Orthopedic Braces and Support System Market

Orthopedic Braces and Support Systems Market by Product Type (Upper Extremity Braces and Support Systems [Shoulder, Elbow, Hand & Wrist, and Finger], Lower Extremity Braces and Support Systems [Foot & Ankle, Knee, Hip, and Others], and Spinal Braces and Support Systems [Cervical, Lumbosacral, and Others ]), Flexibility (Soft and Elastic Braces & Supports, Hard Braces and Supports, and Hinged Braces & Supports), Distribution-Channel (Hospitals & Clinics, Pharmacies, E-Commerce, and Others), Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the rising number of trauma & accident cases and increase in the prevalence of degenerative bone disorders across the globe.

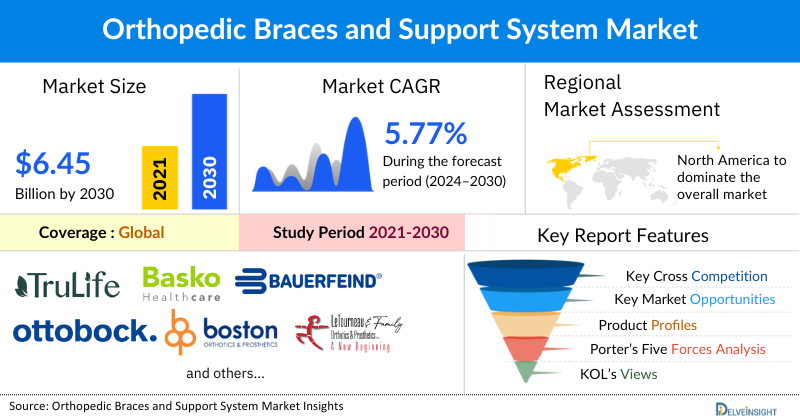

The orthopedic braces and support systems market was valued at USD 4.63 billion in 2023, growing at a CAGR of 5.77% during the forecast period from 2024 to 2030 to reach USD 6.45 billion by 2030. The orthopedic braces and support systems market is growing significantly due to the rising number of trauma and accident cases that cause spinal injuries, the increase in prevalence of degenerative bone disorders such as osteoarthritis and rheumatoid arthritis, rising instances of sports-related injuries, and the increasing prevalence of neuromuscular disorders that are acting as major factors in escalating the demand for orthopedic braces and support systems during the forecast period from 2024 to 2030.

Orthopedic Braces and Support Systems Market Dynamics:

According to the World Health Organization (WHO) (2024) in 2021, 15.4 million people were living with spinal cord injuries globally. Most cases of spinal cord injury result from trauma, including falls, or acts of violence, and are therefore preventable. Moreover, in 2023, it was stated that road traffic injuries were the leading cause of fatality in children and young adults in the age group of 5-29 years. The same factsheet further stated that nearly 20-50 million people suffer from non-fatal injuries in road accidents resulting in disability as a result of their injury globally each year.

As per data from the World Health Organization (2023), 344 million individuals were affected by osteoarthritis globally. Among this population, 73% of people living with osteoarthritis are older than 55 years, and 60% are female. Osteoarthritis is a degenerative joint disease characterized by the breakdown of cartilage in the knee joint, leading to pain, stiffness, and reduced range of motion. As per the same source, 13 million people were living with rheumatoid arthritis. This causes the joint lining to become inflamed and eroded, leading to progressive destruction of the cartilage and bone.

According to the National Safety Council (2024), it stated that in 2023, emergency departments treated 3.7 million people for injuries related to sports and recreational equipment. The activities most often led to these injuries were exercise, cycling, and basketball. Furthermore, it stated that injuries from exercise and exercise equipment went up by 8% in 2023, with 482,886 injuries compared to 445,642 in 2022. The highest injury rate was among 15 to 24-year-olds.

As per data from the WHO in the year 2022, it stated that approximately 1.71 billion people were affected by musculoskeletal conditions worldwide. Further, it stated that Low back pain is the main contributor to the overall burden of musculoskeletal conditions which contributes to 570 million prevalent cases worldwide. Musculoskeletal conditions, affecting a significant portion of the global population, often include low back pain as a major issue.

