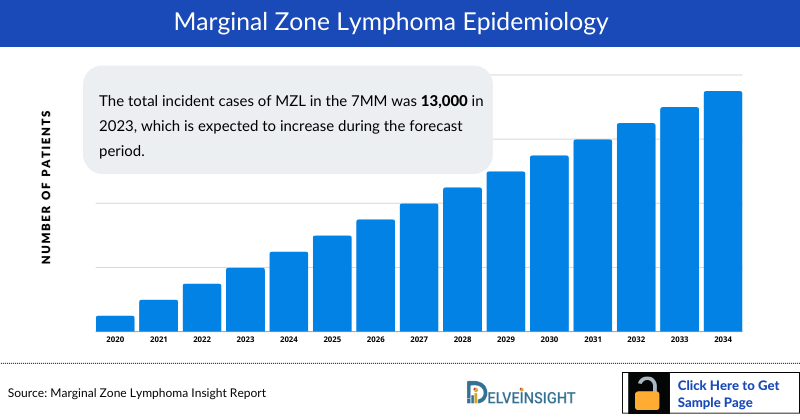

- The total incident cases of MZL in the 7MM was 13,000 in 2023, which is expected to increase during the forecast period.

- Mucosa-assisted lymphoid tissue (MALT) lymphoma is the most common type of MZL.

- Patients with early-stage MALT lymphoma with no underlying infectious etiology, or those for whom antibiotic therapy has failed, can be effectively managed with external beam radiotherapy.

- With the lifestyle change, the patient pool of MZL has increased drastically. MZL has been associated with immune system dysregulation as a result of sustained immune stimulation from chronic infections or autoimmune disorders.

- The first line treatment comprises of only the supportive therapies which include rituximab monotherapy, R-CHOP/R-CVP, rituximab plus bendamustine, cytotoxic chemotherapy, antiviral therapy for hepatitis C infection, Antibiotic/PPIs.

- In the domain of indolent NHL, a subtype known as MZL is gaining attention. Both YESCARTA and BREYANZI are currently undergoing trials in MZL, mirroring the trials conducted in follicular lymphoma.

- BREYANZI has obtained approval for the treatment of most lines of DLBCL within the United States, with the exception of the first line. Looking ahead, it is anticipated that BREYANZI will further extend its reach into other subtypes of NHL such as MZL. Upon approval of both CAR-T therapies in MZL, the treatment landscape for this condition is expected to undergo significant transformation.

- The antibody-drug conjugate ZYNLONTA (loncastuximab tesirine-lpyl) elicited a high response rate with acceptable tolerability in patients with relapsed or refractory marginal zone lymphoma in the Phase II trial.

- In the landscape of emerging therapies for MZL, Tafasitamab, YESCARTA, BREYANZI, and other novel agents are anticipated to launch within the forecast period. Tafasitamab, a monoclonal antibody targeting CD19, has shown promise in combination with lenalidomide for relapsed or refractory diffuse large B-cell lymphoma (DLBCL), and its potential efficacy in MZL is being explored.

Request for Sample Page @ Marginal Zone Lymphoma Market Report

DelveInsight’s “Marginal Zone Lymphoma Market Insights, Epidemiology, and Market Forecast – 2034” report delivers an in-depth understanding of MZL, historical and forecasted epidemiology as well as MZL market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The MZL market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted the 7MM MZL market size from 2020 to 2034. The report also covers current MZL treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market’s potential.

| Study Period | 2020 to 2034 |

| Forecast Period | 2024-2034 |

| Geographies Covered | The US, EU4 (Germany, France, Italy, and Spain) and UK, Japan |

| Marginal Zone Lymphoma Market |

|

| Marginal Zone Lymphomas Market Size | |

| Marginal Zone Lymphoma Companies | Incyte Corporation, HUTCHMED, InnoCare Pharma, ENTEROME SA, Beijing Mabworks Biotech Co., Ltd., ADC Therapeutics, MEI Pharma, Inc., Genentech, Inc., Incyte Corporation, Novartis, AstraZeneca, Kite Pharma, Roche, Oncternal Therapeutics, Inc, Celgene, IGM Biosciences, Inc., Loxo Oncology, Genmab, ArQule, Sound Biologics, Adicet Bio, Inc, Celldex Therapeutics, TG Therapeutics, Inc., VelosBio Inc., Newave Pharmaceutical Inc, Boryung Pharmaceutical Co., Ltd, Cellectar Biosciences, Inc., Bio-Path Holdings, Inc., Nurix Therapeutics, Inc., and others. |