Orthopedic braces and support systems play a crucial role in the management of various musculoskeletal and spinal conditions. For individuals with spinal cord injuries, these devices provide stabilization and support, helping to manage pain and prevent further injury. In cases of osteoarthritis and rheumatoid arthritis, braces can alleviate joint pain, reduce inflammation, and improve mobility by stabilizing affected joints and providing relief from daily activities. For those suffering from sports and recreational injuries, braces and support systems offer protection, support, and rehabilitation assistance, especially for common injuries sustained during activities like cycling and basketball. Additionally, in the broader context of musculoskeletal conditions, including low back pain, braces can support the spine, reduce strain, and aid in the recovery process, thereby enhancing the quality of life for affected individuals.

Therefore, the factors stated above collectively will drive the overall orthopedic braces and support systems market during the forecast period from 2024 to 2030.

However, patient compliance associated with their braces and support systems as prescribed and the availability of alternative therapies among others may limit their end-user base, thus acting as key constraints limiting the growth of the orthopedic braces and support systems market.

Orthopedic Braces and Support Systems Market Segment Analysis:

Orthopedic Braces and Support Systems Market by Product Type (Upper Extremity Braces and Support Systems [Shoulder, Elbow, Hand & Wrist, and Finger], Lower Extremity Braces and Support Systems [Foot & Ankle, Knee, Hip, and Others], and Spinal Braces and Support Systems [Cervical, Lumbosacral, and Others ]), Flexibility (Soft and Elastic Braces & Supports, Hard Braces and Supports, and Hinged Braces & Supports), Distribution-Channel (Hospitals & Clinics, Pharmacies, E-Commerce, and Others), Geography (North America, Europe, Asia-Pacific, and Rest of the World).

In the product type segment of lower extremity braces and support systems, the knee category is expected to have a significant revenue share in the year 2023. The rapid growth of this product category can be attributed to the features associated with this category.

Lower extremity braces and support systems for the knee offer several key features and advantages tailored to enhance mobility and stability. These devices are designed to provide support during rehabilitation, manage chronic conditions, and prevent injuries. Key features often include adjustable strapping and modular designs, which allow for personalized fit and targeted support. They frequently incorporate advanced materials like lightweight composites or breathable fabrics to enhance comfort and durability.

Many knee braces feature integrated joint hinges or rotational control mechanisms to stabilize the knee and reduce strain during movement. The advantages of these systems include improved alignment, reduced pain and inflammation, and enhanced functional mobility. By providing a customizable and supportive solution, these braces help individuals maintain an active lifestyle while managing their knee health effectively.

Therefore, owing to all the above-mentioned factors, the demand for the knee category upsurges, thereby the category is expected to witness considerable growth eventually contributing to the overall growth of the orthopedic braces and support systems market during the forecast period from 2024 to 2030.

North America is expected to dominate the overall orthopedic braces and support systems market:

Among all the regions, North America is expected to dominate the orthopedic braces and support systems market in the year 2023 and is expected to do the same during the forecast period from 2024 to 2030. This can be ascribed to the high prevalence of chronic pain and conditions like gout, underscoring the growing demand for effective management solutions. As the incidence of knee-related issues and chronic pain rises, coupled with ongoing advancements in medical technology and a robust healthcare infrastructure in the region further drives the market for orthopedic braces and support systems during the forecast period from 2024 to 2030.

According to data from the American Academy of Orthopaedic Surgeons in 2024 stated that over 700,000 total knee replacement surgeries are performed each year in the US. In addition to this, recent updates provided by the Arthritis Society Canada (2022), stated that 1 million Canadians were affected by gout, which is the most common form of inflammatory arthritis. Gout predominantly impacts males more than females, with approximately 4% of men and 1% of women affected. Among the various joints that can be affected, the knee joint is the most commonly involved. Knee replacement and reconstruction surgeries are crucial for managing severe knee pain and dysfunction caused by conditions like arthritis and gout.