| Marginal Zone Lymphoma Epidemiology Segmentation |

|

Marginal Zone Lymphoma (MZL) Disease Understanding and Treatment Algorithm

Marginal Zone Lymphoma Overview

Marginal zone lymphoma, the second most prevalent type of slow-growing non-Hodgkin’s lymphoma, encompasses three categories: extranodal MZL (EMZL), splenic MZL, and nodal MZL. EMZL can emerge in various extranodal areas, notably in organs lacking lymphoid tissue like the stomach, intestines, thyroid, lungs, and skin. The stomach is frequently affected, with strong evidence linking H. pylori to gastric EMZL. Splenic MZL primarily originates from marginal zone memory B-cells found in the spleen, splenic hilar lymph nodes, bone marrow, and peripheral blood. While the exact cause of splenic MZL is not entirely clear, it likely involves ongoing stimulation of the BCR signalling pathway, leading to increased proliferation and survival of malignant B cells. Nodal MZL, the least common subtype, also likely results from persistent BCR signalling, fostering the proliferation and survival of malignant B cells, although the precise molecular mechanisms are not fully elucidated.

Marginal Zone Lymphoma Diagnosis

Diagnosing marginal zone lymphoma typically commences with a thorough physical examination, during which the physician assesses lymph nodes and other areas for any signs of swelling. They'll also inquire about your medical history to gain insight into your overall health and potential risk factors. If lymphoma is suspected, a series of tests may be recommended, including a Complete Blood Count (CBC), blood tests, bone marrow aspiration, and imaging tests like computed tomography (CT) scans, which can reveal the presence of cancer and its potential spread. In some cases, a surgical biopsy may be necessary to extract either the spleen or an enlarged lymph node (or a portion of it) suspected of harbouring cancer cells.

Further details related to diagnosis are provided in the report…

Marginal Zone Lymphoma Treatment

Marginal zone lymphoma grows very slowly. People with this condition may not need immediate treatment. Healthcare providers instead may monitor people’s health until they determine that treatment is necessary. This is “watchful waiting” or active surveillance. Treatments for MZL vary depending on the subtype but may include: antibiotics to treat bacterial infections, specifically H. pylori, chemotherapy, and radiation therapy. In the rare cases of life or organ-threatening MZL, high-dose corticosteroids (for example, dexamethasone 40 mg daily) can be used to temporize matters before starting more definitive (Immuno) chemotherapy or radiotherapy. Treatment of indolent lymphoma should be individualized according to the disease subtype, presentation, comorbid conditions, and patient preferences. When possible, the goal of therapy is to cure the disease and/or prolong survival. In all cases, the goal should be to improve quality of life; care must be taken to avoid overtreatment.

Further details related to treatment are provided in the report…

Marginal Zone Lymphoma (MZL) Epidemiology

The Marginal Zone Lymphoma epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by Total Incident Cases of Non-Hodgkin lymphoma (NHL), Incident Cases of MZL, Gender-Specific Incident Cases of MZL, Subtype-Specific Incident Cases of MZL, and Stage-Specific Incident Cases of MZL in the 7MM covering the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2020 to 2034.

- Among the 7MM, the US accounted for the highest incidence cases of MZL in 2023, with more than ~8,000 cases; these cases are expected to increase during the forecast period.

- Among gender-specific incidence cases of MZL, males stand out as major contributors.

- MALT lymphoma has the highest incident population with ~70% cases followed by SMZL and NMZL, in 2023 in the US.

- Among the stage-specific incident cases of MZL, Stage III-IV has the highest incident population followed by Stage I and Stage II in 2023 in the US.

Marginal Zone Lymphoma (MZL) Drug Chapters

The drug chapter segment of the MZL report encloses a detailed analysis of the marketed and late-stage (Phase III, and II) pipeline drugs. The marketed drugs segment encloses REVLIMID (Bristol-Myers Squibb), UKONIQ (TG Therapeutics), etc., Furthermore, the current key players for the upcoming emerging drugs are Tafasitamab (Incyte Corporation), YESCARTA (Gilead Sciences), and others. The drug chapter also helps understand the MZL clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, and the latest news and press releases.

Marginal Zone Lymphoma Marketed Drugs

REVLIMID (lenalidomide): Bristol-Myers Squibb

REVLIMID is an immune-modulating therapy with proven anti-myeloma effects. The drug is an oral therapy that was shown to work in 3 ways in animal models and in vitro, it helps the immune system recognize and destroy myeloma cells. Targets and kills myeloma cells and helps prevent new myeloma cell growth by starving them of blood. In May 2019, the FDA approved REVLIMID in combination with a rituximab product for previously treated follicular lymphoma (FL) and previously treated MZL. Moreover, in December 2019, the European Commission Approval for REVLIMID in combination with rituximab for the treatment of adult patients with previously treated MZL.

UKONIQ (umbralisib): TG Therapeutics

UKONIQ is the first and only oral inhibitor of phosphoinositide 3 kinase (PI3K) delta and casein kinase 1 (CK1) epsilon. PI3K-delta is known to play an important role in supporting cell proliferation and survival, cell differentiation, intercellular trafficking, and immunity and is expressed in both normal and malignant B-cells. CK1-epsilon is a regulator of oncoprotein translation and has been implicated in the pathogenesis of cancer cells, including lymphoid malignancies. In February 2021, the US FDA granted accelerated approval to umbralisib, a kinase inhibitor including PI3K-delta and casein kinase CK1-epsilon, for adult patients with relapsed or refractory marginal zone lymphoma (MZL) who have received at least one prior anti-CD20-based regimen.

| Table 1: Comparison of Marketed Drugs for Marginal Zone Lymphoma (MZL) | |||||

| Drug name | Company name | Indication | MoA | RoA | Approval |

| REVLIMID | Bristol-Myers Squibb | Previously-treated MZL | Immunomodulators | Oral | US: May 2019 |

| UKONIQ | TG Therapeutics | Relapsed or refractory MZL | Phosphatidylinositol 3 kinase delta inhibitors | Oral | US: February 2021 |

Note: Detailed list will be provided in the final report...

Marginal Zone Lymphoma Emerging Drugs

Tafasitamab: Incyte Corporation

Tafasitamab is a humanized Fc-modified CD19-targeting immunotherapy. In 2010, MorphoSys licensed exclusive worldwide rights to develop and commercialize tafasitamab from Xencor, Inc. Tafasitamab incorporates an XmAb-engineered Fc domain, which mediates B-cell lysis through apoptosis and immune effector mechanism including Antibody-Dependent Cell-Mediated Cytotoxicity (ADCC) and Antibody-Dependent Cellular Phagocytosis (ADCP). Currently, the drug is being investigated in Phase III for marginal zone lymphoma.

YESCARTA (axicabtagene ciloleucel): Gilead Sciences

YESCARTA, a CD19-directed genetically modified autologous T-cell immunotherapy, binds to CD19-expressing cancer cells and normal B-cells. In September 2020, Gilead Sciences subsidiary, Kite submitted a supplemental Biologics License Application (sBLA) to the FDA for YESCARTA for the treatment of r/r FL and MZL after two or more prior lines of systemic therapy. ZUMA-5 is a Phase II, multi-center, single-arm study of YESCARTA in patients with iNHL including follicular lymphoma (FL) and marginal zone lymphoma (MZL).

BREYANZI (lisocabtagene maraleucel): Bristol Myers Squibb

BREYANZI is an investigational CAR-T-cell therapy designed to target CD19, a surface glycoprotein expressed during normal B-cell development. Liso-cel CAR-T-cells aim to target and kill non-Hodgkin lymphoma cells through a CAR construct that includes an anti-CD19 single-chain variable fragment (scFv) targeting domain for antigen specificity, a transmembrane domain, a 4-1BB costimulatory domain hypothesized to increase T-cell proliferation and persistence, and a CD3-zeta T-cell activation domain. Currently, the drug is investigated in Phase II for the treatment of relapsed/refractory marginal zone lymphoma.

Note: Detailed emerging therapies assessment will be provided in the final report...

| Table 2: Comparison of Emerging Drugs for Marginal Zone Lymphoma (MZL) | ||||

| Product | Company | Mechanism of Action | Phase | Molecule Type |

| Tafasitamab | Incyte Corporation | CD19-targeting immunotherapy | III | Monoclonal antibodies |

| YESCARTA | Gilead Sciences | CD19-directed genetically modified autologous T-cell immunotherapy | II | Autologous CAR-T-cell therapy |

| BREYANZI | Bristol Myers Squibb | CD19-directed genetically modified autologous T-cell immunotherapy | II | Autologous CAR-T-cell therapy |

Note: Detailed list will be provided in the final report...