According to data from the Centers for Disease Control and Prevention (2023), it stated that in 2021, there were 51.6 million US adults who were suffering from chronic pain. In addition to this 17.1 million individuals had experienced high-impact chronic pain (i.e., chronic pain that results in substantial restriction to daily activities). Moreover, as per data from the Public Health Agency of Canada (2023), 8 million individuals live with chronic pain in Canada.

According to data from the Centers for Disease Control and Prevention (2023), it stated that Guillain-Barré Syndrome (GBS) is a rare disorder in which the body's immune system mistakenly attacks the peripheral nerves. This damage to the nerves leads to muscle weakness and, in some cases, paralysis. The exact cause of GBS is not fully understood, but it frequently occurs following an infection with a virus or bacteria. In the United States, an estimated 3,000 to 6,000 people develop GBS each year.

Orthopedic braces and support systems are crucial in managing various conditions and post-surgical recovery. For individuals undergoing total knee replacement surgeries, braces can assist in stabilizing the joint and supporting the healing process, particularly during the early stages of rehabilitation. In cases of gout, which often affects the knee joint, braces or splints can help alleviate pain and reduce inflammation, providing relief and support. For those dealing with chronic pain, including high-impact chronic pain, supportive braces can offer stability and comfort, potentially improving mobility and quality of life. Additionally, in the context of GBS, braces and orthotic devices are used to support weakened muscles and improve function, aiding in daily activities and mobility as patients recover.

Therefore, the interplay of all the aforementioned factors above would provide a conducive growth environment for the North America region in the orthopedic braces and support systems market.

Orthopedic Braces and Support Systems Market key players:

Some of the key market players operating in the orthopedic braces and support systems market include Ottobock, Boston Orthotics & Prosthetics, LeTourneau Prosthetics and Orthotics, BOUNDLESS BIOMECHANICAL BRACING INC., 3M, Trulife, Basko Healthcare, Bauerfeind, Breg, Inc., DJO, LLC, Acor Orthopaedic, Inc., Aspen Medical Products, LLC, DeRoyal Industries, Inc., Allard USA Inc., Steeper Inc., ORTHOMERICA PRODUCTS, INC., Conwell Medical Co., Ltd., Kao Chen Enterprise Co., Ltd., Össur, medi GmbH & Co. KG, and others.

Recent Developmental Activities in the Orthopedic Braces and Support Systems Market:

- In May 2024, McDavid, a leader in sports medicine and protective gear, announced the launch of new NRG knee braces featuring Spring Hinge Joint Assist technology. Available in the NRG over Knee Wrap and NRG Knee Brace, this hinge technology proved to be a game-changing recovery solution— by storing energy when flexed and rebounding with the body's natural movement, it reduced stress on knees by up to 25%.

- In May 2024, Create it REAL, a Danish 3D printing R&D center specializing in orthopedic braces and support systems, unveiled a new digital ordering platform at OTWorld in Leipzig, Germany. This platform is designed to simplify the ordering process for orthopedic professionals, allowing them to focus on the product rather than the technology.

- In January 2024, Enovis' DJO announced the launch of its DonJoy Roam OA knee brace, designed to address osteoarthritis, knee pain, and instability.

- In February 2021, Breg, Inc. launched 15 new spine bracing products in two product lines- Pinnacle and Ascend™.

Key Takeaways from the Orthopedic Braces and Support Systems Market Report Study

- Market size analysis for current orthopedic braces and support systems market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/services developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years

- Key companies dominating the orthopedic braces and support systems market

- Various opportunities available for the other competitors in the orthopedic braces and support systems market space

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current orthopedic braces and support systems market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for orthopedic braces and support systems market growth in the coming future?

Target audience who can be benefited from this Orthopedic Braces and Support Systems Market Report Study

- Orthopedic braces and support systems product providers

- Research organizations and consulting companies

- Orthopedic braces and support systems-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in orthopedic braces and support systems

- Various end-users who want to know more about the orthopedic braces and support systems market and the latest developments in the orthopedic braces and support systems market