Drug Class Insights

In the realm of drug classes for MZL, several categories stand out. Monoclonal antibodies (mAbs) like rituximab target specific proteins in cancer cells, aiding in their destruction. Immunomodulatory agents such as lenalidomide enhance immune responses against cancer cells. Emerging therapies like chimeric antigen receptor (CAR) T-cell therapies show promise by harnessing engineered immune cells to target cancer cells. Traditional chemotherapy agents remain a part of treatment regimens, particularly in aggressive disease or when other therapies fail. Understanding these drug classes is essential for tailoring effective treatment strategies for MZL patients.

Discover the latest advancements with Marginal Zone Lymphoma Pipeline Insight, 2024. Stay ahead with cutting-edge research and innovations today!

Marginal Zone Lymphoma Market Outlook

Treatment selection for a patient with Marginal Zone Lymphoma depends on the type, stage, and location of the disease. Due to the slow nature of progression, most patients tend to present before developing significant complications. In the rare cases of life or organ-threatening MZL, high-dose corticosteroids (for example, dexamethasone 40 mg daily) can be used to temporize matters before starting more definitive (Immuno) chemotherapy or radiotherapy. Treatment of indolent lymphoma should be individualized according to the disease subtype, presentation, comorbid conditions, and patient preferences. When possible, the goal of therapy is to cure the disease and/or prolong survival. In all cases, the goal should be to improve quality of life; care must be taken to avoid overtreatment.

Patients with the relapsing disease after at least one CD20-based therapy have several recently approved chemotherapy-free options including immunomodulatory agents, such as lenalidomide and rituximab (FDA-approved in MZL and FL). Phosphoinositide 3-kinase (PI3K) inhibitors have shown excellent activity in iNHL, specifically in MZL, with breakthrough designation status for copanlisib and umbralisib, allowing off-label use of this class of agents in clinical practice.

Marginal Zone Lymphoma (MZL) pipeline possesses potential drugs in late and mid-stage developments to be launched in the near future. In the emerging therapies, Tafasitamab YESCARTA, BREYANZI, and others are expected to launch in the forecast period.

- The United States contributes the highest market size in the 7MM.

- Among the EU4 and the UK, Germany had the highest market size in 2023, while Spain had the lowest market size.

- YESCARTA and BREYANZI are emerging as potential treatments for MZL, with BREYANZI expected to secure approval for use in third-line (3L+) MZL cases by 2026.

- The expected launch of potential therapies may increase the market size in the coming years, assisted by an increase in the incident population of MZL. The market is expected to witness a significant positive shift owing to the positive outcomes of several products during the developmental stage by key players such as Incyte Corporation, Gilead Sciences, Bristol Myers Squibb, and others.

Marginal Zone Lymphoma Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2024–2034, which depends on the competitive landscape, safety, efficacy data, and order of entry. It is important to understand that the key players evaluating their novel therapies in the pivotal and confirmatory trials should remain vigilant when selecting appropriate comparators to stand the greatest chance of a positive opinion from regulatory bodies, leading to approval, smooth launch, and rapid uptake.

YESCARTA (axicabtagene ciloleucel), a chimeric antigen receptor (CAR) T-cell therapy, has shown promising results in the treatment of relapsed or refractory large B-cell lymphoma. However, its use in MZL remains investigational. The drug is expected to enter the US market by 2031, followed by the EU4 and the UK, and Japan.

Further detailed analysis of emerging therapies drug uptake in the report...

Marginal Zone Lymphoma Activities

The report provides insights into different Marginal Zone Lymphoma clinical trials within Phase III and Phase II stages. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for marginal zone lymphoma emerging therapies.

KOL Views

To keep up with the real-world scenario in current and emerging market trends, we take opinions from Key Industry leaders working in the domain through primary research to fill the data gaps and validate our secondary research. Industry experts contacted for insights on the evolving treatment landscape, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake along with challenges related to accessibility, including Medical/scientific writers, Professors, and others.

Delveinsight’s analysts connected with 30+ KOLs to gather insights; however, interviews were conducted with 10+ KOLs in the 7MM. Centers such as the Center for Lymphoma, Anderson Cancer Center, etc., were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or marginal zone lymphoma market trends.

| KOL Views |

| “In some cases like H. pylori—which is about 90% of gastric MALT lymphomas—in gastric MALT lymphoma and hepatitis C virus in splenic MZL, it is very necessary to treat related infections before MZL.” |

Qualitative Analysis

We perform qualitative and market Intelligence analysis using various approaches, such as SWOT analysis and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst’s discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Market Access and Reimbursement

Reimbursement is the price negotiation between the manufacturer and payer that allows the manufacturer access to that market. It is provided to reduce the high costs and make essential drugs affordable. In the US healthcare system, both Public and Private health insurance coverage are included. In addition, Medicare and Medicaid are the largest government-funded programs in the US. The major healthcare programs, including Medicare, Medicaid, the Children’s Health Insurance Program (CHIP), and the state and federal health insurance marketplaces, are overseen by the Centers for Medicare & Medicaid Services (CMS). Other than these, Pharmacy Benefit Managers (PBMs), and third-party organizations that provide services and educational programs to aid patients are also present.

The report further provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenario of currently used therapies, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Upcoming 2024 ASCO Annual Meeting Presentation updates

1. Abstract Title: " Phase I/II of EO2463 immunotherapy as monotherapy and in combination with lenalidomide and/or rituximab in indolent NHL (EONHL1-20/SIDNEY) "

In April 2024, Enterome announced that clinical data from the ongoing Phase I/II trial of EO2463 in monotherapy and combination with lenalidomide and/or rituximab in indolent non-Hodgkin lymphoma (NHL) will be presented at the 2024 ASCO Annual Meeting, to take place May 31 - June 4, in Chicago, Illinois. The study aims to assess the safety, tolerability, immunogenicity, and preliminary efficacy of EO2463 monotherapy and combination therapy in approximately 60 patients with follicular lymphoma (FL) and marginal zone lymphoma (MZL).

Scope of the Marginal Zone Lymphoma Market Report

- The report covers a segment of key events, an executive summary, and a descriptive overview of marginal zone lymphoma, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight has been provided into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the marginal zone lymphoma market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis and expert insights/KOL views, patient journey, and treatment preferences that help in shaping and driving the 7MM marginal zone lymphoma market.

Marginal Zone Lymphoma Report Insights

- Marginal Zone Lymphoma Patient Population

- Marginal Zone Lymphoma Therapeutic Approaches

- Marginal Zone Lymphoma Pipeline Analysis

- Marginal Zone Lymphoma Market Size and Trends

- Existing and Future Market Opportunity

Marginal Zone Lymphoma Report Key Strengths

- 11 Years Forecast

- The 7MM Coverage

- Marginal Zone Lymphoma Epidemiology Segmentation

- Key Cross Competition

- Marginal Zone Lymphoma Drugs Uptake

- Key Marginal Zone Lymphoma Market Forecast Assumptions

Marginal Zone Lymphoma Report Assessment

- Current Marginal Zone Lymphoma Treatment Practices

- Marginal Zone Lymphoma Unmet Needs

- Marginal Zone Lymphoma Pipeline Product Profiles

- Marginal Zone Lymphoma Market Attractiveness

- Qualitative Analysis (SWOT)

- Marginal Zone Lymphoma Market Drivers

- Marginal Zone Lymphoma Market Barriers

FAQs

- What is the historical and forecasted marginal zone lymphoma patient pool in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- What was the marginal zone lymphoma total market size, the market size by therapies, market share (%) distribution in 2020, and what would it look like by 2034? What are the contributing factors for this growth?

- Which therapy is going to be the largest contributor by 2034?

- What are the pricing variations among different geographies for approved and off-label therapies?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the country-specific accessibility issues of expensive, recently approved therapies?

Reasons to Buy Marginal Zone Lymphoma Market Report

- The report will help in developing business strategies by understanding the latest trends and changing treatment dynamics driving the Marginal Zone Lymphoma Market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- Distribution of historical and current patient share based on real-world prescription data along with reported sales of approved products in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Highlights of access and reimbursement policies of approved therapies, barriers to accessibility of expensive off-label therapies, and patient assistance programs.

- To understand Key Opinion Leaders’ perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy.